- United States

- /

- Banks

- /

- NasdaqGS:BOKF

A Closer Look at BOK Financial (BOKF) Valuation Following Fed Rate Cut Expectations and Market Optimism

Reviewed by Simply Wall St

Comments from the New York Federal Reserve President about possible interest rate cuts have lifted market optimism, sending BOK Financial (BOKF) shares up 4%. The anticipation of lower rates is providing a particular boost to regional banks at the moment.

See our latest analysis for BOK Financial.

After a steady start to the year, BOK Financial has found some momentum, with the latest share price now at $113.54 and a one-week share price return of 6.6%. However, the 1-year total shareholder return is still in negative territory at -2.97%, so while recent optimism has helped, the long-term picture remains mixed.

If news about shifting rate expectations has you rethinking your next move, it could be a great time to discover fast growing stocks with high insider ownership

With the stock now trading close to its analyst price target and showing some recent gains, the key question for investors is whether BOK Financial is undervalued based on its fundamentals or if the market has already priced in its recovery. Is this a genuine buying opportunity, or are expectations for future growth already reflected in the current share price?

Most Popular Narrative: 4.3% Undervalued

BOK Financial’s most widely followed narrative pegs its fair value at $118.70, just above the last close of $113.54. This slim margin highlights how closely the stock’s share price tracks the underlying fundamentals right now, stirring debate over how much upside really remains.

BOK Financial's strategic expansion into fast-growing markets like Texas and Arizona, alongside talent acquisition in key markets, positions the company to capitalize on secular migration and economic trends. This approach may support above-peer loan and revenue growth. The company's diversified fee income, including trading, wealth management, and treasury services, provides resilience against interest rate fluctuations and contributes to a more stable and growing earnings base.

Want to see the full story behind this modest undervaluation? Analysts’ forecasts hinge on bold projections for growth in loans and fee-based income, all under a higher future profit multiple. Curious what profit and revenue leaps justify a valuation like this? Find out what makes this narrative tick.

Result: Fair Value of $118.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressure and heavy reliance on regional growth could present challenges to BOK Financial’s path to sustainable long-term gains if conditions shift.

Find out about the key risks to this BOK Financial narrative.

Another View: What Do Valuation Ratios Say?

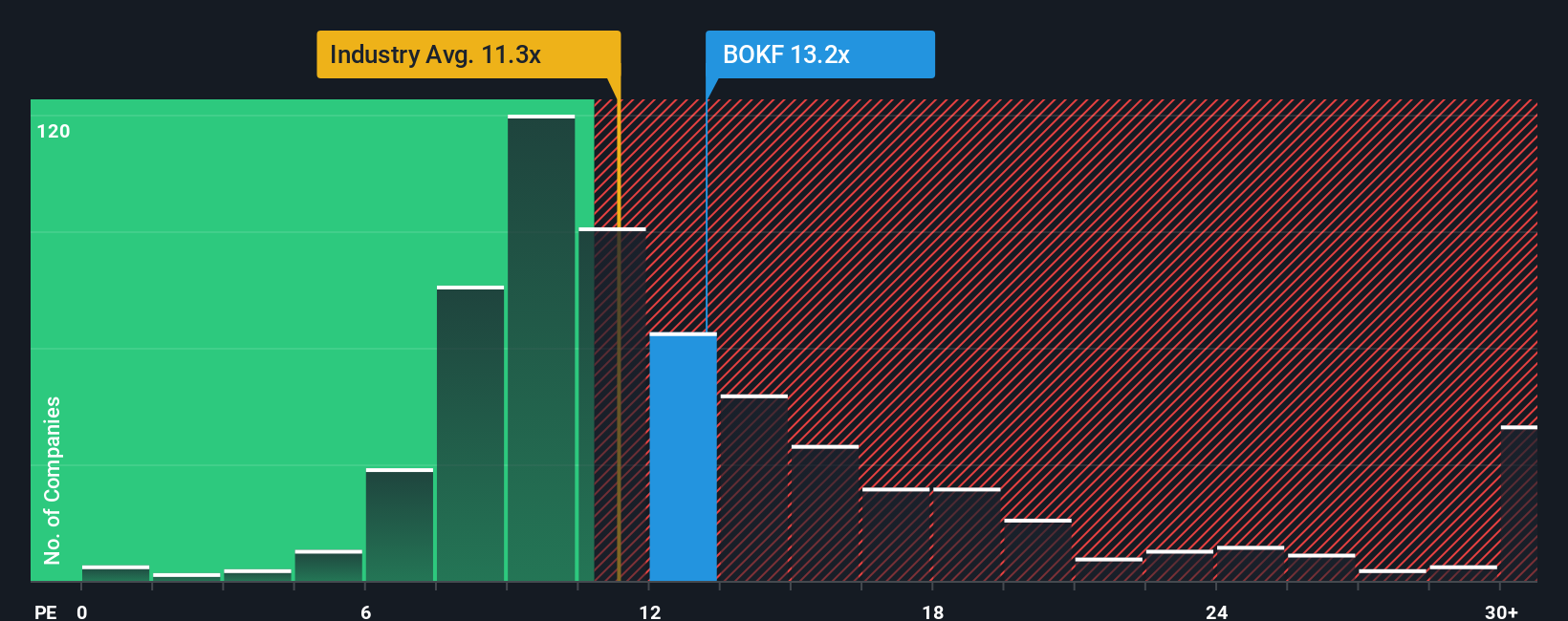

Looking through the lens of valuation ratios, BOK Financial’s price-to-earnings figure of 13.5x stands above both the US Banks industry average of 11.2x and its peer group average of 12.8x. Meanwhile, the fair ratio suggests the market could shift closer to 11x. Does this premium indicate quality, or could it add risk if growth stalls?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BOK Financial Narrative

If you see things differently or like to draw your own conclusions from the numbers, it’s quick and easy to frame your own perspective. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding BOK Financial.

Looking for more investment ideas?

Don’t let the next big opportunity pass you by. Take charge and use these hand-picked stock screens to spot unique investments with serious potential:

- Supercharge your portfolio by checking out these 924 undervalued stocks based on cash flows, which is packed with stocks trading below their intrinsic worth.

- Capture the momentum in artificial intelligence by browsing these 26 AI penny stocks, where innovative tech companies are accelerating growth.

- Boost your income strategy with these 14 dividend stocks with yields > 3%, featuring shares offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BOK Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BOKF

BOK Financial

Operates as the financial holding company for BOKF, NA that provides various financial products and services in Oklahoma, Texas, New Mexico, Northwest Arkansas, Colorado, Arizona, and Kansas/Missouri.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success