- United States

- /

- Auto Components

- /

- NYSE:SMP

Why Investors Shouldn't Be Surprised By Standard Motor Products, Inc.'s (NYSE:SMP) Low P/E

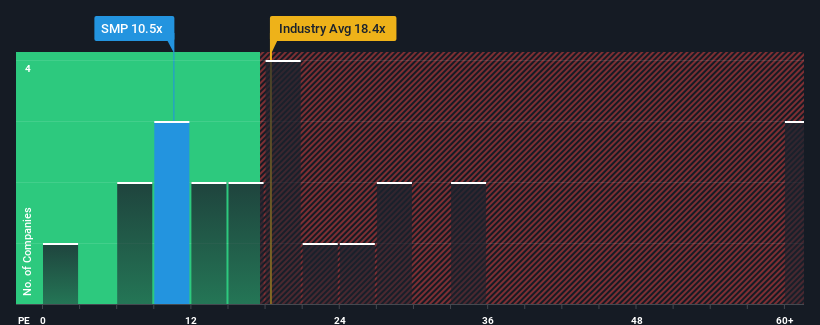

With a price-to-earnings (or "P/E") ratio of 10.5x Standard Motor Products, Inc. (NYSE:SMP) may be sending bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 33x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

As an illustration, earnings have deteriorated at Standard Motor Products over the last year, which is not ideal at all. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Standard Motor Products

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Standard Motor Products' to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 8.3%. This means it has also seen a slide in earnings over the longer-term as EPS is down 34% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 12% shows it's an unpleasant look.

In light of this, it's understandable that Standard Motor Products' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Standard Motor Products' P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Standard Motor Products maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Standard Motor Products that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMP

Standard Motor Products

Manufactures and distributes replacement automotive parts in the United States and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026