- United States

- /

- Auto

- /

- NYSE:RACE

Is Ferrari’s Recent 22% Stock Drop a Reason to Revisit Its Valuation?

Reviewed by Bailey Pemberton

- Curious if Ferrari’s high-octane brand translates into real stock market value? Let’s cut through the hype and answer the ultimate question: is Ferrari worth its share price right now?

- The last month has not been kind to Ferrari shareholders, with the stock dropping 21.8%. It is also down 17.0% over the past year, despite a doubling over three years.

- Recent headlines have centered on Ferrari’s moves into luxury lifestyle products and partnerships with high-profile brands. This has fueled debate on whether the company can keep accelerating outside of its traditional supercar lane. Investors are considering whether these bold steps signal sustained growth or increased risk in a changing industry.

- Ferrari currently has a valuation score of 0/6 under our checks, suggesting that it may be fully priced or even somewhat expensive. We will examine the numbers using a few standard approaches and present a different perspective on valuation by the end of this article.

Ferrari scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ferrari Discounted Cash Flow (DCF) Analysis

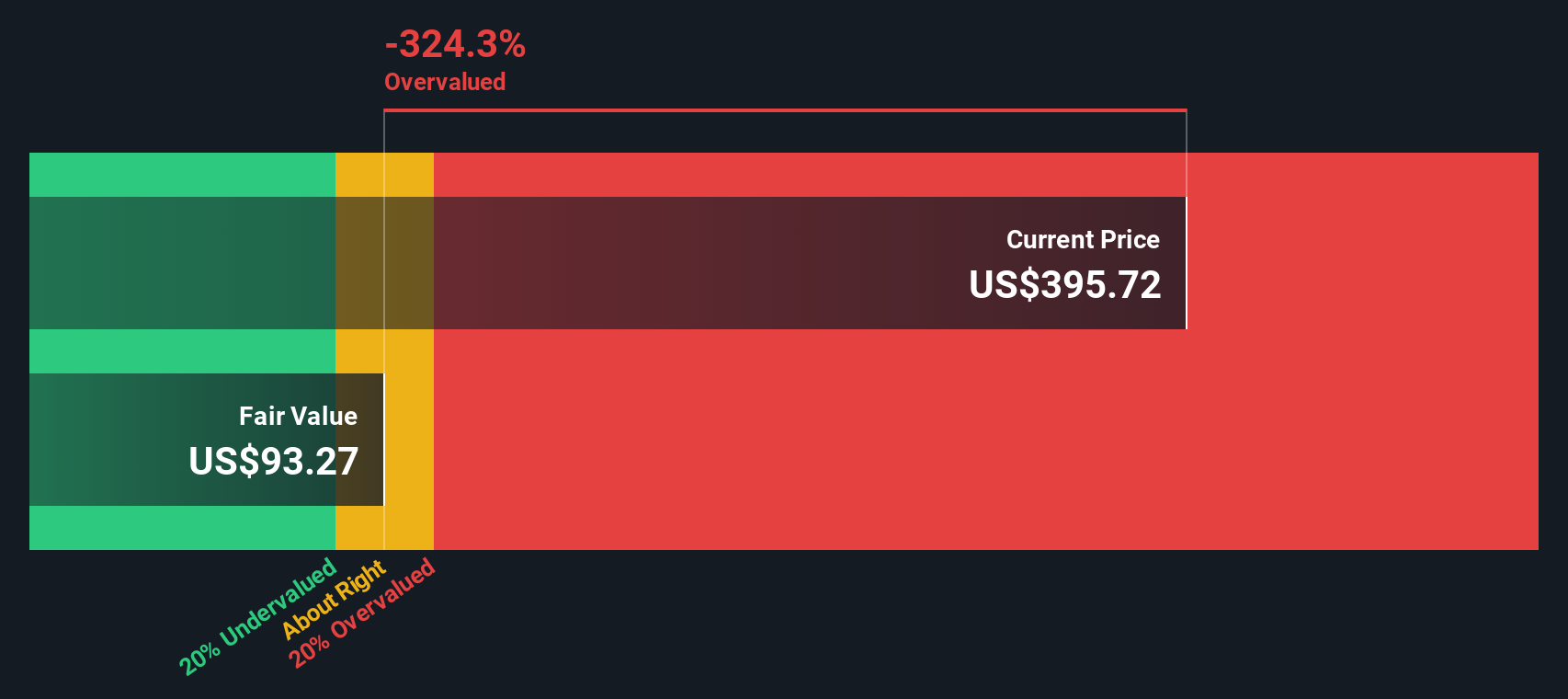

A Discounted Cash Flow (DCF) model works by estimating Ferrari's future cash flows and then discounting those expected cash flows back to their present value in today's euros. This approach helps to assess the true worth of the business based on its potential to generate cash in the future, rather than relying solely on current earnings or assets.

For Ferrari, the most recent Free Cash Flow (FCF) stands at approximately €1.3 billion. Analysts have provided growth projections out to 2029, expecting FCF to rise to about €1.94 billion by that year. Beyond 2029, further increases are forecasted using realistic growth estimates. These are extrapolations rather than direct analyst consensus.

According to this DCF model, the estimated intrinsic value of each Ferrari share comes out to just €94.39. Compared to the current share price, this calculation suggests the stock is 315.3% above its intrinsic value. In other words, the market is pricing Ferrari several times higher than what future cash flows seem to justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ferrari may be overvalued by 315.3%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ferrari Price vs Earnings

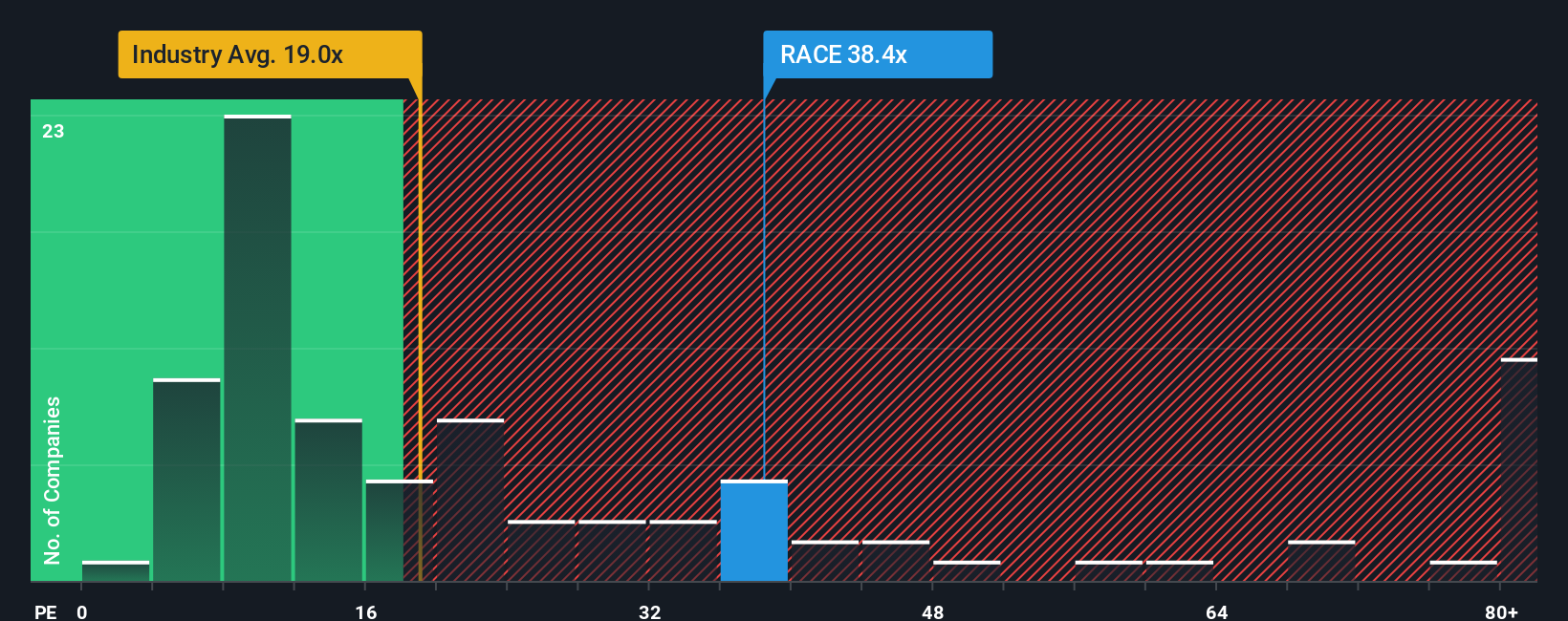

For profitable companies like Ferrari, the Price-to-Earnings (PE) ratio is often a go-to valuation metric because it directly ties a company's market value to its actual earnings. It helps investors understand how much they are paying for each euro of profit, making it particularly suitable for established companies with solid bottom-line results.

Generally, a higher PE ratio can be justified if investors expect stronger earnings growth and lower risk. A lower PE suggests either modest growth potential or higher uncertainty. Determining what constitutes a "normal" or “fair” PE ratio involves weighing factors like the company's prospects, profitability, and the overall industry mood.

Ferrari's current PE ratio stands at 37.85x, which is significantly higher than the auto industry average of 18.22x and the peer average of 15.96x. At first glance, this premium suggests the market has high hopes for Ferrari's growth or stability. However, at Simply Wall St, a proprietary “Fair Ratio” is calculated for each company. For Ferrari, this Fair Ratio is 14.34x. This benchmark goes beyond simple peer or industry comparisons by factoring in crucial elements such as Ferrari’s expected earnings growth, profit margin, industry dynamics, market capitalization, and business risks.

The Fair Ratio offers a more tailored benchmark, reflecting what investors should reasonably pay for Ferrari given its specific growth track record, risk profile, and industry standing, rather than just how it compares to other companies.

Since Ferrari's current PE ratio of 37.85x is well above its Fair Ratio of 14.34x, the stock appears to be significantly overvalued based on earnings fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ferrari Narrative

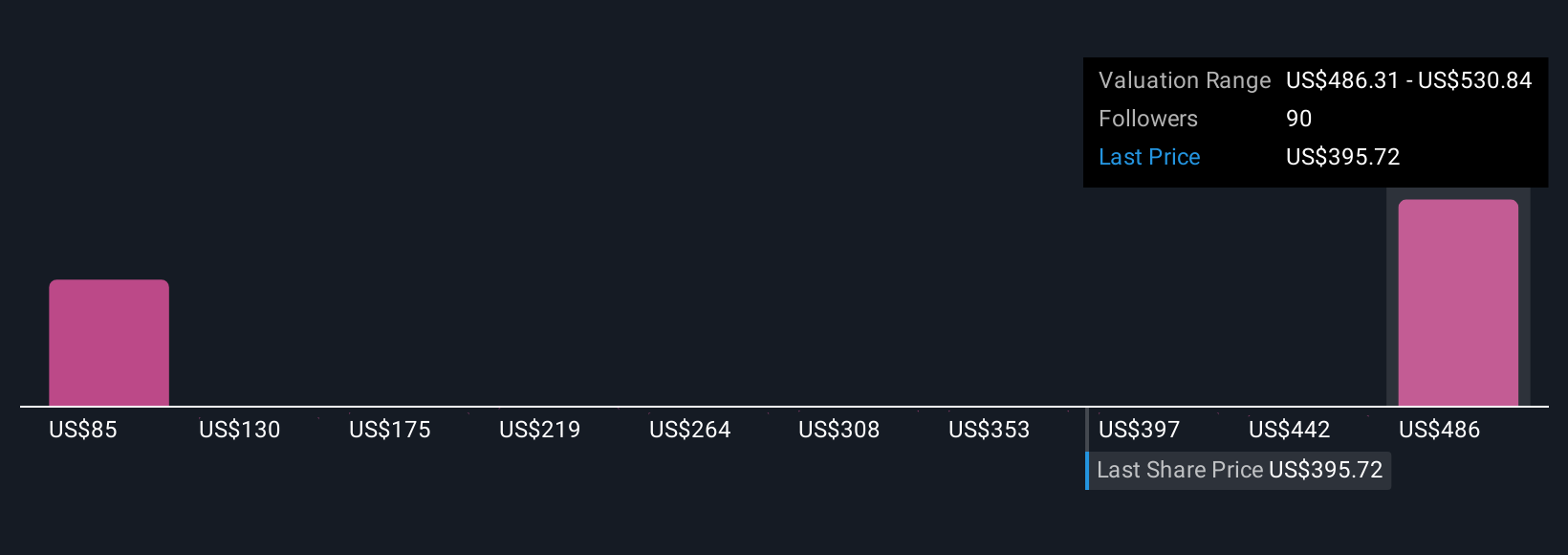

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is your story about a company. It is how you connect your own expectations of Ferrari's future growth, margins, and risks to what you believe the business is truly worth. Narratives let you take the information behind the numbers, like revenue estimates and fair value, and weave them together into a clear rationale for buying or selling based on your personal outlook.

On Simply Wall St’s Community page, millions of investors are already using Narratives to track and update their thinking, comparing their custom fair value to the current price and deciding when to act. Whenever new information arrives, whether it is a quarterly result or breaking news, Narratives are dynamically refreshed so your investment thesis stays up to date without extra effort.

For example, one Ferrari Narrative could be very optimistic, reflecting analyst price targets up to $597 based on strong electric car growth, expanded personalization, and premium branding. On the other hand, the most cautious Narrative might see just $397 as fair value, focusing on risks like over-saturation from new model launches or margin pressure in a volatile economy. With Narratives, you can align your investing decisions to your own expectations, not just the broader market consensus.

Do you think there's more to the story for Ferrari? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives