- United States

- /

- Banks

- /

- NasdaqGS:BOKF

The Bull Case For BOK Financial (BOKF) Could Change Following New Buyback and Dividend Announcement – Learn Why

Reviewed by Simply Wall St

- In late July 2025, BOK Financial Corporation announced a new share repurchase program of up to 5,000,000 shares and confirmed a quarterly dividend of US$0.57 per share, payable August 27, 2025.

- These actions signal the company's ongoing focus on returning capital to shareholders and underline board confidence in its financial stability.

- We'll examine how BOK Financial's new buyback plan and dividend affirmation reinforce its long-term capital return and earnings narrative.

Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

BOK Financial Investment Narrative Recap

Owning BOK Financial means believing in continued economic and population growth across the Sun Belt and Midwest, driving demand for loans, real estate, and wealth management. While the new share repurchase plan and stable dividend reinforce management’s commitment to shareholder returns, these actions do not meaningfully shift the current biggest risk: elevated credit exposure in commercial real estate and energy, which could impact earnings if sector conditions worsen.

Among recent events, the 5,000,000-share buyback program stands out, signaling BOK Financial’s intent to support its long-term capital return strategy despite ongoing volatility in its loan portfolios. This move aligns with institutional confidence but doesn’t resolve the underlying sector-specific risks that could affect near-term outcomes.

But investors should also be paying attention to BOK Financial's concentrated exposure to commercial real estate, which means that if ...

Read the full narrative on BOK Financial (it's free!)

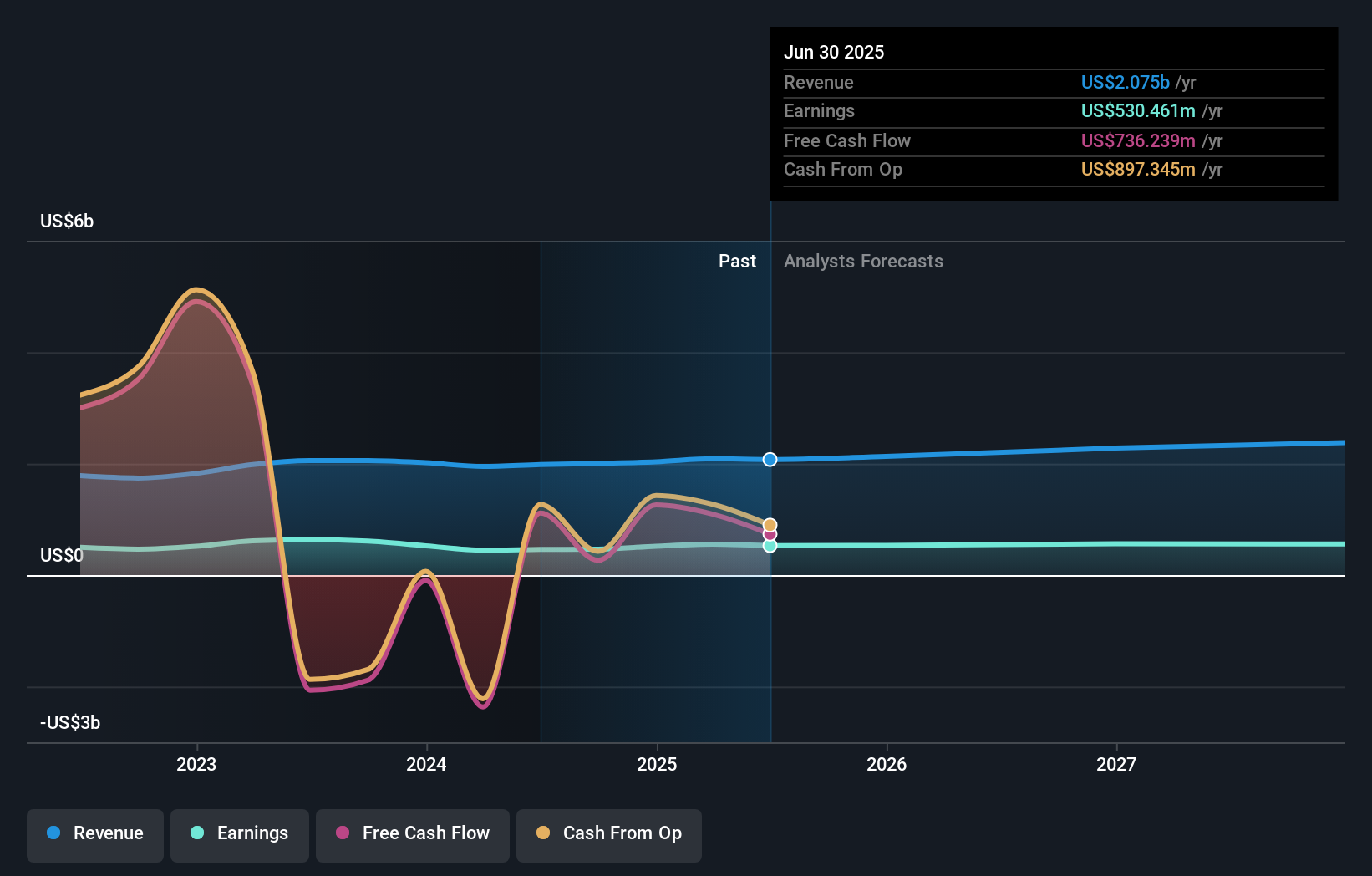

BOK Financial's outlook forecasts $2.5 billion in revenue and $579.1 million in earnings by 2028. This is based on an expected annual revenue growth rate of 5.9% and a $48.6 million increase in earnings from the current level of $530.5 million.

Uncover how BOK Financial's forecasts yield a $115.10 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Only one Simply Wall St Community estimate exists for BOK Financial’s fair value at US$146.82 per share, above the recent market price. While many see value, ongoing credit risk from commercial real estate exposure remains a key consideration for long-term performance.

Explore another fair value estimate on BOK Financial - why the stock might be worth just $146.82!

Build Your Own BOK Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BOK Financial research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BOK Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BOK Financial's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BOK Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BOKF

BOK Financial

Operates as the financial holding company for BOKF, NA that provides various financial products and services in Oklahoma, Texas, New Mexico, Northwest Arkansas, Colorado, Arizona, and Kansas/Missouri.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives