- United States

- /

- Auto

- /

- NYSE:LVWR

The Price Is Right For LiveWire Group, Inc. (NYSE:LVWR) Even After Diving 30%

To the annoyance of some shareholders, LiveWire Group, Inc. (NYSE:LVWR) shares are down a considerable 30% in the last month, which continues a horrid run for the company. The last month has meant the stock is now only up 7.8% during the last year.

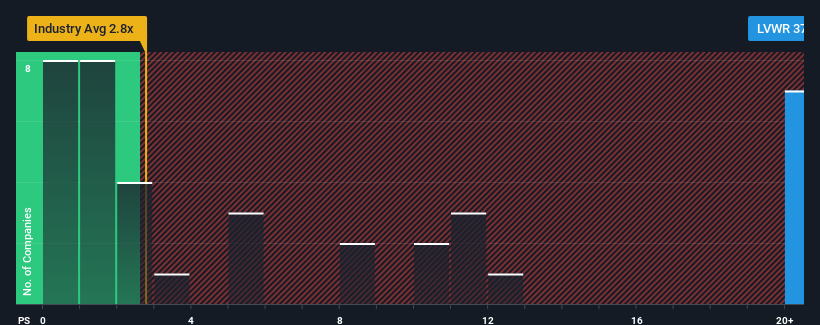

Although its price has dipped substantially, when almost half of the companies in the United States' Auto industry have price-to-sales ratios (or "P/S") below 2.8x, you may still consider LiveWire Group as a stock not worth researching with its 37.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for LiveWire Group

How LiveWire Group Has Been Performing

While the industry has experienced revenue growth lately, LiveWire Group's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on LiveWire Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, LiveWire Group would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 23% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 450% as estimated by the only analyst watching the company. With the industry only predicted to deliver 20%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why LiveWire Group's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On LiveWire Group's P/S

Even after such a strong price drop, LiveWire Group's P/S still exceeds the industry median significantly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that LiveWire Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Auto industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with LiveWire Group.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LVWR

LiveWire Group

Manufactures and sells electric motorcycles in the United States, Austria, and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives