- United States

- /

- Banks

- /

- NasdaqGS:DCOM

Dime Community Bancshares (DCOM): Assessing Valuation After Universal Shelf Registration Filing

Reviewed by Simply Wall St

Dime Community Bancshares (DCOM) recently filed a universal shelf registration, which allows it to issue debt, equity, and other financial instruments. This move could set the stage for future financing opportunities and may influence how investors view the stock.

See our latest analysis for Dime Community Bancshares.

Over the past year, Dime Community Bancshares’ share price has trended lower, down 10.5% year-to-date and delivering a -16.5% total shareholder return. This comes despite the company completing a share buyback and now preparing for potential new financing after its universal shelf registration. Momentum appears mixed; while the recent filing can spark fresh interest, the one-month share price return of -9.1% signals caution among investors as they weigh near-term risks and opportunities against the stock’s longer-term profile.

If news of potential capital moves has you rethinking your strategy, now is a smart time to broaden your investing lens and discover fast growing stocks with high insider ownership

With shares now trading at a notable discount to analyst targets, investors may be wondering whether Dime Community Bancshares is an undervalued pick with upside ahead, or if the market has already priced in future growth.

Most Popular Narrative: 24.6% Undervalued

With the last close at $27.15 and the most popular narrative setting fair value at $36, the upside potential is significant if its growth projections play out. This narrative’s thesis hinges on operational expansion, digital transformation, and long-term structural improvements that could dramatically change Dime Community Bancshares’ earnings profile.

Ongoing digital transformation, new business lending verticals, and further rationalization of the branch network are set to drive operational efficiencies and lower costs. These efforts could enable sustained improvement in net margins over time.

Is there a formula to this optimism? Big assumptions drive these forecasts, with bold revenue growth expectations and profit margins unlike anything seen in recent history. Curious what key numbers underpin this valuation? See what bullish forecasters are relying on and what could shift the outcome when you dive into the full narrative.

Result: Fair Value of $36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent concentration in the New York market and high exposure to commercial real estate could quickly dampen growth optimism if local conditions change.

Find out about the key risks to this Dime Community Bancshares narrative.

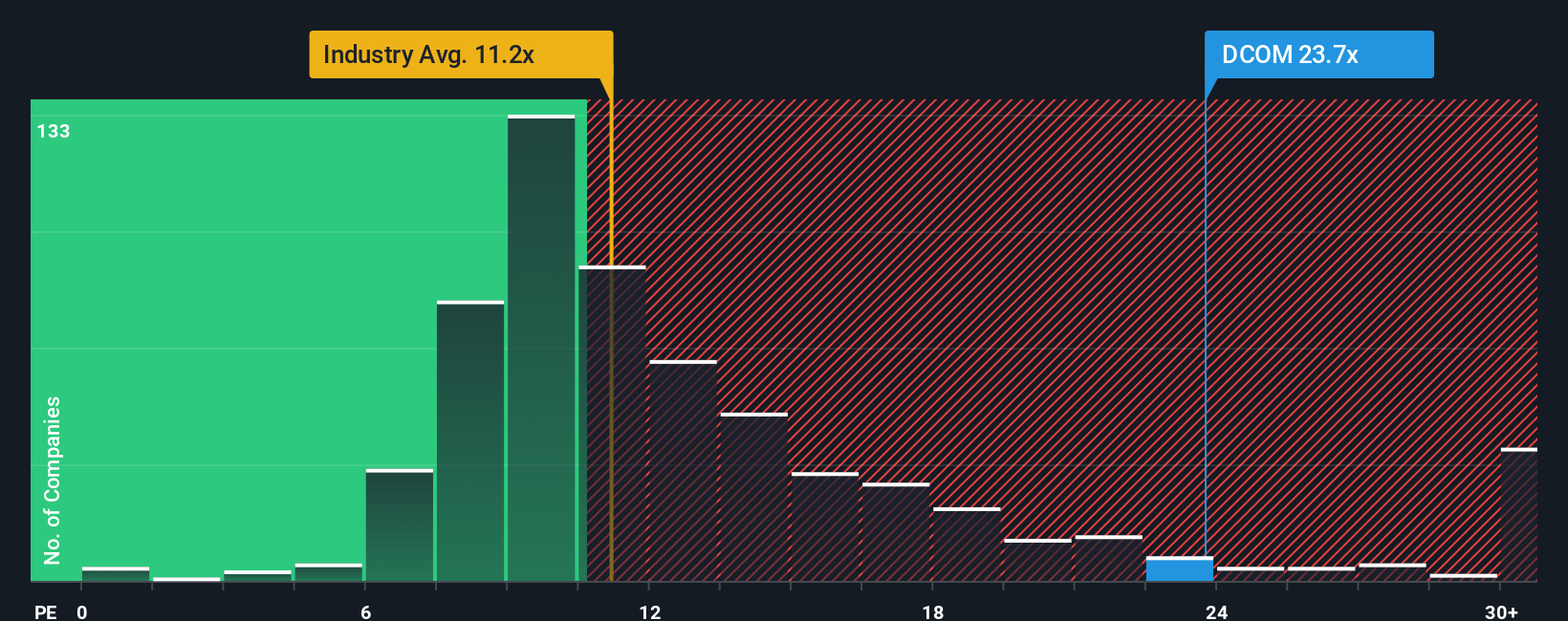

Another View: Price-to-Earnings Ratios Raise Caution

While the popular narrative sees Dime Community Bancshares as undervalued, its price-to-earnings ratio of 23.7 times stands out as higher than the US Banks industry average of 11.1 times and above its own fair ratio of 19.8 times. This premium signals that investors are already pricing in a positive outlook, which could leave little room for disappointment. Could the upside already be built into today's valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dime Community Bancshares Narrative

If you have a different outlook or want to dig into the data firsthand, you can put together your own narrative in just a few minutes, and Do it your way.

A great starting point for your Dime Community Bancshares research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Now is the perfect time to add more powerful stocks to your watchlist. Don’t let tomorrow’s winners slip past you while others get ahead.

- Amplify your potential income by targeting robust companies offering reliable returns by scanning these 16 dividend stocks with yields > 3% paying over 3% yield.

- Ride the wave of digital innovation and position yourself where artificial intelligence changes markets through these 25 AI penny stocks.

- Seize value opportunities as they emerge and act quickly by searching for these 878 undervalued stocks based on cash flows based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DCOM

Dime Community Bancshares

Operates as the holding company for Dime Community Bank that engages in the provision of various commercial banking and financial services.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives