- United States

- /

- Banks

- /

- NasdaqGS:CBSH

A Look at Commerce Bancshares (CBSH) Valuation Following Board Changes and Dividend Updates

Reviewed by Simply Wall St

Commerce Bancshares (CBSH) recently announced two meaningful updates: the addition of a new independent board member with a healthcare leadership background, and plans for both a regular cash dividend and a 5% stock dividend.

See our latest analysis for Commerce Bancshares.

While Commerce Bancshares’ leadership refresh and new dividends signal confidence, the stock itself has struggled to regain momentum. Despite these positive moves, its 1-year total shareholder return of -19.7% and a year-to-date share price return of -12.4% show investors are still cautious. Longer-term performance remains mixed, suggesting the market is still weighing growth potential against recent headwinds.

If you’re curious to see which other financial sector names are bucking the trend, broaden your search and discover fast growing stocks with high insider ownership.

With these changes and a stock that remains well below analyst targets, investors are left wondering if Commerce Bancshares is trading at a discount or if the market is already pricing in its next chapter of growth.

Price-to-Earnings of 12.9x: Is it justified?

Commerce Bancshares is trading at a price-to-earnings (P/E) ratio of 12.9x, putting it above both the US Banks industry average (11.1x) and its peer group average (11.8x). At $54.07 per share, the market appears to be assigning a premium compared to competitors despite recent share price underperformance.

The P/E ratio measures how much investors are willing to pay for each dollar of the company’s earnings. For banks, this metric is especially important as it reflects market sentiment on future profitability and growth stability.

Currently, Commerce Bancshares' P/E ratio is elevated relative to industry and peer benchmarks. This suggests the market anticipates steadier or higher profit growth compared to rivals, or that quality factors like stability and an experienced management team command a valuation premium. Compared to an estimated fair P/E of 11.3x, the current valuation remains somewhat stretched and could converge toward the fair level if expectations are not met.

Explore the SWS fair ratio for Commerce Bancshares

Result: Price-to-Earnings of 12.9x (OVERVALUED)

However, slowing revenue and net income growth, along with a 1-year total return of -19.7%, could trigger a reassessment of current valuation optimism.

Find out about the key risks to this Commerce Bancshares narrative.

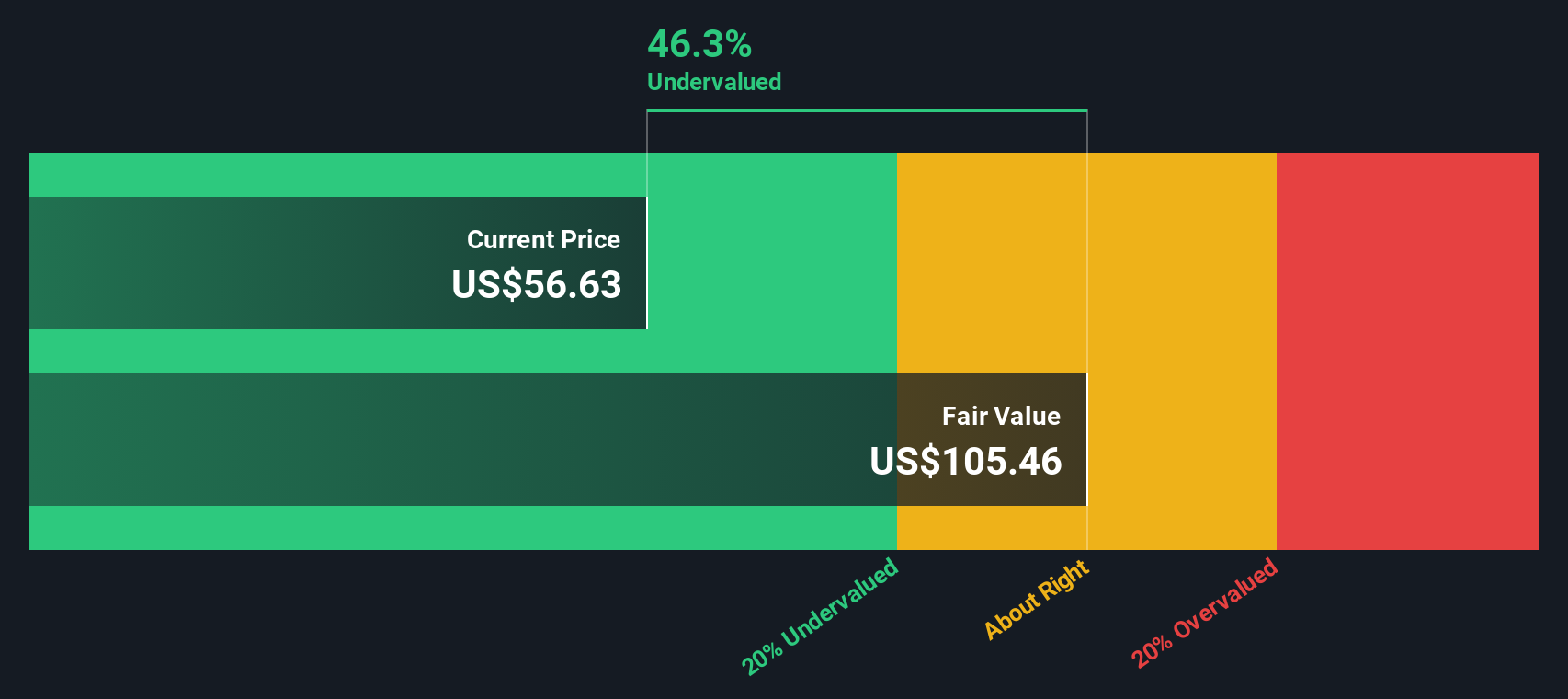

Another View: Our DCF Model Paints a Different Picture

While the current price-to-earnings ratio suggests Commerce Bancshares is overvalued next to peers, our SWS DCF model estimates its fair value at $102.60 per share, which is about 47% above the current price. This signals the market might be underappreciating its future cash flow potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Commerce Bancshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Commerce Bancshares Narrative

If you see things differently or want a fresh perspective based on your own analysis, it's fast and easy to put together your own story. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Commerce Bancshares.

Looking for more investment ideas?

Make your next move count by browsing fresh opportunities shaping tomorrow’s markets. Don’t limit yourself to one angle; see what’s unfolding beyond the obvious picks.

- Boost your portfolio’s income by reviewing companies offering impressive yields through these 16 dividend stocks with yields > 3%, earning more for every dollar you invest.

- Capture future growth trends by chasing returns with these 24 AI penny stocks and position yourself at the heart of the artificial intelligence transformation.

- Step ahead of the crowd by uncovering hidden value with these 865 undervalued stocks based on cash flows before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CBSH

Commerce Bancshares

Operates as the bank holding company for Commerce Bank that provides retail, mortgage banking, corporate, investment, trust, and asset management products and services to individuals and businesses in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives