- United States

- /

- Auto

- /

- NYSE:RACE

Ferrari (NYSE:RACE): Exploring Valuation Drivers Behind Recent Performance Shift

Reviewed by Simply Wall St

See our latest analysis for Ferrari.

Ferrari’s recent upswing comes after a turbulent month. Taking a step back reveals a stock with long-term horsepower, as the 3-year total shareholder return stands at a remarkable 106%, even though the recent 1-year total shareholder return is down 7.5%. This momentum shift suggests investors are weighing growth potential against evolving risks, keeping Ferrari firmly in the spotlight for those watching the luxury auto space.

If Ferrari’s shifts have you thinking about what else is accelerating in the sector, now’s an ideal time to check out the See the full list for free.

With earnings climbing but recent returns trailing broader markets, the key question for investors is whether Ferrari is trading below its true value, or if the current price already reflects all future growth potential.

Most Popular Narrative: 13.3% Undervalued

Ferrari's most followed narrative places fair value substantially above the last close price of $406.67. This highlights ambitious growth dynamics and fuels ongoing debate about how high the stock can go.

Ferrari's expansion of infrastructure and product offerings, including the new e-building and paint shop for enhanced personalization, is expected to increase production flexibility and support revenue growth as well as improved net margins through operational efficiencies.

Curious about what powers Ferrari’s high sticker price? The narrative centers on bold forecasts for profit margins and relentless innovation. Want to see exactly how these projections add up to a double-digit upside? Click through and dissect the financial engine behind this valuation target.

Result: Fair Value of $468.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential over-saturation from multiple new model launches and ongoing supply chain challenges could undermine Ferrari’s ability to sustain high margins and exclusivity.

Find out about the key risks to this Ferrari narrative.

Another View: Trading at a Premium?

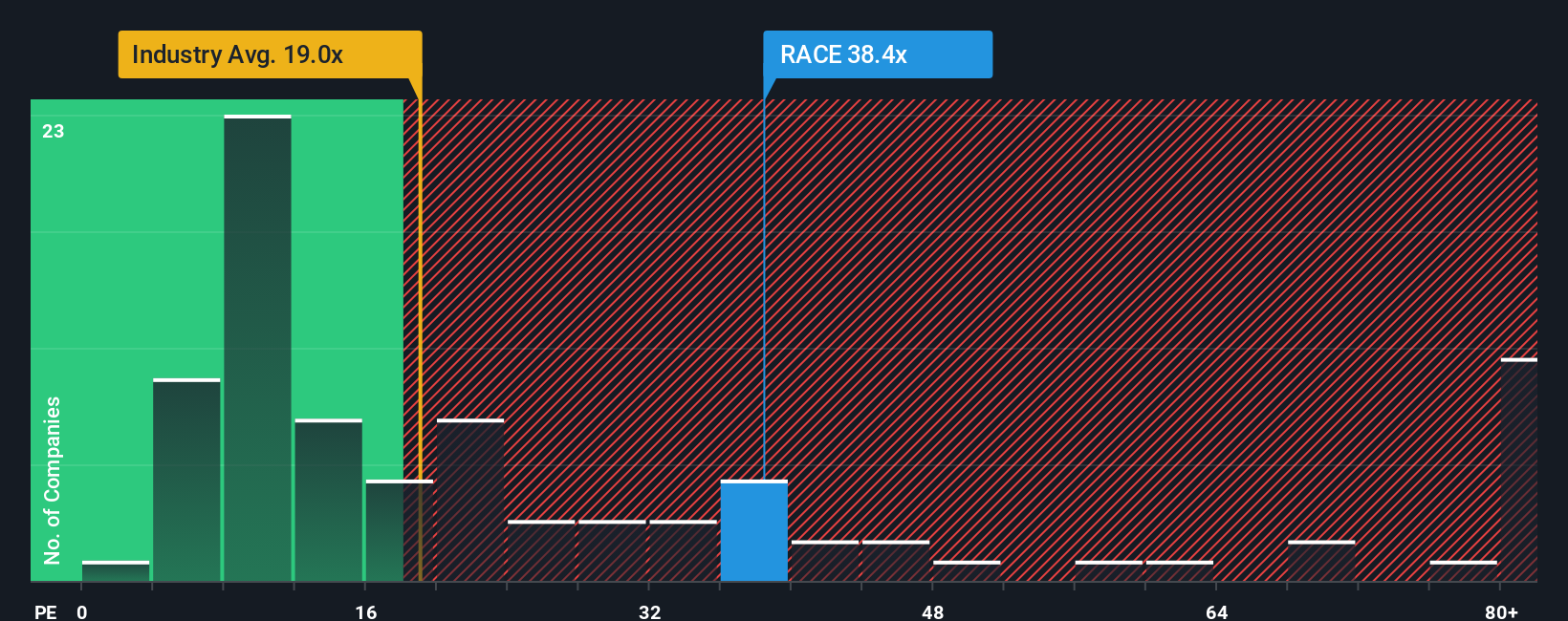

Looking through another valuation lens raises fresh questions. Ferrari trades at a price-to-earnings ratio of 39.3x, sharply higher than its industry peers at 15.9x and the fair ratio of 14.3x. This signals the market is pricing in strong performance, but is it too much too soon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ferrari Narrative

If you see the story differently or want your own take, chart your course using the data and insights on offer. You can do this all in just a few minutes. Do it your way

A great starting point for your Ferrari research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Seeking Smarter Investment Moves?

Great investors always keep new opportunities on the radar. Don’t let others get ahead; put your capital to work in ideas that defy the ordinary and could shape tomorrow’s markets.

- Catch undervalued gems by targeting potential upside with these 844 undervalued stocks based on cash flows, making sure you never miss out on stocks trading under their true worth.

- Boost your portfolio’s income potential by selecting these 20 dividend stocks with yields > 3% to reveal companies delivering attractive yields above 3% right now.

- Position yourself early in the next wave of digital innovation. Fuel your watchlist with these 26 AI penny stocks and ride the momentum of artificial intelligence leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives