- United States

- /

- Banks

- /

- NasdaqGS:AVBH

Avidbank Holdings (AVBH) Profit Margin Surge Challenges Valuation Skeptics

Reviewed by Simply Wall St

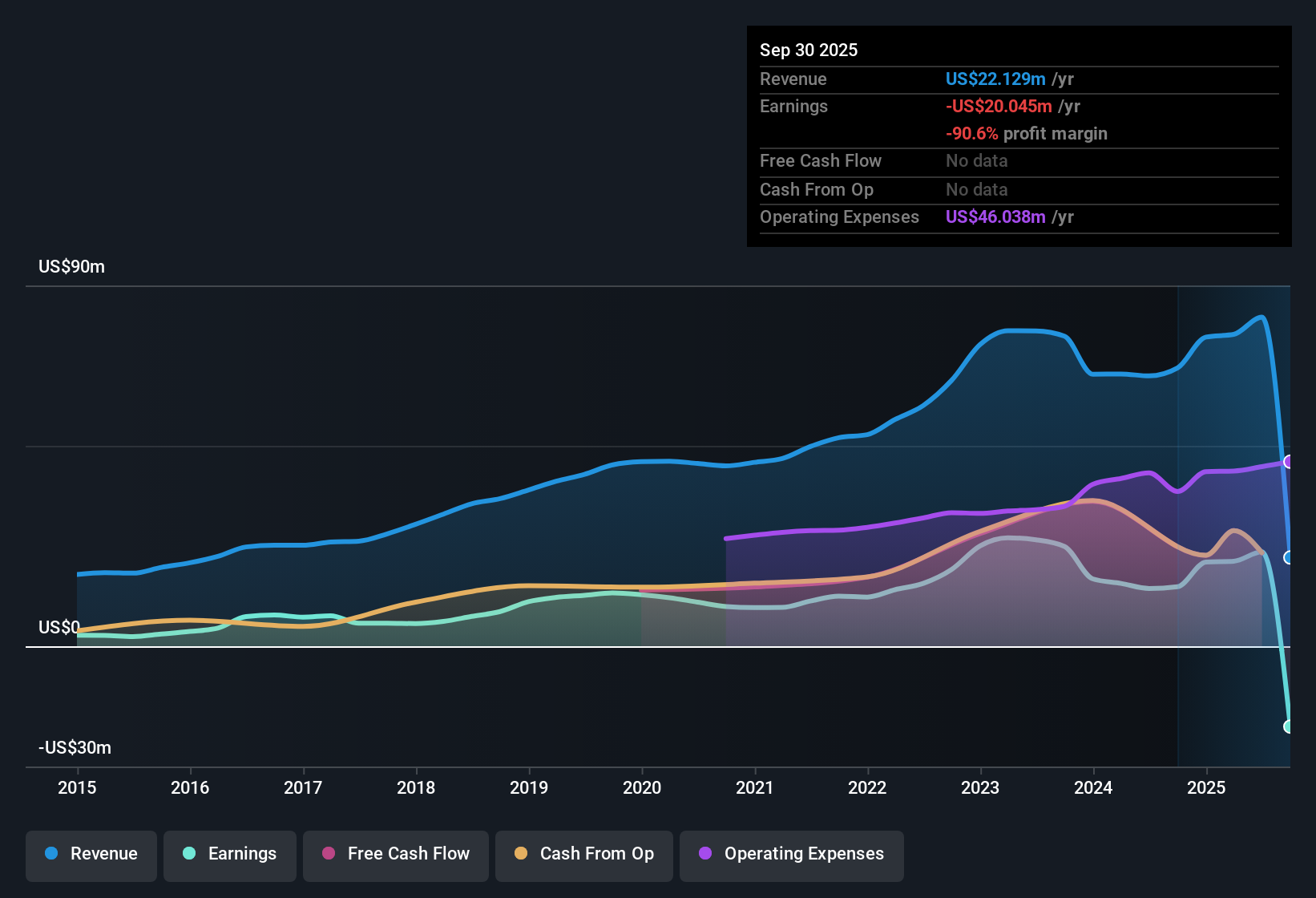

Avidbank Holdings (AVBH) has delivered a strong showing, with net profit margin jumping to 28.7%, up from last year's 21.4%. Profits surged 63.2% over the latest year, which is well above its 14.2% annual average over the past five years. The company is expected to outpace the broader US market, with earnings forecast to grow at 20% per year and revenue projected to increase by 13.7% per year. Investors are weighing this high-quality growth against a valuation that looks expensive compared to peers on traditional multiples, but attractive on some discounted cash flow estimates.

See our full analysis for Avidbank Holdings.The real test is how these headline numbers measure up against the dominant narratives. Sometimes expectations get confirmed, but standout results can also spark new debates.

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Fair Value Sits Far Above the Market Price

- Avidbank’s shares trade at $26.18, which is significantly below the DCF fair value estimate of $70.27. This suggests a theoretical upside of nearly 170% based on cash flow modeling.

- Recent profit growth and a net margin of 28.7% heavily supports positive expectations for future cash generation.

- Revenue is forecast to rise 13.7% per year, ahead of the US market’s 10% growth projection.

- No new share dilution removes a key risk that could otherwise drag future value down.

P/E Premium Over Peers Raises Valuation Debate

- The stock’s P/E ratio of 12.2x outpaces the US banking sector’s 11.2x and peer group’s 9.9x. This highlights that investors are paying a premium for recent performance and perceived quality.

- Because the P/E sits above sector averages while fair value models point much higher, conviction splits. Some view the premium as justified by consistency and margin strength.

- Others are cautious since sector headwinds or mean reversion could trim forecasted growth.

- This dynamic often keeps the shares debated by both growth-oriented bulls and valuation-conscious skeptics.

Profit Margin Expansion Outpaces Historical Trend

- Net profit margin grew to 28.7%, a step up from 21.4% the previous year and well above the company’s long-term average.

- What’s surprising is this margin gain coincided with 63.2% profit growth, outstripping the already robust 14.2% annual five-year average. This deepens confidence in efficiency and prudence even as the sector faces broad macro risks.

- Bulls will note these combined margin and growth improvements are rare, not just incremental.

- Critics are left looking for cracks that have yet to materialize in the filings.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Avidbank Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Avidbank’s valuation premium over peers and sector averages raises concerns that future returns may falter if growth slows or sentiment shifts.

If you’re looking for better value and less premium risk, check out these 874 undervalued stocks based on cash flows to find companies trading at more attractive prices relative to their fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVBH

Avidbank Holdings

Operates as a bank holding company for Avidbank that provides financial solutions and services.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives