- United States

- /

- Banks

- /

- NasdaqGS:DCOM

A Look at Dime Community Bancshares’s (DCOM) Valuation After Dividend Reaffirmation and Fresh Analyst Rating Shift

Reviewed by Simply Wall St

Dime Community Bancshares (DCOM) reaffirmed its quarterly cash dividend at $0.25 per share, extending an uninterrupted payout streak that reflects steady underlying earnings and continues to attract income focused investors to the stock.

See our latest analysis for Dime Community Bancshares.

That steady dividend message is landing in a market that has already noticed Dime, with a 21.18 percent 1 month share price return off the back of branch expansion news and a more nuanced, but still constructive, shift in risk perception. Longer term total shareholder returns show momentum building rather than fading.

If this kind of steady but improving story appeals to you, it could be a good moment to see what else is gaining traction through fast growing stocks with high insider ownership.

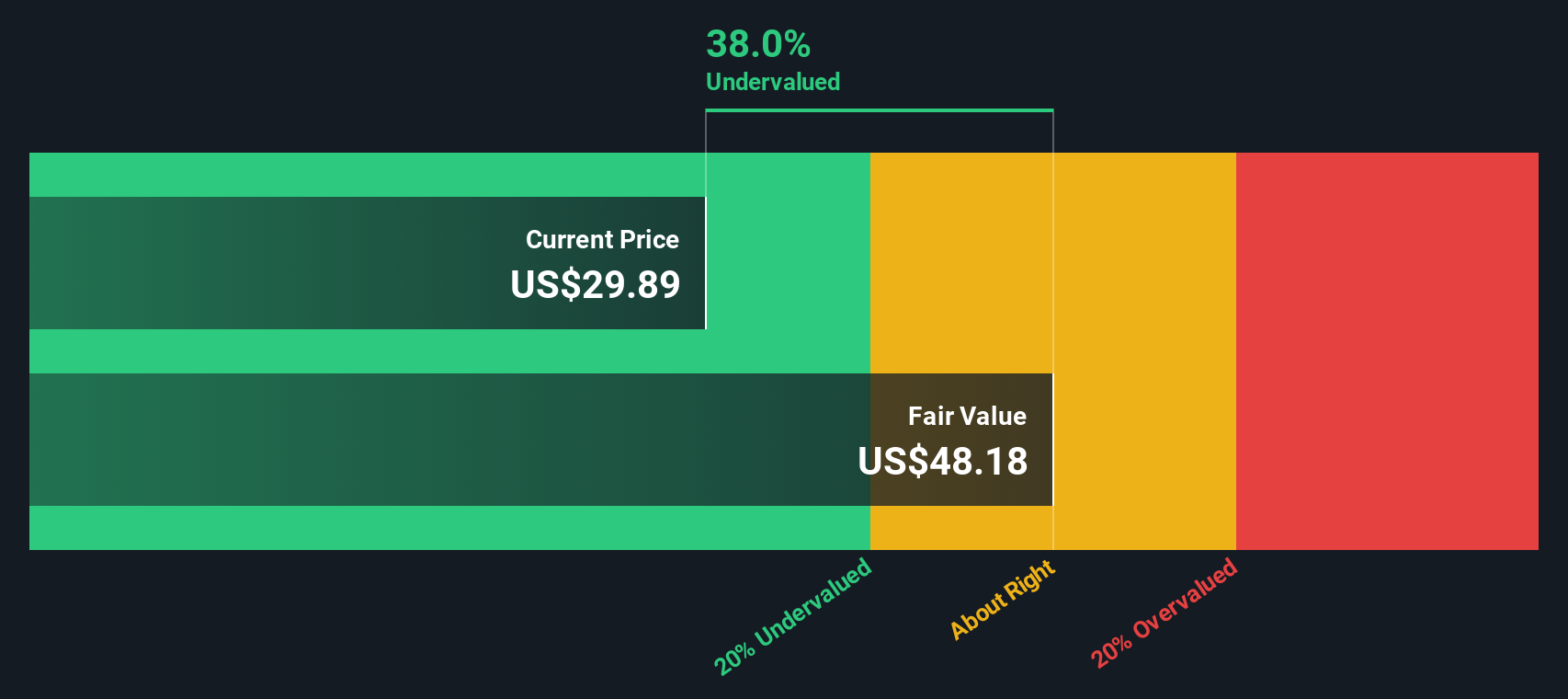

With the shares up double digits in a month yet still trading at a discount to both analyst targets and some intrinsic value estimates, is Dime quietly undervalued, or are markets already banking on its next leg of growth?

Most Popular Narrative: 11.2% Undervalued

With Dime Community Bancshares last closing at $31.98, the most followed narrative points to a higher fair value, anchored in aggressive profit expansion.

The upcoming repricing of nearly $2 billion in loans at substantially higher market rates by the end of 2026, plus another $1.7 billion in 2027, is expected to structurally expand net interest margin and boost earnings significantly in the medium to long term. Continued robust hiring of experienced banking teams, especially in business banking and commercial lending verticals, provides the foundation for above peer business loan growth and broadening of the customer base, supporting future revenue acceleration.

Want to see how rapid revenue expansion, soaring margins and a compressed future earnings multiple can still point to upside? The narrative lays out the full math.

Result: Fair Value of $36.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change if New York's economy softens or commercial real estate strains intensify, which could pressure loan quality and delay expected margin expansion.

Find out about the key risks to this Dime Community Bancshares narrative.

Another Lens on Value

While the most popular narrative sees only modest upside to $36, our DCF model is more optimistic, pointing to a fair value of $49.83 and identifying Dime as deeply undervalued at current prices. Is the market underestimating its earnings power, or is the model too generous?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dime Community Bancshares Narrative

If you see the numbers differently or want to stress test your own assumptions, you can quickly build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Dime Community Bancshares.

Looking for more investment ideas?

Before the next move in Dime's story, give yourself an edge by scanning other opportunities on Simply Wall St's powerful screener so you are never caught reacting late.

- Capture early growth potential in smaller names by scanning through these 3628 penny stocks with strong financials that pair compelling stories with improving fundamentals.

- Ride structural shifts in healthcare by targeting innovators within these 29 healthcare AI stocks that blend medical expertise with advanced algorithms.

- Lock in resilient income streams by focusing on these 13 dividend stocks with yields > 3% offering attractive yields backed by solid financial profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DCOM

Dime Community Bancshares

Operates as the holding company for Dime Community Bank that engages in the provision of various commercial banking and financial services.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion