- United States

- /

- Banks

- /

- NasdaqGS:BOKF

A Look at BOK Financial's (BOKF) Valuation Following Robust Q3 Earnings and Positive 2024 Guidance

Reviewed by Simply Wall St

BOK Financial (BOKF) released its third-quarter results along with fresh guidance for the year, highlighting growth across its loan portfolio and investment banking revenue. The company is projecting steady full-year revenue growth and stable net interest income.

See our latest analysis for BOK Financial.

Following these results, BOK Financial’s share price has shown modest movement, with a 1.42% gain in the past day helping offset a softer run in the last month. Total shareholder returns tell a more resilient story, up 2.8% over the past year and 104% in the last five years. This signals that long-term value has steadily built up even as short-term price momentum has been uneven. Recent share repurchases and strong investment banking revenue appear to have supported sentiment, hinting that investor confidence remains intact for now.

If updates like these have you curious about what else is driving long-term gains, now’s the perfect time to broaden your radar and explore fast growing stocks with high insider ownership

With shares showing resilience and new growth projections in place, the key question for investors is whether BOK Financial remains undervalued at current prices or if the market has already accounted for the company’s future prospects.

Most Popular Narrative: 10.8% Undervalued

The latest narrative suggests BOK Financial's fair value stands at $119.20, noticeably higher than its last close of $106.28. This difference highlights renewed interest in how the company’s fundamentals are shaping its outlook.

BOK Financial's strategic expansion into fast-growing markets like Texas and Arizona, along with talent acquisition in key markets, positions the company to capitalize on secular migration and economic trends. This can drive above-peer loan and revenue growth. The company's diversified fee income, including trading, wealth management, and treasury services, provides resilience against interest rate fluctuations and contributes to a more stable and growing earnings base.

Want to know what’s really powering this fair value leap? Hints of aggressive growth strategies, stabilizing income streams, and bold demographic bets are all in play. Which numbers and assumptions push BOK Financial toward this projected valuation? Find out which catalysts set this narrative apart.

Result: Fair Value of $119.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to commercial real estate loans and regional economic shifts could challenge BOK Financial’s optimistic growth outlook if conditions become less favorable.

Find out about the key risks to this BOK Financial narrative.

Another View: Multiples Tell a Different Story

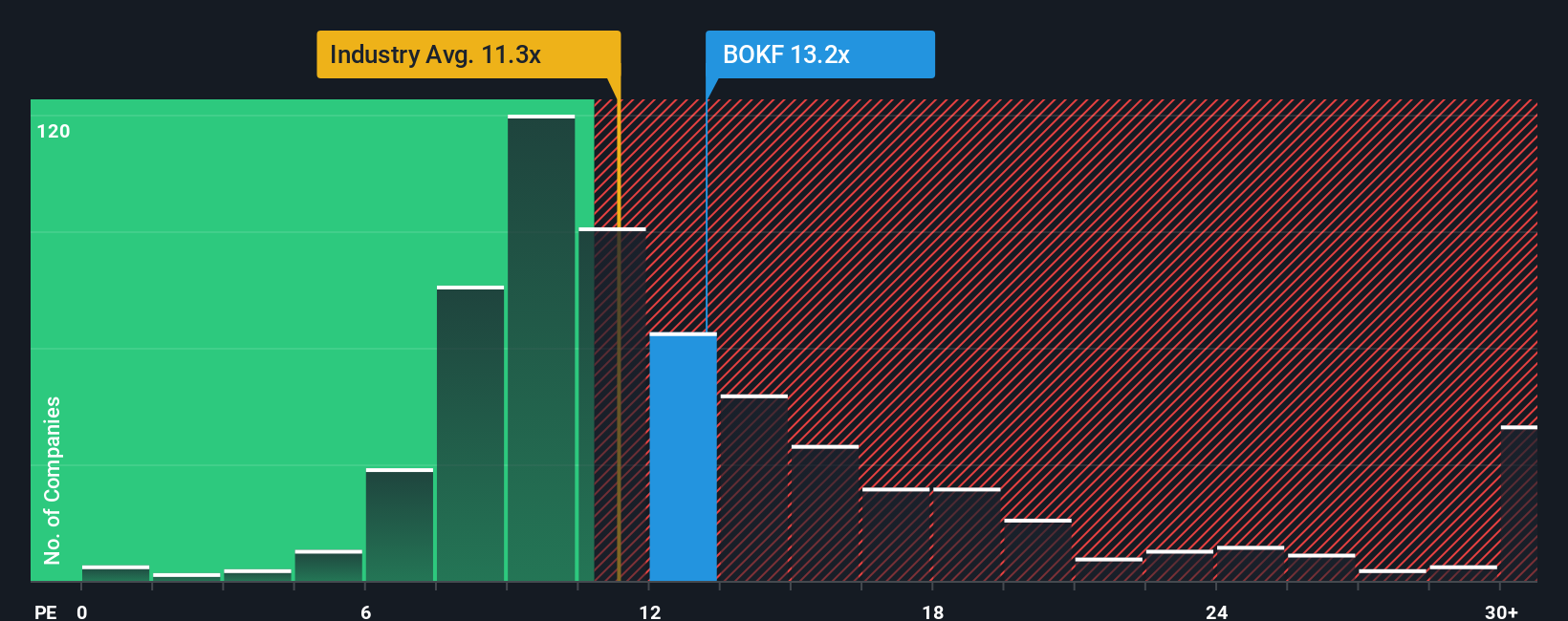

Looking from another angle, BOK Financial’s price-to-earnings ratio stands at 12.7x. This is higher than both the industry average of 11.2x and the peer average of 11.6x. It also exceeds its fair ratio of 12.2x, suggesting investors are paying a premium. Is the market excitement about growth perhaps running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BOK Financial Narrative

If you see things differently or want to dig into the numbers on your own, you can assemble your own narrative in under three minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding BOK Financial.

Looking for More Investment Ideas?

Don’t limit your opportunities to just one company. Sharpen your investing edge by checking these hand-selected stock ideas and rethinking what’s possible with your portfolio.

- Strengthen your income potential and weather volatility by securing a spot in the market with these 17 dividend stocks with yields > 3%, which yields more than 3% returns.

- Capitalize on the growth surge in artificial intelligence by targeting these 27 AI penny stocks before the broader market catches on.

- Get ahead of value-seekers by targeting these 878 undervalued stocks based on cash flows, which is based on robust cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BOK Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BOKF

BOK Financial

Operates as the financial holding company for BOKF, NA that provides various financial products and services in Oklahoma, Texas, New Mexico, Northwest Arkansas, Colorado, Arizona, and Kansas/Missouri.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives