- United States

- /

- Banks

- /

- NasdaqGS:BUSE

A Fresh Look at First Busey (BUSE) Valuation Following CFO Appointment and Dividend Announcement

Reviewed by Simply Wall St

See our latest analysis for First Busey.

First Busey’s share price has seen modest movement this year, with momentum picking up after the new CFO appointment and dividend news. Its 1-year total shareholder return remains subdued at -11.1%. Long-term holders, however, have seen a 35% gain over five years, even as near-term price action reflects shifting risk perceptions.

If you’re watching changes among regional banks, it could be a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading below analyst targets and substantial intrinsic value implied by fundamentals, investors must consider whether First Busey is genuinely undervalued or if the market has already factored in its future growth prospects.

Price-to-Earnings of 21.1x: Is it justified?

First Busey is currently trading at a price-to-earnings (P/E) ratio of 21.1x, significantly above its industry peers and what many consider reasonable for US banks. At yesterday's close of $23.21, the stock commands a premium multiple in contrast to the sector average.

The price-to-earnings ratio measures how much investors are willing to pay for $1 of the company's earnings. It is an essential indicator of market expectations for future growth. For banks and financial institutions, a higher P/E usually suggests optimism about future profit growth, stability, or a perceived edge over competitors.

However, First Busey's current P/E is nearly double the US Banks industry average of 11.2x and also surpasses the peer group average of 12x. It is also above the estimated "fair" P/E of 18x. This suggests today's valuation leaves little margin for disappointment in earnings trends or risk perception. If markets revert toward the fair ratio, investor sentiment could shift quickly.

Explore the SWS fair ratio for First Busey

Result: Price-to-Earnings of 21.1x (OVERVALUED)

However, sustained high valuation is vulnerable if revenue growth slows or if the banking sector sentiment weakens. This could potentially amplify near-term downside risks for First Busey.

Find out about the key risks to this First Busey narrative.

Another View: What Does the DCF Model Say?

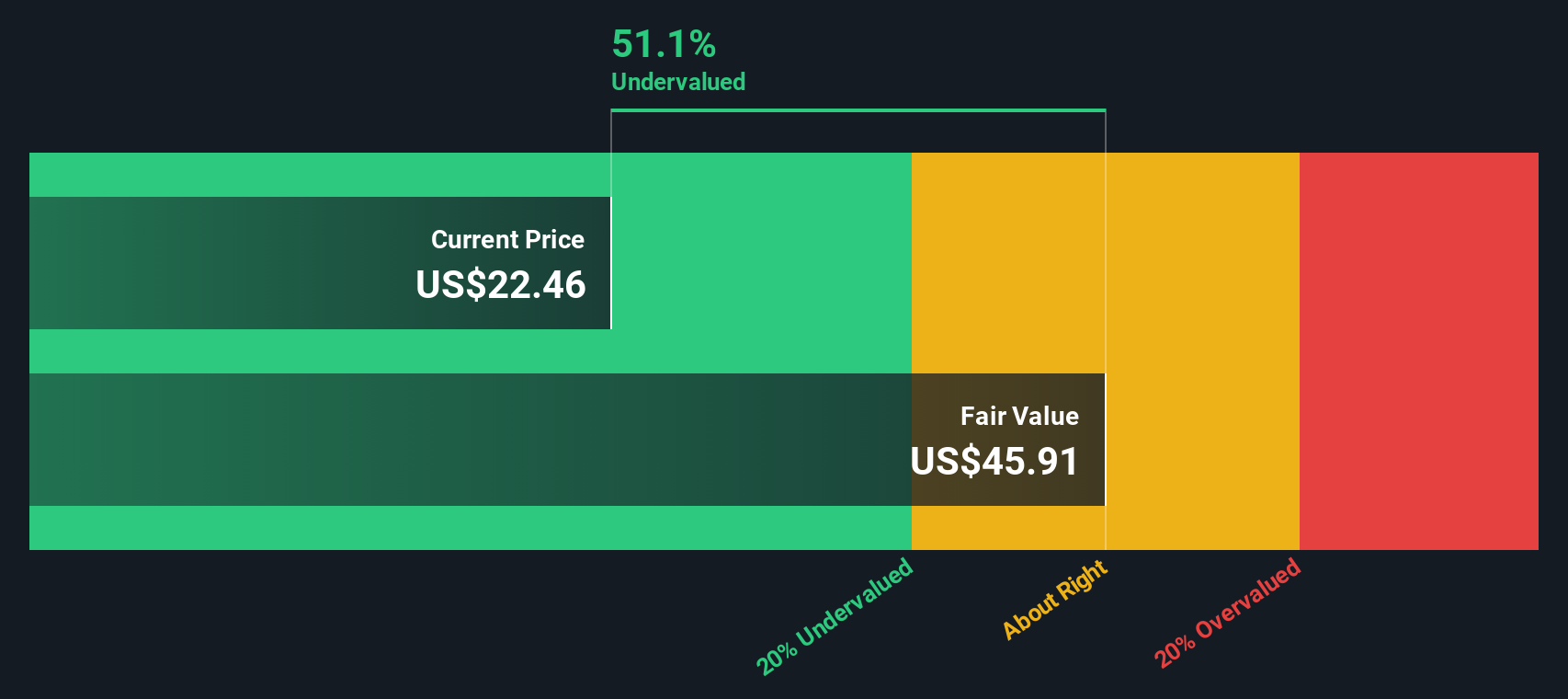

While the price-to-earnings ratio paints First Busey as expensive, the SWS DCF model offers a very different picture. Based on future cash flows, the model values shares at nearly double today’s price. This suggests the market might be overlooking significant intrinsic value. Can such a gap really persist for long?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Busey for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Busey Narrative

If you have your own perspective or want to dig deeper into the numbers, it's quick and easy to build your own analysis and narrative. You can have it ready in minutes. Do it your way

A great starting point for your First Busey research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit your strategy to just one stock? The smartest investors always stay ahead by tracking promising trends and hidden gems others miss. Make your next smart move right now.

- Uncover generous income opportunities by growing your portfolio with these 15 dividend stocks with yields > 3% offering attractive yields and a track record of regular payouts.

- Tap into high-potential innovation by checking out these 26 AI penny stocks pushing boundaries in artificial intelligence and powering tomorrow's advancements.

- Boost your returns with these 927 undervalued stocks based on cash flows that might be trading below their true worth and poised for a strong comeback.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BUSE

First Busey

Operates as the bank holding company for Busey Bank that engages in the provision of retail and commercial banking products and services to individual, corporate, institutional, and governmental customers in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives