Stock Analysis

- United States

- /

- Banks

- /

- NasdaqGS:CARE

Does Carter Bank & Trust's (NASDAQ:CARE) Share Price Gain of 49% Match Its Business Performance?

It might be of some concern to shareholders to see the Carter Bank & Trust (NASDAQ:CARE) share price down 11% in the last month. On the bright side the share price is up over the last half decade. However we are not very impressed because the share price is only up 49%, less than the market return of 69%.

See our latest analysis for Carter Bank & Trust

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Carter Bank & Trust's earnings per share are down 4.6% per year, despite strong share price performance over five years.

By glancing at these numbers, we'd posit that the decline in earnings per share is not representative of how the business has changed over the years. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

It is not great to see that revenue has dropped by 1.6% per year over five years. So it seems one might have to take closer look at earnings and revenue trends to see how they might influence the share price.

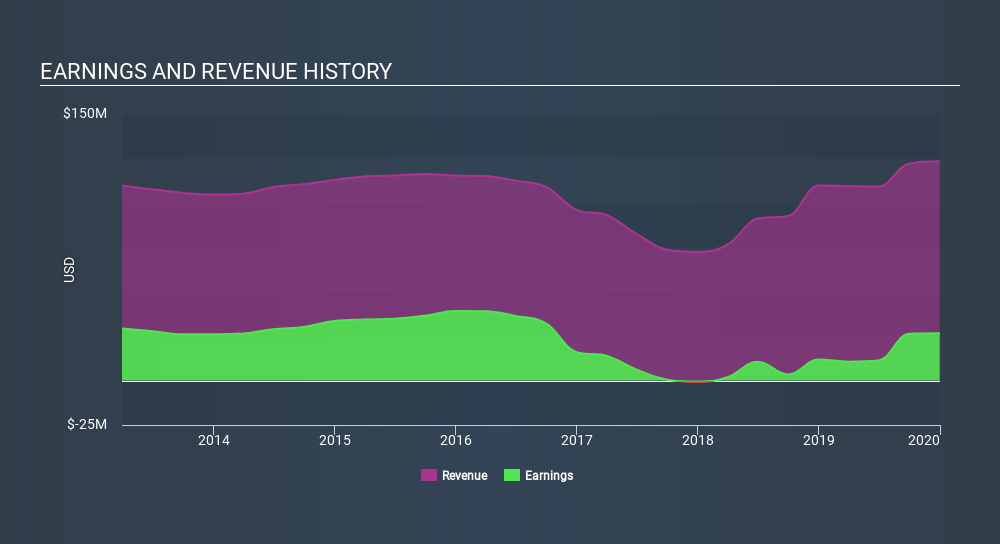

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So it makes a lot of sense to check out what analysts think Carter Bank & Trust will earn in the future (free profit forecasts).

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Carter Bank & Trust's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Carter Bank & Trust shareholders, and that cash payout contributed to why its TSR of 57%, over the last 5 years, is better than the share price return.

A Different Perspective

Carter Bank & Trust shareholders gained a total return of 16% during the year. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 9.4% over half a decade It is possible that returns will improve along with the business fundamentals. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:CARE

Carter Bankshares

Operates as the bank holding company for Carter Bank & Trust that provides various banking products and services in the United States.

Reasonable growth potential with adequate balance sheet.