- United States

- /

- Auto Components

- /

- NYSE:MOD

A Fresh Look at Modine Manufacturing’s (MOD) Valuation Following Crypto & AI Infrastructure Conference 2025

Reviewed by Simply Wall St

Modine Manufacturing (MOD) saw a rise in attention as CEO Neil D. Brinker and company leaders participated in the Crypto & AI/Energy Infrastructure Conference 2025. Investors often use these industry gatherings to gauge the company’s direction and priorities.

See our latest analysis for Modine Manufacturing.

After grabbing headlines with its high-profile industry conference appearance and a board retirement announcement, Modine Manufacturing’s share price has pulled back 14.2% over the past month. However, momentum remains in play over the longer run, with a 13.6% year-to-date share price return and a remarkable 512% total shareholder return over three years, reflecting strong growth potential and resilient investor confidence.

If you’re wondering what else might be building momentum in the auto space, now is a perfect time to check out the See the full list for free..

With share prices cooling off after a spectacular multi-year run and analyst targets suggesting more upside, investors have to ask: is Modine Manufacturing still undervalued, or is the market already factoring in its future growth?

Most Popular Narrative: 28.6% Undervalued

Based on the narrative’s fair value assessment, Modine Manufacturing’s calculated price target stands significantly above today’s closing price. This suggests notable upside potential if expectations are met. The price gap centers on foundational drivers that support future revenue and earnings potential, setting the stage for a deeper exploration of what is powering this outlook.

The accelerating build-out of data centers and the need for next-generation cooling solutions are driving extraordinary demand for Modine's products. Management is forecasting the potential to double data center revenues from approximately $1 billion in fiscal 2026 to $2 billion by fiscal 2028. This structural demand from digital infrastructure is expected to materially boost revenue growth and deliver significant operating leverage over time.

Curious what’s fueling this bold price target? The narrative is built on a surge of future earnings, margin expansion that surpasses sector norms, and a financial leap supported by ambitious projections. What is the critical catalyst behind Modine’s value jump? Click through to discover the full playbook revealed in the numbers.

Result: Fair Value of $185 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Modine’s concentrated North American growth and the execution challenges tied to recent acquisitions could quickly cool enthusiasm if expansion targets are missed.

Find out about the key risks to this Modine Manufacturing narrative.

Another View: High Valuation Signals a Note of Caution

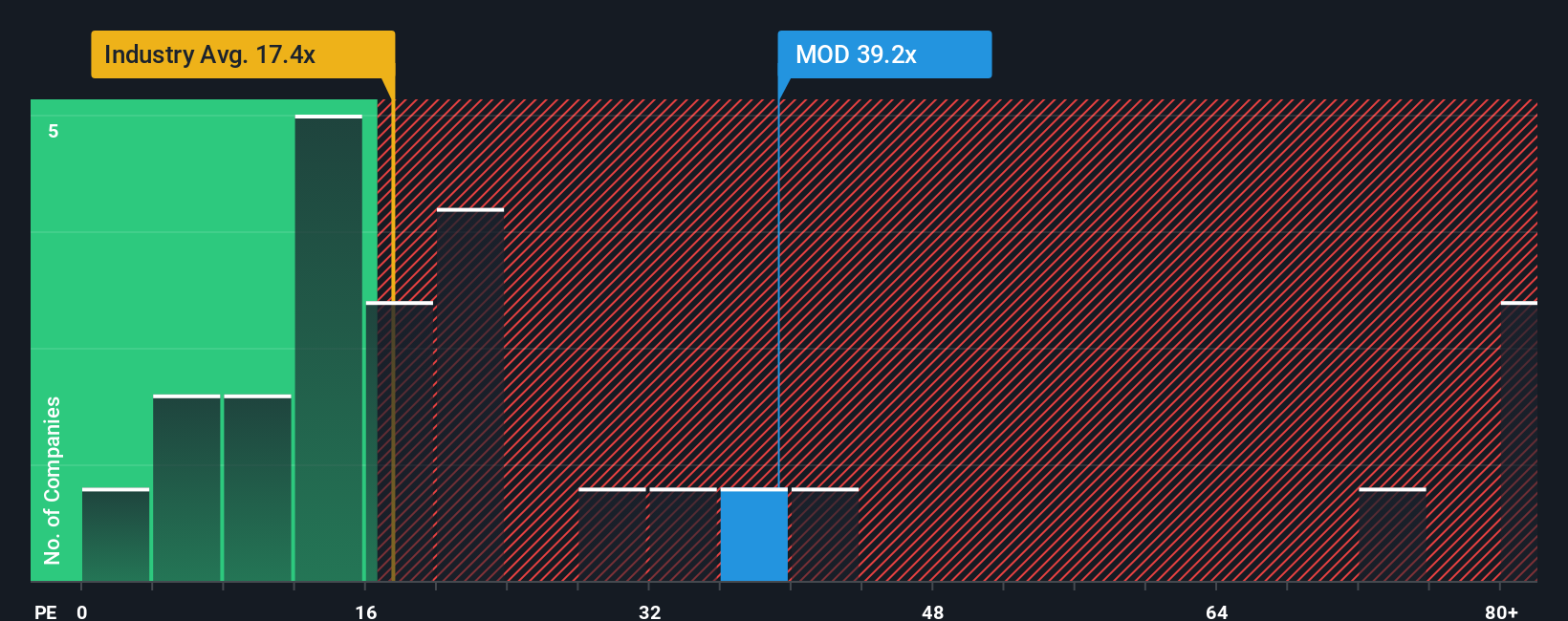

While the narrative points to significant value upside, a quick look at the price-to-earnings ratio tells a different story. Modine trades at 37.3x, which is well above both its industry average of 23.2x and the peer average of 27.1x, and also higher than the fair ratio of 29.9x. This premium suggests investors are placing big bets on continued growth. The question remains: is this optimism too far ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Modine Manufacturing Narrative

If you have a different take or want to run the numbers on your terms, you can shape your unique perspective in just a few minutes with Do it your way.

A great starting point for your Modine Manufacturing research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't stop at just one opportunity. Expand your portfolio potential right now by tapping into strategies that are revealing hidden winners across the market.

- Capitalize on strong cash flow by targeting companies with overlooked value. Start by examining these 886 undervalued stocks based on cash flows to spot those undervalued based on real financials.

- Access the future of healthcare innovation when you check out these 32 healthcare AI stocks for firms advancing with artificial intelligence breakthroughs in medicine.

- Maximize your growth and income by exploring these 16 dividend stocks with yields > 3% that deliver consistent dividends above 3% for lasting returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOD

Modine Manufacturing

Designs, engineers, tests, manufactures, and sells mission-critical thermal solutions in the United States, Canada, Italy, Hungary, the United Kingdom, China, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives