- United States

- /

- Banks

- /

- NasdaqGS:BANR

Banner (BANR): Is the Recent Share Price Rebound Backed by the Valuation?

Reviewed by Simply Wall St

Banner (BANR) has quietly drifted higher over the past month, and that steady move is getting investors to revisit the regional bank’s mix of growth, income, and valuation.

See our latest analysis for Banner.

That 10.36% 1 month share price return stands out against a flat year to date move and a modest 1 year total shareholder return of 3.8%. This suggests momentum is only just starting to rebuild as investors reassess Banner’s earnings resilience and valuation.

If Banner’s steady climb has you thinking about where else capital might work harder, this could be a smart moment to explore fast growing stocks with high insider ownership.

With earnings still growing, a share price near analysts’ targets, and some models pointing to deeper intrinsic value, the real question is whether Banner is quietly undervalued or whether the market is already pricing in its future growth.

Most Popular Narrative Narrative: 9.8% Undervalued

With Banner last closing at $66.23 against a narrative fair value of $73.40, the story leans toward upside driven by steady, compounding growth.

The company's investments in new deposit and loan origination systems, as well as ongoing digitization efforts, are expected to reduce branch and back-office costs, while also expanding its reach to new customer segments, potentially improving net margins and efficiency ratios. Robust recent loan growth, driven by origination activity in owner-occupied commercial real estate, C&I, construction, and small business lending, indicates Banner is effectively capitalizing on economic and demographic shifts in its regions, supporting sustained top-line growth and earnings expansion.

Want to see how modest growth assumptions still justify a richer future earnings multiple than many peers? The narrative blends steady revenue expansion with resilient margins and a surprisingly confident earnings path. Curious which earnings and valuation bridge connects today’s price to that higher fair value?

Result: Fair Value of $73.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Banner’s heavy CRE exposure and reliance on higher cost funding persist for an extended period, they could pressure margins and quickly weaken this upside narrative.

Find out about the key risks to this Banner narrative.

Another Take on Valuation

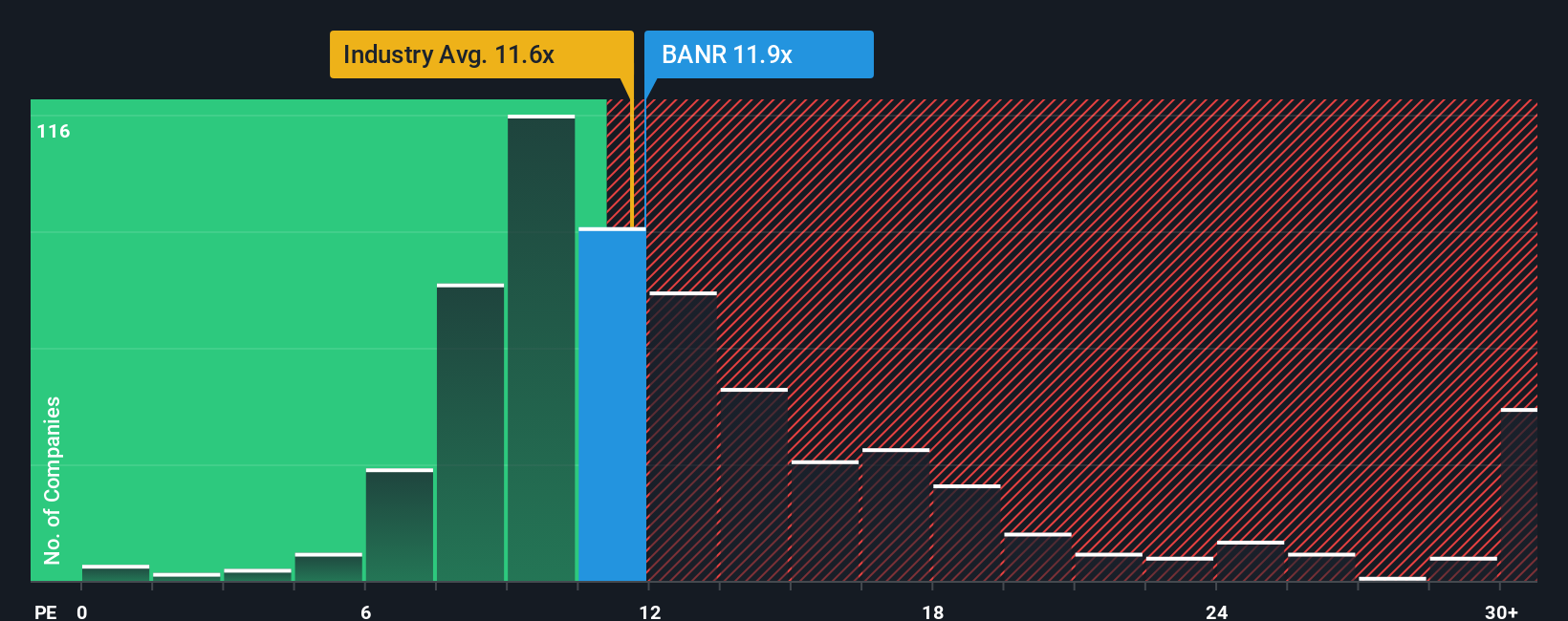

While the narrative and analyst targets lean toward upside, a simple earnings multiple sends a more cautious signal. Banner trades on about 12.1 times earnings, slightly richer than the US banks at 12.0 times and above its own fair ratio of 11.2, hinting at limited margin for disappointment. Is this a value story or a fully priced slow grower?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Banner Narrative

If you see the story differently and want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Banner research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential edge by using the Simply Wall Street Screener to uncover stocks that fit your strategy, not someone else’s.

- Target steady cash returns by scanning these 13 dividend stocks with yields > 3% and pinpointing companies that might strengthen your portfolio’s income stream.

- Spot tomorrow’s innovators early through these 25 AI penny stocks, focusing on businesses shaping the next wave of intelligent technology.

- Pursue compelling value opportunities with these 916 undervalued stocks based on cash flows, where fundamentals and pricing can align in your favor before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Banner might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BANR

Banner

Operates as the bank holding company for Banner Bank that engages in the provision of commercial banking and financial products and services to individuals, businesses, and public sector entities in the United States.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion