- United States

- /

- Banks

- /

- NasdaqCM:PKBK

Top US Dividend Stocks To Watch In August 2024

Reviewed by Simply Wall St

As of late August 2024, U.S. stock markets have edged higher, with major indices like the S&P 500 and Nasdaq Composite closing slightly up amid a holding pattern ahead of Nvidia's highly anticipated earnings report. With economic indicators showing mixed signals and market participants closely watching for signs from the Federal Reserve on interest rate cuts, dividend stocks can offer a measure of stability and income in uncertain times. When evaluating dividend stocks, investors often look for companies with strong financial health, consistent earnings growth, and a history of reliable dividend payments. In this context, here are three U.S. dividend stocks to watch in August 2024.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.82% | ★★★★★★ |

| BCB Bancorp (NasdaqGM:BCBP) | 5.22% | ★★★★★★ |

| WesBanco (NasdaqGS:WSBC) | 4.50% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.97% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.10% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.98% | ★★★★★★ |

| OceanFirst Financial (NasdaqGS:OCFC) | 4.59% | ★★★★★★ |

| OTC Markets Group (OTCPK:OTCM) | 4.76% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.44% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.39% | ★★★★★★ |

Click here to see the full list of 176 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Parke Bancorp (NasdaqCM:PKBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Parke Bancorp, Inc., with a market cap of $247.57 million, operates as the bank holding company for Parke Bank, offering personal and business financial services to individuals and small to mid-sized businesses.

Operations: Parke Bancorp, Inc. generates $64.61 million in revenue from its community banking segment, providing financial services to individuals and small to mid-sized businesses.

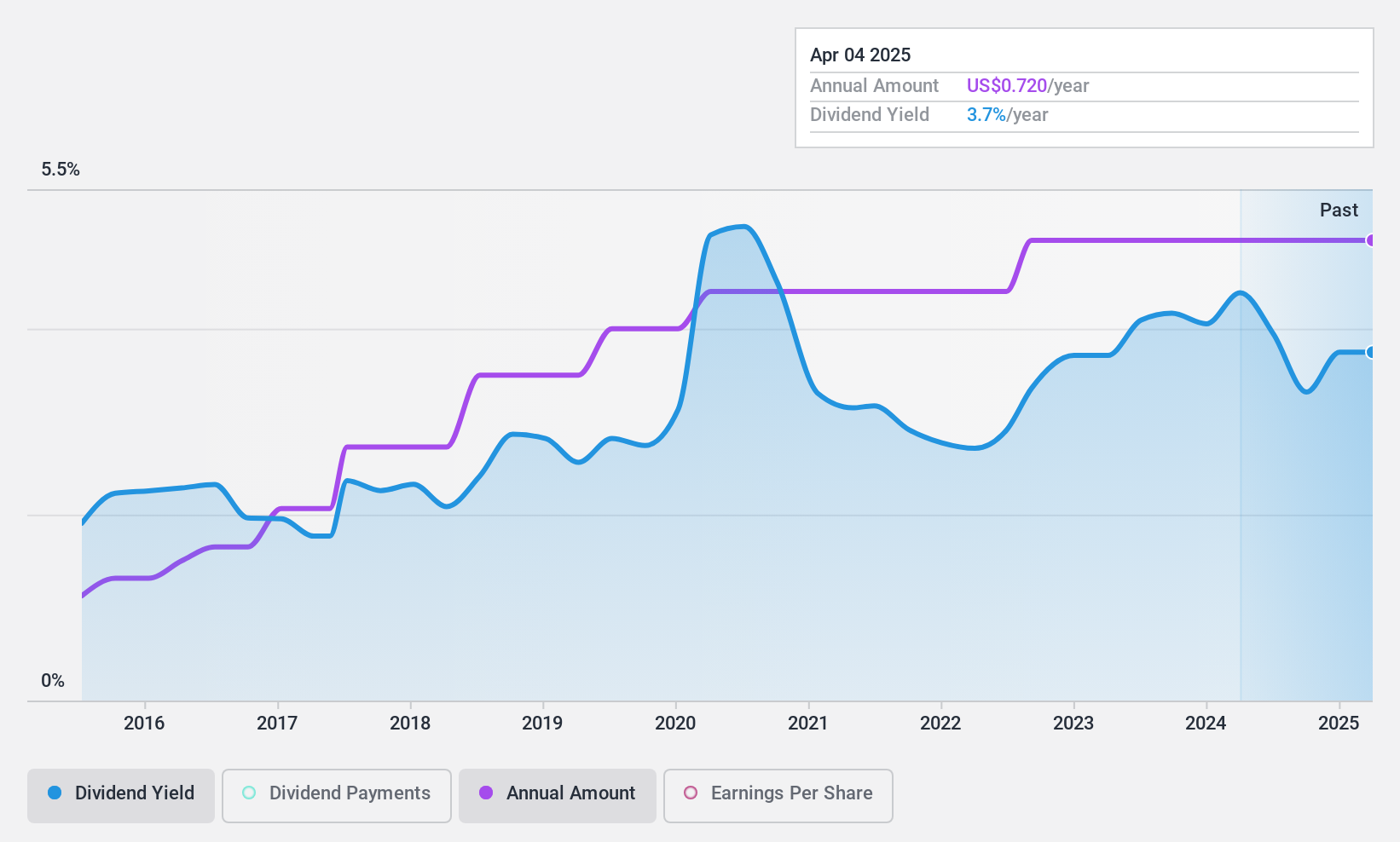

Dividend Yield: 3.5%

Parke Bancorp's dividend payments have been stable and growing over the past 10 years, with a current yield of 3.48%. The company's recent share repurchase program may signal confidence in its financial stability despite a decline in net income and profit margins compared to last year. The $0.18 per share cash dividend declared for July 2024 reflects its commitment to returning value to shareholders, supported by a low payout ratio of 39.5%.

- Delve into the full analysis dividend report here for a deeper understanding of Parke Bancorp.

- Our comprehensive valuation report raises the possibility that Parke Bancorp is priced lower than what may be justified by its financials.

CVB Financial (NasdaqGS:CVBF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CVB Financial Corp., with a market cap of $2.57 billion, operates as a bank holding company for Citizens Business Bank, offering banking and financial services to small to mid-sized businesses and individuals.

Operations: CVB Financial Corp. generates $527.11 million in revenue from its banking segment, providing financial services to small to mid-sized businesses and individuals.

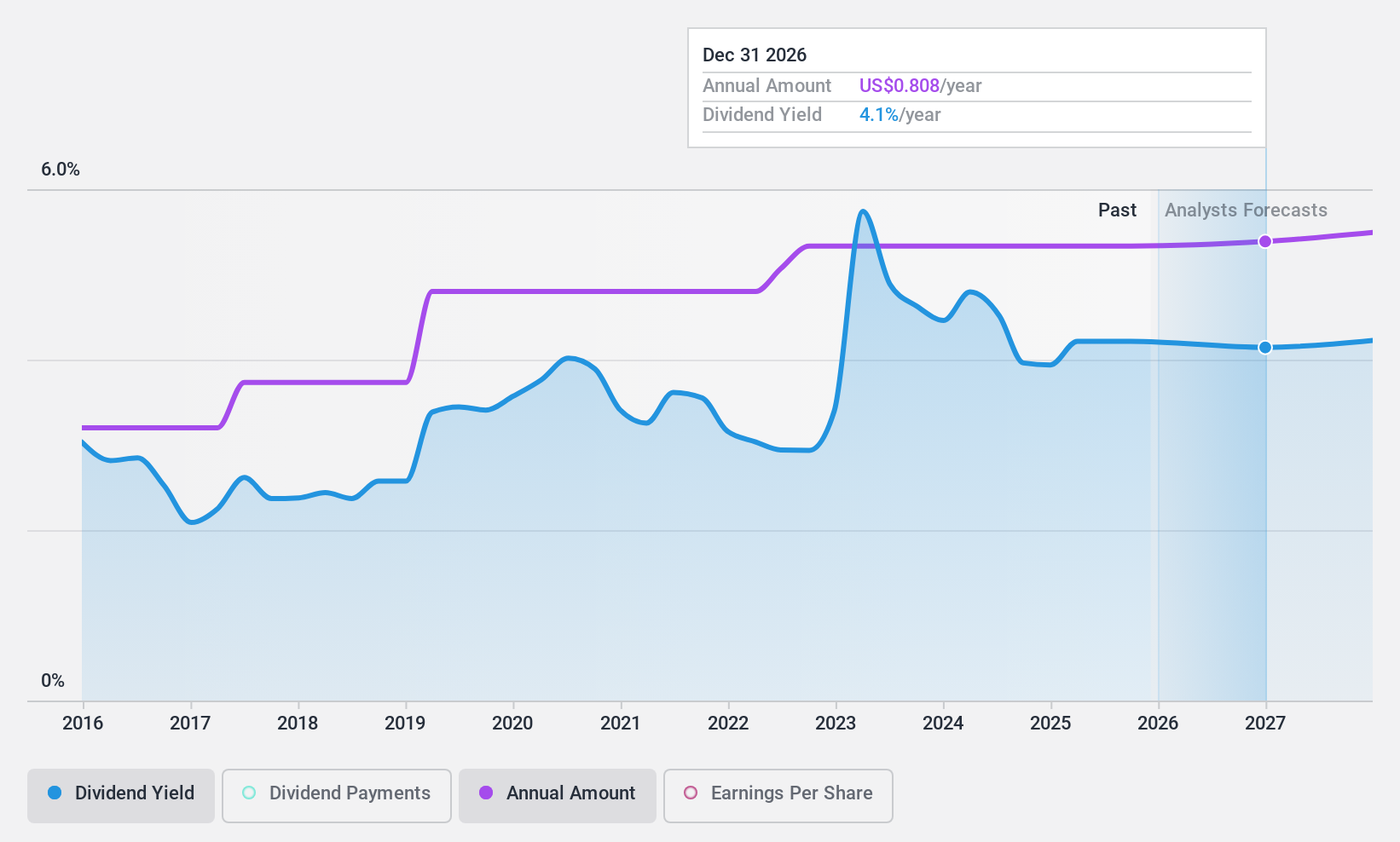

Dividend Yield: 4.4%

CVB Financial offers a solid dividend yield of 4.37%, placing it in the top 25% of US dividend payers. The company has maintained stable and growing dividends over the past decade, supported by a reasonable payout ratio of 54.4%. Despite recent declines in net interest income and net income for Q2 2024, CVB Financial affirmed a $0.20 per share cash dividend for the same period, underscoring its commitment to shareholder returns.

- Navigate through the intricacies of CVB Financial with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that CVB Financial is trading behind its estimated value.

Dime Community Bancshares (NasdaqGS:DCOM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dime Community Bancshares, Inc., with a market cap of $988.50 million, operates as the holding company for Dime Community Bank, providing various commercial banking and financial services.

Operations: Dime Community Bancshares, Inc. generates $320.39 million from its Community Banking segment.

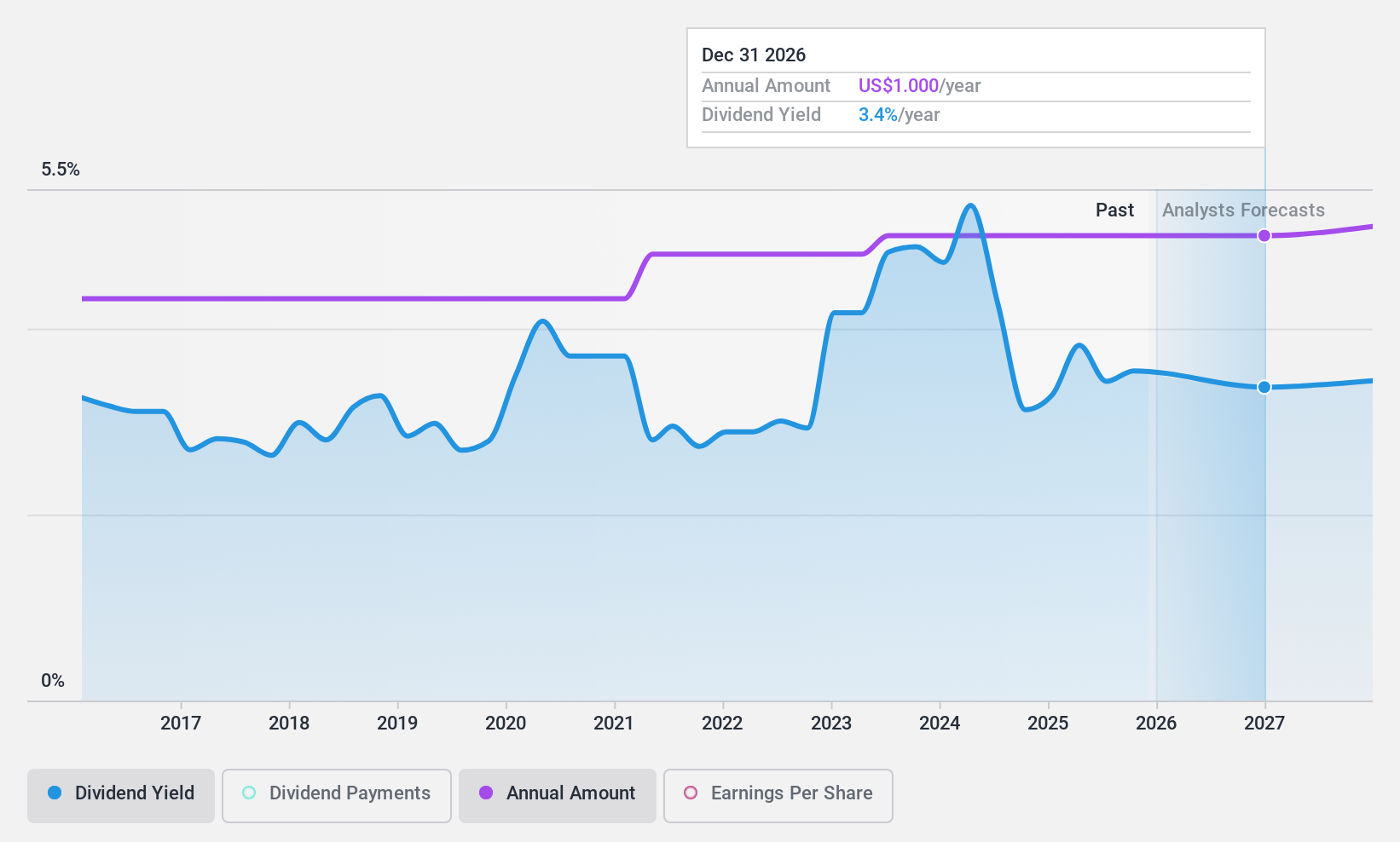

Dividend Yield: 4%

Dime Community Bancshares offers a reliable dividend yield of 4.02%, though it falls short of the top 25% in the US market. The company has maintained stable and growing dividends over the past decade, supported by a reasonable payout ratio of 64.6%. Despite recent declines in net interest income and net income for Q2 2024, Dime Community affirmed a $0.25 per share cash dividend, reflecting its ongoing commitment to shareholder returns.

- Unlock comprehensive insights into our analysis of Dime Community Bancshares stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Dime Community Bancshares shares in the market.

Where To Now?

- Delve into our full catalog of 176 Top US Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PKBK

Parke Bancorp

Operates as the bank holding company for Parke Bank that provides personal and business financial services to individuals and small to mid-sized businesses.

Flawless balance sheet, good value and pays a dividend.