- United States

- /

- Banks

- /

- NasdaqGS:EBC

Eastern Bankshares (EBC): Evaluating Valuation After Recent Share Price Dip and Merger Progress

Reviewed by Simply Wall St

Eastern Bankshares (EBC) shares have traded lower recently, giving investors reason to take a closer look at what is driving sentiment around the stock. The company operates in the banking sector, which has seen mixed performance this year.

See our latest analysis for Eastern Bankshares.

Eastern Bankshares’ share price recently dipped, reflecting some caution from investors, but the total shareholder return over the past year stands at an impressive 14.3%. While price momentum has cooled from its recent high, the bank’s long-term performance continues to hint at its underlying strengths.

If you’re keeping an eye on what’s moving in the world of banks, this could be the perfect chance to broaden your outlook and discover fast growing stocks with high insider ownership

But with analysts forecasting a higher price target and solid recent results, the question remains: is Eastern Bankshares now undervalued, or has the market already factored in its future growth prospects and left little room for upside?

Most Popular Narrative: 19.7% Undervalued

Eastern Bankshares is trading at $17.66, while the most popular narrative suggests a much higher fair value of $22 per share. That gap could reflect shifting growth assumptions and major corporate actions shaping the stock’s future trajectory.

The successful merger with Cambridge Trust and its integration into Eastern Bankshares creates a stronger organization with enhanced service offerings. This is expected to drive future revenue and earnings growth, particularly in the Greater Boston, Eastern Massachusetts, and New Hampshire markets.

Eastern Bankshares' expansion of its online and mobile banking platform provides opportunities to improve customer experience and capture market share. This may boost future revenue and net margins.

Want to know why analysts are betting on a corporate transformation to unlock massive upside for the stock? A hidden financial lever and one big growth assumption form the backbone of this bullish narrative, but the details are only revealed deeper in the story. See what makes the price target so ambitious.

Result: Fair Value of $22.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential concerns around commercial real estate loan quality and ongoing merger-related volatility could influence Eastern Bankshares’ otherwise upbeat outlook going forward.

Find out about the key risks to this Eastern Bankshares narrative.

Another View: Are the Multiples Telling a Different Story?

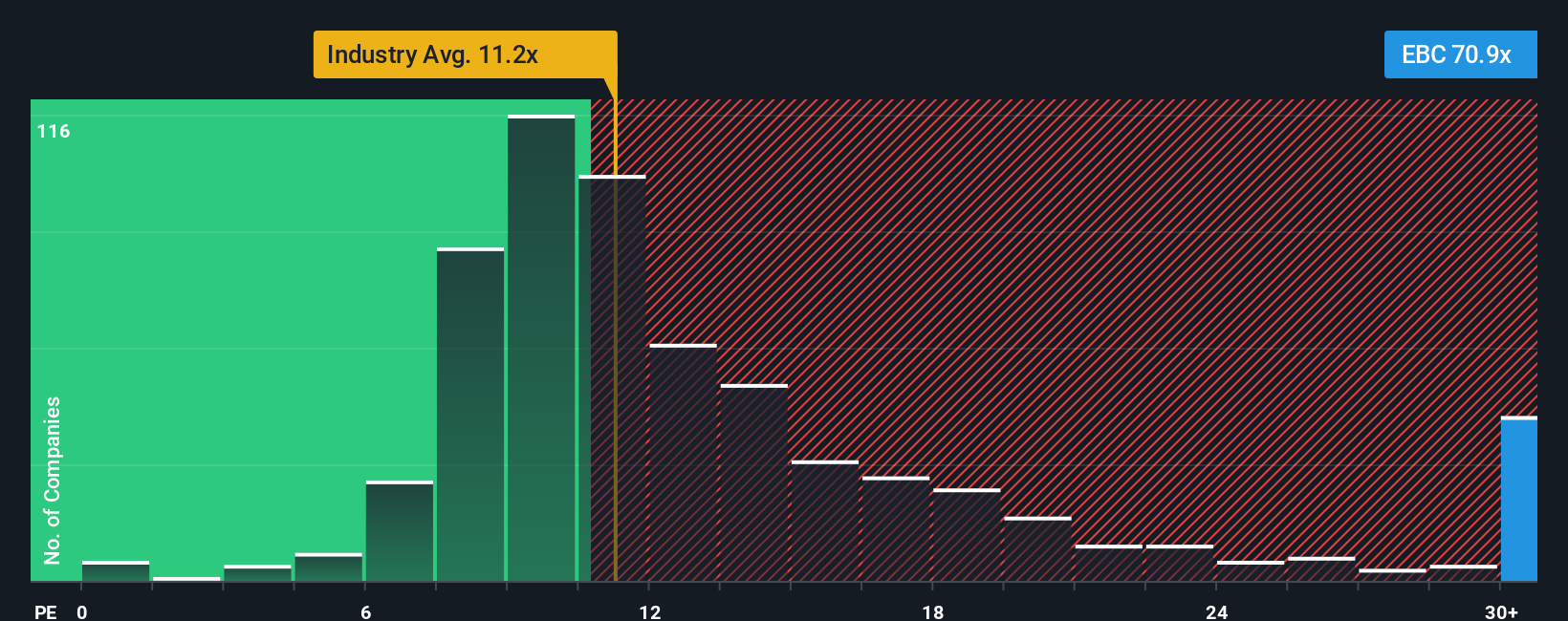

While the popular narrative points to Eastern Bankshares being undervalued, a look at its price-to-earnings ratio gives a contrasting view. The company trades at 70.9x earnings, which is much higher than both its industry average of 11.2x and the fair ratio of 32.6x. This suggests that, by this metric, the stock is actually expensive and may carry valuation risk if market optimism fades. Does this mean the upside is already priced in, or is there something unique about the story that the multiples miss?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eastern Bankshares Narrative

If you see the story unfolding differently or prefer to dig into the numbers and come to your own conclusions, exploring and building your own perspective takes just minutes. Do it your way

A great starting point for your Eastern Bankshares research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Expand your portfolio with handpicked stocks outside the usual radar. The right tools can help you spot unique opportunities that others may overlook.

- Unlock the potential of high-yielding portfolios and boost your income by screening for top picks among these 17 dividend stocks with yields > 3%.

- Stay on the pulse of cutting-edge innovation by targeting companies leading breakthroughs with these 28 quantum computing stocks.

- Capitalize on tomorrow’s growth stories before the crowd by finding value in these 877 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastern Bankshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBC

Eastern Bankshares

Operates as the bank holding company for Eastern Bank that provides banking, trust, and investment services to retail, commercial, and small business customers.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives