- United States

- /

- Banks

- /

- NasdaqCM:BHRB

Burke & Herbert Financial Services (BHRB): Net Margin Surge Challenges Cautious Earnings Quality Narratives

Reviewed by Simply Wall St

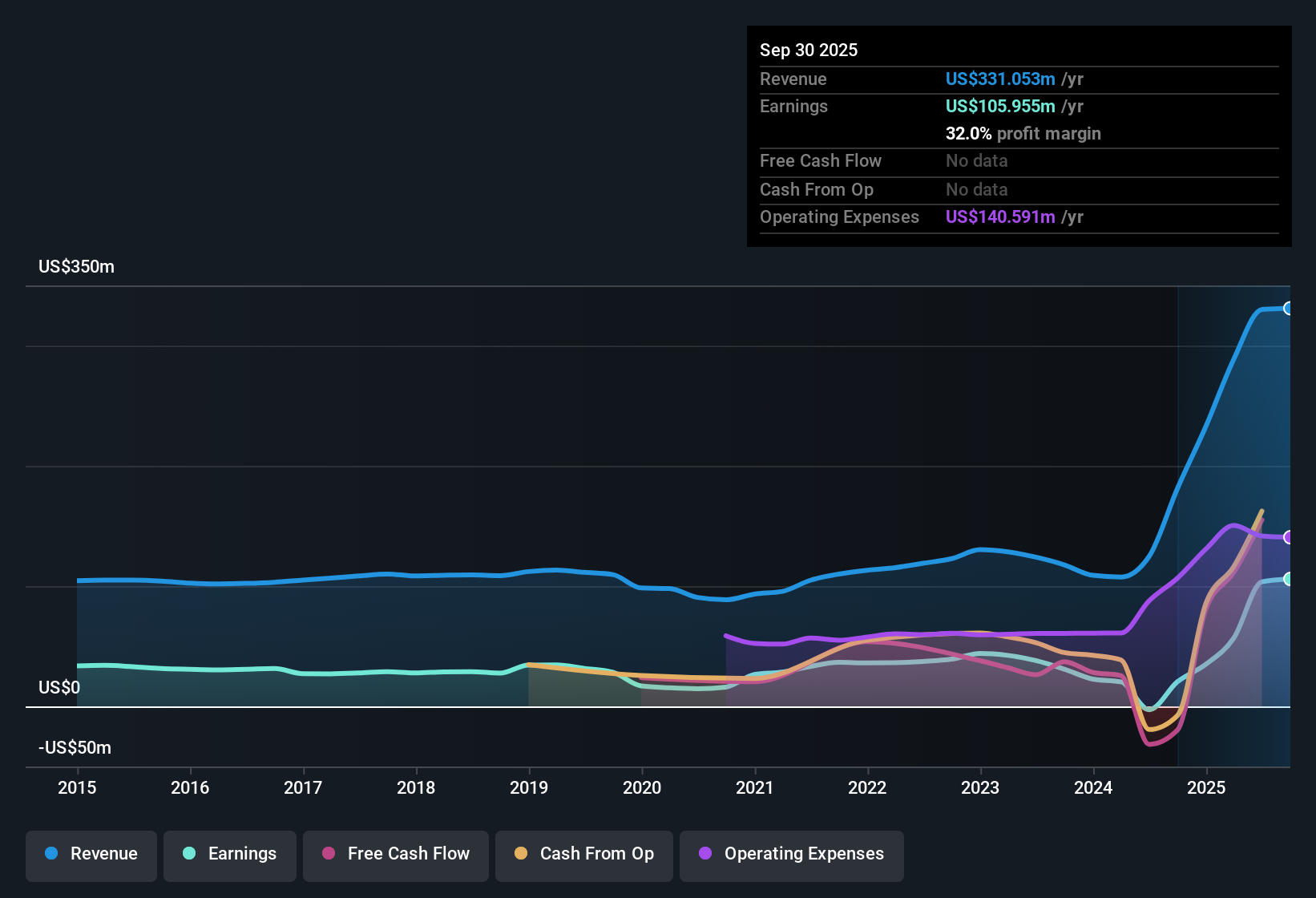

Burke & Herbert Financial Services (BHRB) turned in a net profit margin of 32.5%, a substantial increase from last year’s 11.3%, and delivered EPS growth of 415.8% over the past year, far outpacing its five-year average of 18.9% per year. As impressive as the bottom line looks, the latest results reflect both standout profitability and a significant one-off $36.5 million loss. Slower forward growth forecasts are also likely to weigh on how investors size up the quality and sustainability of recent results.

See our full analysis for Burke & Herbert Financial Services.Next, we're putting these headline numbers side by side with the key narratives that investors follow to see what stands up to scrutiny and what might need a second look.

Curious how numbers become stories that shape markets? Explore Community Narratives

Growth Forecasts Lagging US Market Pace

- The company's expected annual earnings growth of 5.2% and revenue growth of 6.6% both trail broader US market forecasts, which stand at 15.5% and 10% respectively.

- Bears might point out that this slower outlook challenges BHRB's appeal as a growth story, especially considering the following:

- Current projections indicate the company is not expected to keep pace with peers, potentially limiting valuation expansion even after a period of strong margin performance.

- Lower forecasted growth could weigh on investor sentiment and curb upward momentum, despite the significant improvement in recent net profit margin.

Peer Discount Deepens Relative Value

- BHRB trades at a Price-to-Earnings Ratio of 8.8x, a notable discount compared to both its peer average and the US banks industry average of 11.2x.

- Supporters of value investing may argue this relative undervaluation is compelling, particularly in light of the following points:

- The bank’s share price of $61.70 is significantly below a DCF fair value estimate of $131.93, highlighting potential upside if margins stabilize and sector conditions improve.

- Discounted trading multiples suggest BHRB could attract greater attention from bargain hunters, especially if market risk appetite recovers for regional banks.

One-Off Loss Distorts Profit Quality

- Reported profit incorporates a significant one-time loss of $36.5 million, which impacts the apparent strength of recent results and raises questions about earning sustainability.

- It is notable that, even after accounting for this exceptional charge, the bank still showed margin expansion, although the following considerations remain:

- Investors will need to closely watch whether these elevated margins and unusually high earnings levels are repeatable, or if normalization will set in as the effect of the one-off fades.

- The outlier loss serves as a reminder that beneath headline growth, risk events can temporarily inflate or distort performance metrics, making it important to separate core trends from non-recurring impacts.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Burke & Herbert Financial Services's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

BHRB’s outlook is clouded by slower growth forecasts and a big one-time loss. This raises doubts about the consistency and quality of recent earnings momentum.

To focus on names with reliable, steady expansion, use our stable growth stocks screener (2099 results) to find companies built to deliver consistent results even as conditions change.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burke & Herbert Financial Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BHRB

Burke & Herbert Financial Services

Operates as the bank holding company for Burke & Herbert Bank & Trust Company that provides various community banking products and services in Virginia and Maryland.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives