- United States

- /

- Auto Components

- /

- NasdaqGS:QS

QuantumScape (QS) Valuation in Focus After Solid-State Prototype Shipments and Improved Quarterly Performance

QuantumScape (QS) drew solid investor attention after announcing shipments of its advanced QSE-5 B1 solid-state battery prototypes and reporting narrower quarterly losses. These developments marked progress on its roadmap toward commercializing next-generation battery technology.

See our latest analysis for QuantumScape.

QuantumScape’s steady progress on solid-state battery milestones, such as shipping advanced QSE-5 B1 prototypes and installing its Eagle Line pilot, helped shift the narrative around the company’s long-term potential. That optimism was quickly reflected in the shares, which have surged with a remarkable year-to-date share price return of 178.7% and a one-year total shareholder return of 196.9%. This indicates that momentum has been firmly building despite near-term volatility following insider sales and quarterly results.

If the fresh technology buzz has you thinking broader, now is a great time to see what’s happening across other electric vehicle makers—discover See the full list for free.

With QuantumScape shares rallying sharply on breakthroughs and analyst upgrades, investors now face a key decision: is there still a buying opportunity here, or is the market already factoring in all future growth?

Most Popular Narrative: 38% Undervalued

According to the most liked narrative by davidlsander, QuantumScape’s fair value is pegged at $25 per share, well above the latest closing price of $15.44. This bullish assessment points toward a major disconnect between recent momentum and the potential upside being projected by retail investors tracking the story closely.

At the heart of QuantumScape's innovation is its proprietary ceramic separator, a unique component that enables an anode-free lithium metal battery architecture. This design allows them to solve the elusive "and problem," simultaneously achieving multiple critical performance metrics that have long eluded the battery industry.

Want to know why bold claims are being made? The narrative projects unprecedented battery breakthroughs as a game-changer for EVs. Wondering just how high growth and cost savings might go? The key numbers driving this valuation are hidden in the details. Dive deeper and find the catalyst that could push everything higher.

Result: Fair Value of $25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant production scale-up challenges and tough competition from industry giants could quickly shift sentiment if setbacks or delays emerge.

Find out about the key risks to this QuantumScape narrative.

Another View: Not Cheap on Traditional Metrics

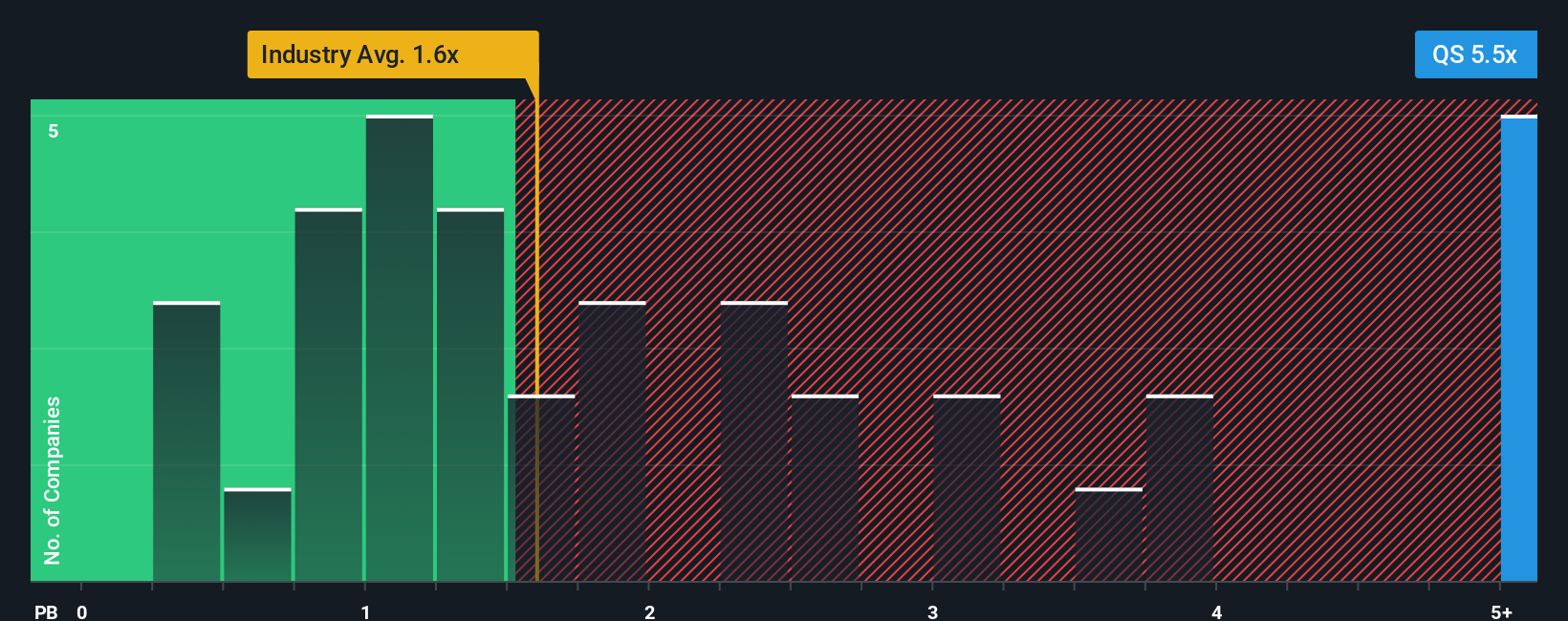

While retail investors see significant upside, the market tells a different story when looking at QuantumScape’s price-to-book ratio. At 7.6x, the shares are much pricier than both the US Auto Components industry average of 1.6x and the peer group’s 3.3x. This sizable premium suggests investors are paying up for future growth that is still unproven. Is this optimism justified, or is risk being overlooked as the next phase unfolds?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own QuantumScape Narrative

If you want to challenge the consensus or dig into the numbers yourself, you can craft your own QuantumScape story in just a few minutes with Do it your way.

A great starting point for your QuantumScape research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing starts with fresh, unique research. Don’t leave opportunities on the table by powering up your portfolio and exploring ideas that go beyond the obvious picks.

- Uncover tomorrow’s growth stories by targeting emerging leaders in the quantum revolution starting with these 28 quantum computing stocks.

- Tap into lucrative income streams and reliable yields when you check out these 20 dividend stocks with yields > 3%, featuring stocks offering attractive potential.

- Get ahead of market trends by finding undervalued opportunities with strong fundamentals through these 844 undervalued stocks based on cash flows before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QuantumScape might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QS

QuantumScape

Focuses on the development and commercialization of solid-state lithium-metal batteries for electric vehicles and other applications in the United States.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Inotiv NAMs Test Center

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.