- United States

- /

- Auto

- /

- NYSE:ZK

Zeekr (NYSE:ZK): Evaluating Valuation After Strong October Delivery Growth Update

Reviewed by Simply Wall St

ZEEKR Intelligent Technology Holding (NYSE:ZK) has just shared its October delivery results. The company delivered 61,636 vehicles across its Zeekr and Lynk & Co brands, a 10% rise from last year and up 21% from the previous month.

See our latest analysis for ZEEKR Intelligent Technology Holding.

Following the upbeat delivery numbers, ZEEKR Intelligent Technology Holding has captured more attention, but momentum in the share price has cooled lately. The stock logged a one-year total shareholder return of 11.04%, though its latest share price is down nearly 9% over the past month, signaling that the excitement around operational growth has not yet translated to sustained upward price momentum.

If the surging EV shipments have you watching the auto sector, now could be the perfect moment to discover other movers with our auto manufacturers screener. Check out See the full list for free..

With strong delivery growth but recent share weakness, the question for investors is clear: is ZEEKR trading below its true value, or have the markets already factored in all of its future potential?

Most Popular Narrative: 26.5% Undervalued

At a last close of $27.57, ZEEKR Intelligent Technology Holding sits notably below the most popular narrative’s fair value estimate of $37.52. Strong growth ambitions and a new wave of hybrid innovation have shaped the foundation behind this figure, offering a roadmap that contrasts sharply with the current market price.

The company’s strong innovation pipeline, specifically upcoming launches of premium models such as the Zeekr 9X and 8X with proprietary super electric hybrid technology and 900V fast charging, positions ZEEKR to capture increased demand as consumers globally shift towards high-tech, intelligent electric mobility. This is likely to drive revenue growth and improved vehicle margins in the coming quarters.

Curious about the high-octane assumptions fueling this price target? The real intrigue lies in projections about explosive revenue growth, fatter margins, and an earnings turnaround that rivals industry giants. Get ready to uncover the financial leap this narrative is betting on.

Result: Fair Value of $37.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, surging global competition and heavy reliance on Geely technology could pressure margins and stall the rapid growth story that investors are hoping for.

Find out about the key risks to this ZEEKR Intelligent Technology Holding narrative.

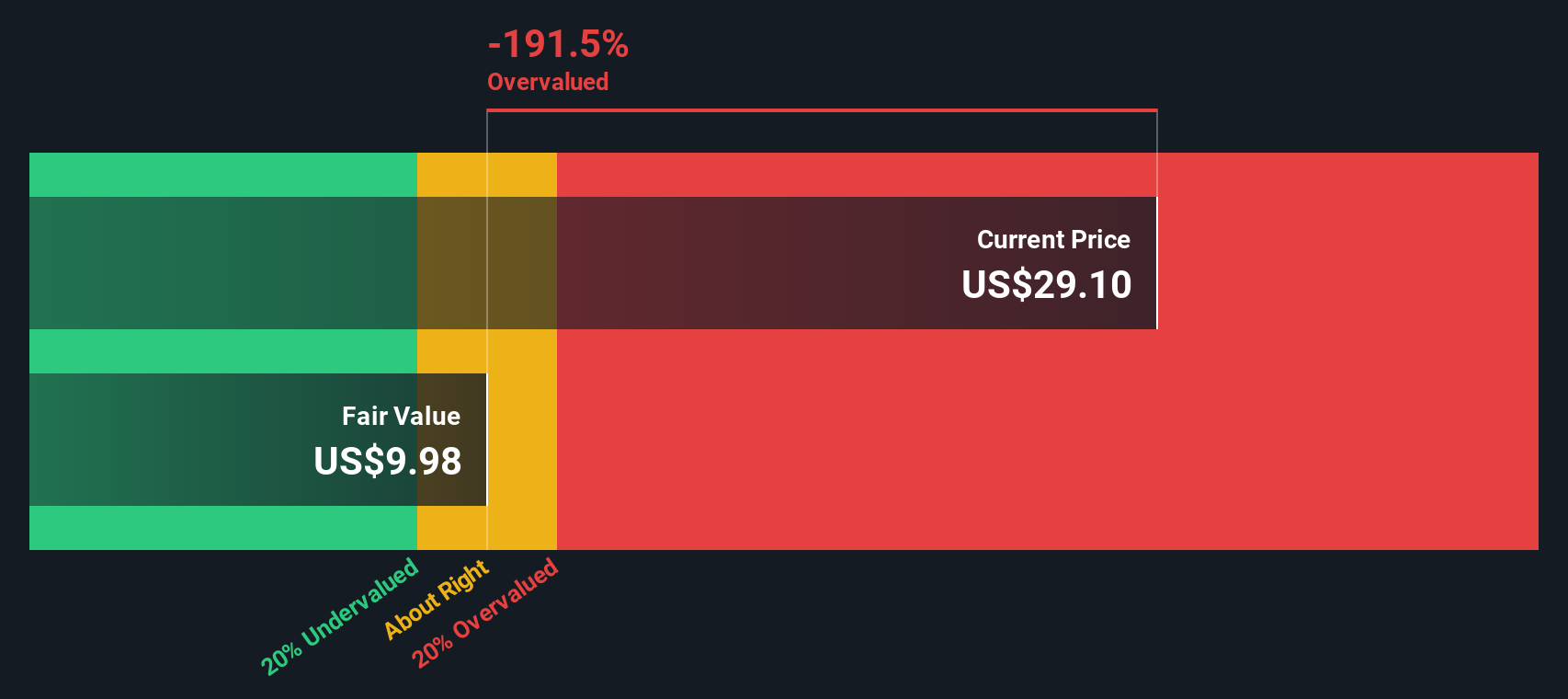

Another View: SWS DCF Model Challenges the Optimism

While the analyst consensus pegs ZEEKR as undervalued, our DCF model suggests a much lower fair value of $10.50 per share compared to the current price. This gap highlights real tension between long-term cash flow expectations and the bullish growth assumptions in the market narrative. Could the stock be riskier than it looks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ZEEKR Intelligent Technology Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ZEEKR Intelligent Technology Holding Narrative

Not convinced by the current story or eager to interpret the figures your own way? You can craft your personalized narrative in just minutes, so dive in and Do it your way.

A great starting point for your ZEEKR Intelligent Technology Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Ideas?

Smart investing means keeping your options open and tapping into opportunities others might overlook. Each of these handpicked screens could spark your next big move. Why settle for ordinary when standout stocks are just a click away?

- Capture income and potential growth by targeting companies that offer attractive yields with these 16 dividend stocks with yields > 3% delivering over 3% returns.

- Ride the technology wave and stake your claim in the future of finance, automation, and innovation with these 24 AI penny stocks.

- Take advantage of undervalued stocks by grabbing your chance with these 870 undervalued stocks based on cash flows before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZEEKR Intelligent Technology Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZK

ZEEKR Intelligent Technology Holding

An investment holding company, engages in the research and development, production, commercialization, and sale of the electric vehicles and batteries.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives