- United States

- /

- Banks

- /

- NasdaqGS:BSRR

Sierra Bancorp (BSRR) Net Profit Margin Beats, Reinforcing Value Narrative for Investors

Reviewed by Simply Wall St

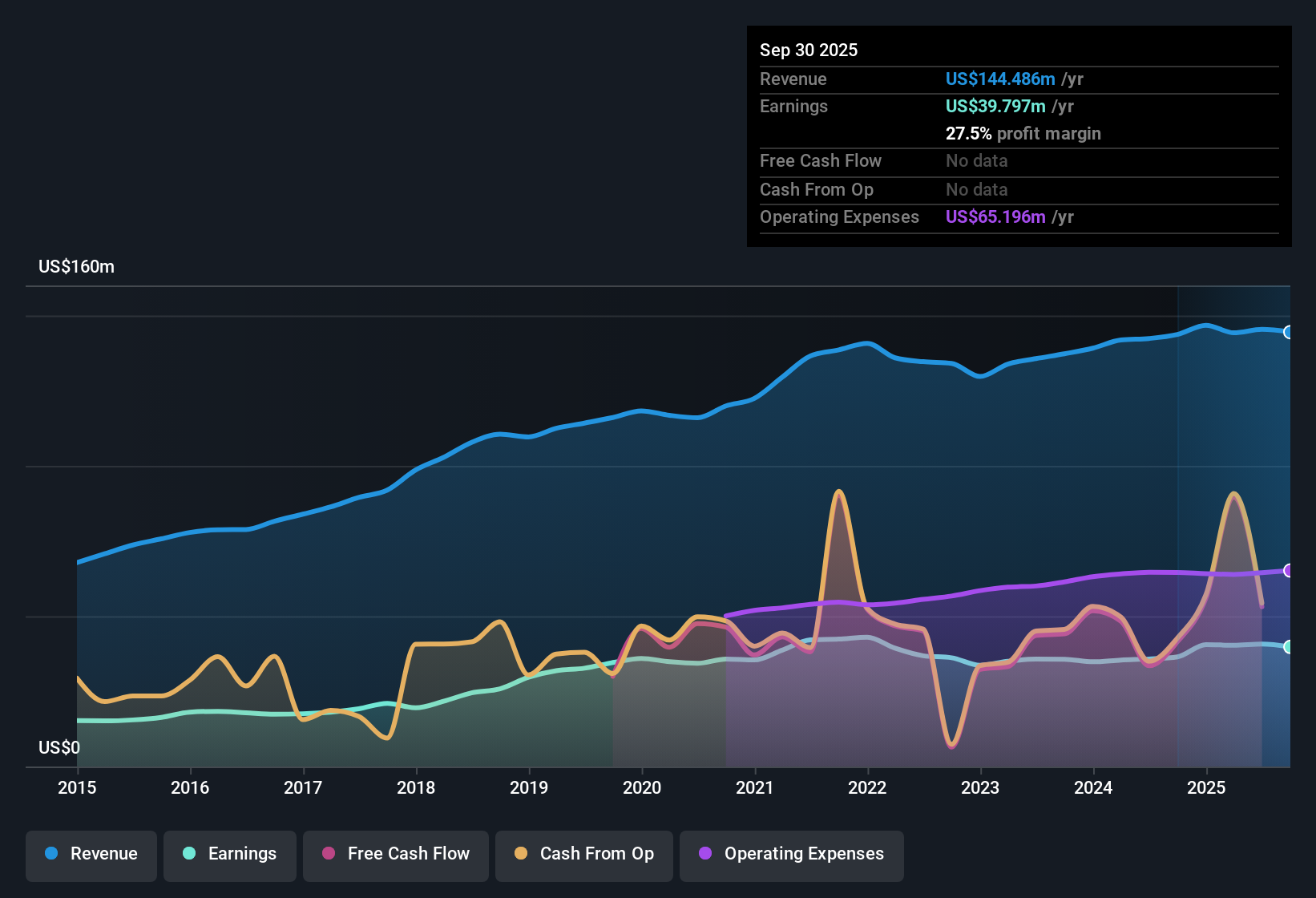

Sierra Bancorp (BSRR) delivered net profit margins of 28%, noticeably higher than last year's 25.1%, and posted recent earnings growth of 13.8% following a trend of five-year average declines at 0.4% per year. With the shares trading at $27.61, well below the estimated fair value of $52.41 and boasting a price-to-earnings ratio of 9.1x compared to peer averages, the company’s results highlight a combination of improved profitability and value for investors. These figures, alongside a healthy dividend and only minor insider selling risks, set the stage for value-focused investors to see current prospects in a favorable light even as growth expectations moderate.

See our full analysis for Sierra Bancorp.The next step is to weigh these results against the popular narratives that shape investor expectations. Some long-held views will be confirmed, but the data may challenge others.

Curious how numbers become stories that shape markets? Explore Community Narratives

Growth Outpaces Recent History but Trails Market

- With analysts forecasting Sierra Bancorp’s annual revenue to rise by 3.4% and earnings by 3.6%, both growth rates remain well below the broader US market averages of 10.1% and 15.5% respectively. These figures, however, represent a turnaround from the company’s previous five-year average earnings decline of 0.4% per year.

- The prevailing analysis highlights that this cautious growth outlook puts Sierra Bancorp in a defensively stable spot relative to more aggressive banks. Its shift from declining to moderate positive growth reassures those looking for consistency and prudent management.

- Market watchers focus on the company’s transition to modest, steady gains and see the earnings recovery as a signal of strong underlying operations, despite muted headline growth versus peers.

- This improvement underpins Sierra Bancorp’s reputation for resilience but also tempers expectations for dramatic upside, keeping the focus on durability instead of momentum.

Dividend Appeal and High Quality Earnings Stand Out

- The filing points out Sierra Bancorp’s attractive dividend characteristics, supported by high quality earnings, positioning it as a steady payer for yield-focused investors amid industry fluctuation.

- According to prevailing market research, the emphasis on dividend stability and earnings quality appeals to investors seeking safer havens within the sector.

- Reliable dividend metrics distinguish Sierra Bancorp from regional bank peers facing greater volatility or capital stress. This helps the bank attract investors less concerned about near-term growth limitations.

- Consistent profitability and payout reliability align with broader investor sentiment favoring defensiveness over riskier expansion in today’s uncertain banking environment.

Valuation Deep Discount Draws Value Investors

- Sierra Bancorp currently trades at a price-to-earnings ratio of 9.1x, below the US Banks industry average of 11.2x and the peer group’s 12.3x. Its $27.59 share price is nearly half of the estimated DCF fair value of $54.32.

- Investment commentary underscores that this pronounced valuation gap, paired with steady operations, heavily favors those with a value-oriented mindset.

- Despite industry-wide headwinds and lower growth projections, Sierra Bancorp’s discounted valuation and quality income stream help set it apart from less stable banks with similar or higher multiples but weaker fundamentals.

- Market participants point to the balance between deep value and operational prudence as a rare find, particularly for investors who prioritize downside protection.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Sierra Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Sierra Bancorp’s modest growth forecasts and limited upside potential leave some investors wanting a more consistent track record of revenue and earnings expansion.

If steady growth is what you value most, check out stable growth stocks screener (2110 results) to focus on companies delivering reliable gains year after year, regardless of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BSRR

Sierra Bancorp

Operates as the bank holding company for Bank of the Sierra that provides retail and commercial banking products and services to individuals and businesses in California.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives