- United States

- /

- Banks

- /

- NasdaqCM:BFC

Will Board Appointment and Earnings Growth Signal a New Chapter for Bank First (BFC)?

Reviewed by Sasha Jovanovic

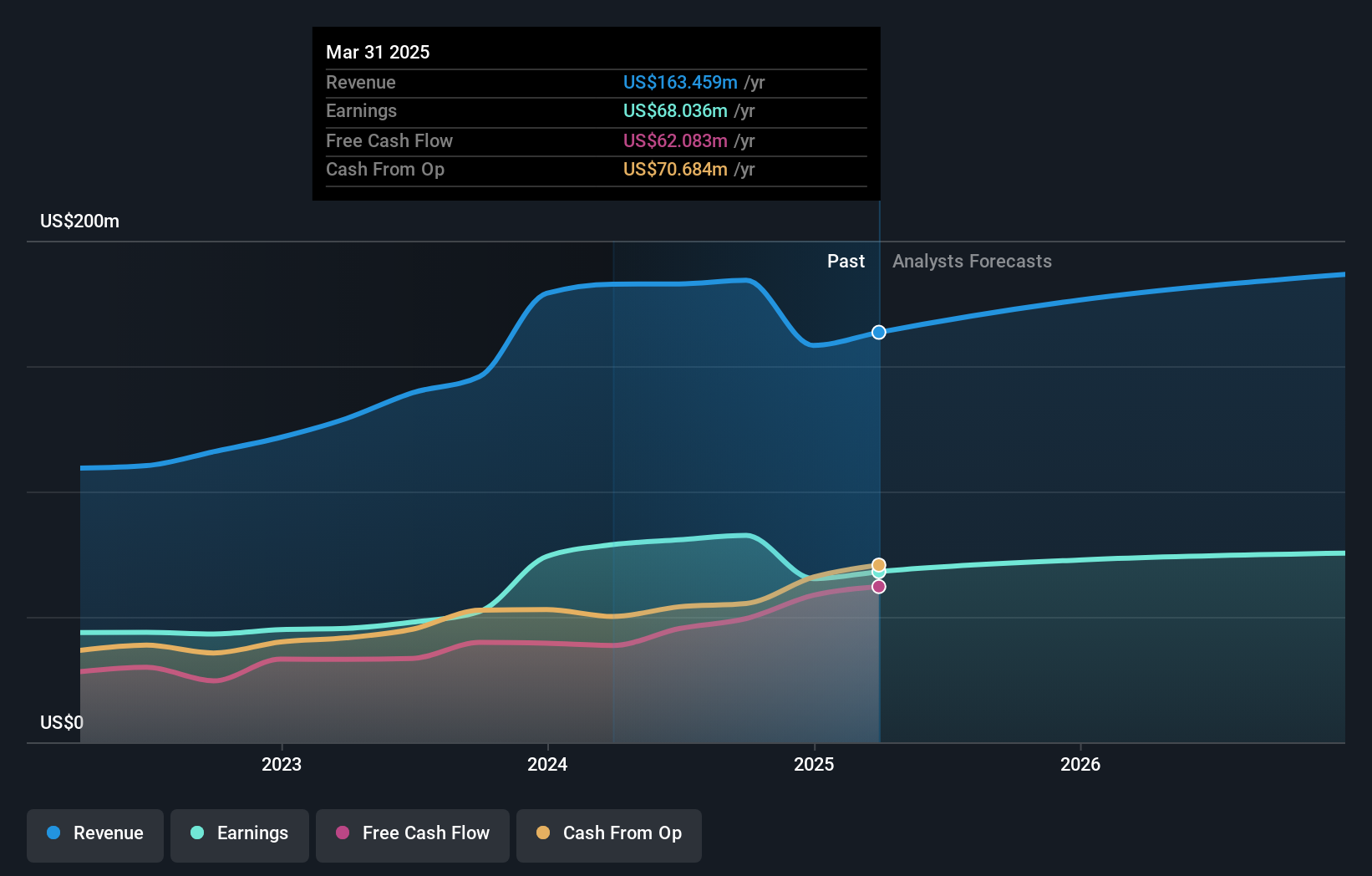

- On October 21, 2025, Bank First Corporation reported higher net income and net interest income year-over-year for both the third quarter and first nine months, reaffirmed its quarterly cash dividend, and appointed experienced financial services executive Todd A. Sprang to its Board of Directors and Audit Committee.

- Sprang’s extensive leadership in public accounting and financial services is set to strengthen Bank First’s governance and fiscal oversight as the company continues to emphasize operational performance and shareholder returns.

- We’ll explore how the appointment of a seasoned financial expert to the board supports Bank First’s commitment to sound governance and shareholder value.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Bank First's Investment Narrative?

To believe in Bank First as a shareholder right now, you’d look to its resurgent earnings momentum, affirmed dividend, and visible share buyback activity, all signals of board confidence in operational performance and capital return priorities. The appointment of Todd A. Sprang, with decades of financial services and audit experience, directly addresses current sector-wide risks around governance and regulatory scrutiny. His background is likely to strengthen the Audit Committee’s scrutiny, a relevant upgrade given recent board retirements and the sector’s constant focus on effective risk management. For most short-term catalysts, including execution on forecasted growth and the pace of share repurchases, Sprang’s addition marginally improves oversight rather than shifts the outlook dramatically. While the boost to board expertise fits with efforts to sustain performance and support valuation, it does little to alter the biggest ongoing risks: sector earnings volatility and the premium valuation compared to peers.

Yet not all risks have been resolved, especially around that premium valuation and industry headwinds. Bank First's shares have been on the rise but are still potentially undervalued by 19%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Bank First - why the stock might be worth just $146.00!

Build Your Own Bank First Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank First research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Bank First research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank First's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank First might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BFC

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives