- United States

- /

- Auto

- /

- NYSE:LVWR

LiveWire (LVWR) Losses Worsen, High Valuation Reinforces Bearish Market Narratives

Reviewed by Simply Wall St

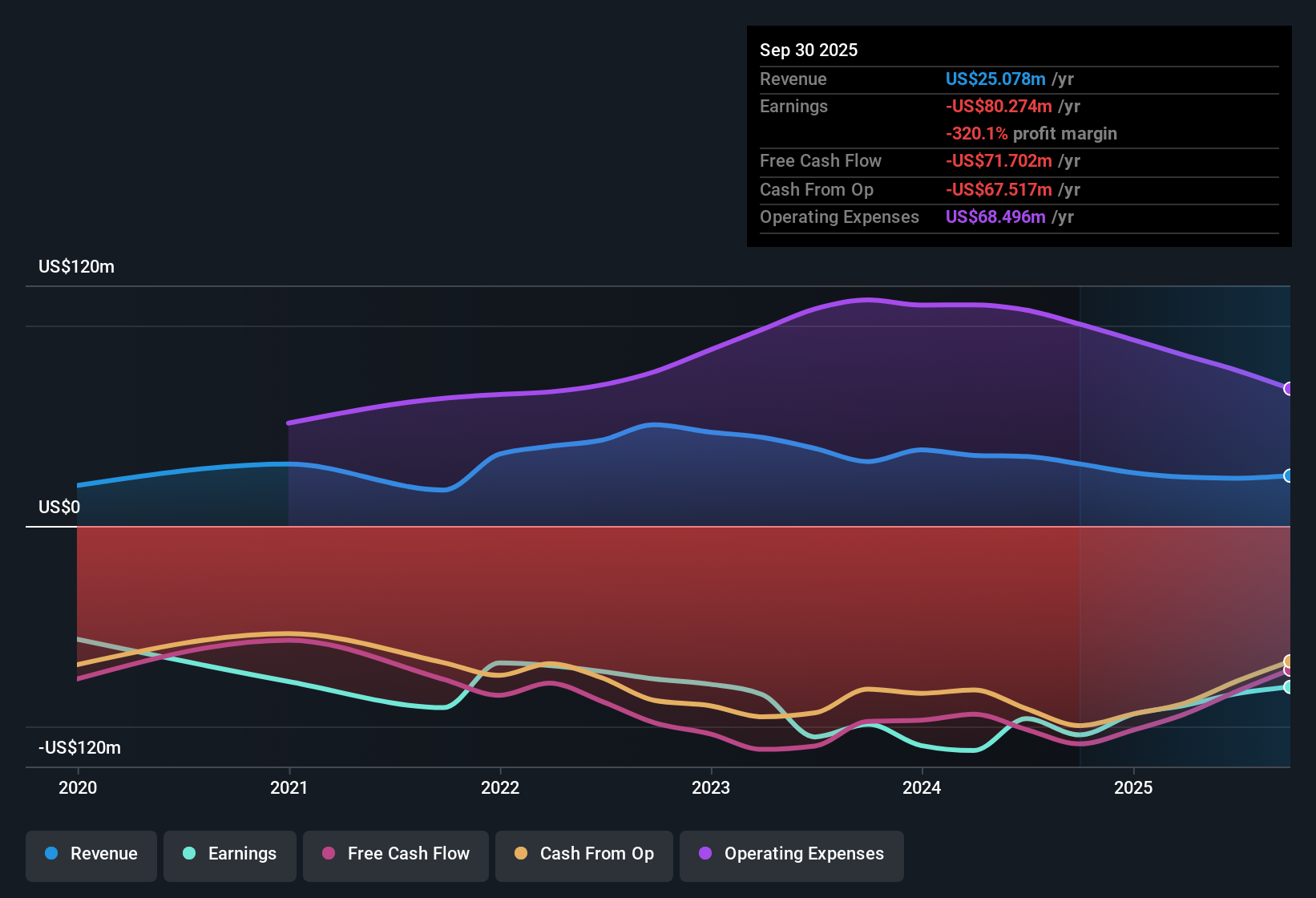

LiveWire Group (LVWR) continues to post losses, with annual losses rising by 5.1% per year over the last five years. Net profit margin remains negative and shows no meaningful acceleration. The company’s lofty Price-To-Sales Ratio of 38.9x is much higher than the US auto industry average of 1.2x as well as the peer average of 0.7x. Given the persistently unprofitable operations and high valuation relative to industry standards, investors are likely to remain cautious as no material growth or rewards are on the horizon.

See our full analysis for LiveWire Group.Now, let's see how these headline results compare with the current market narratives. Some expectations may be reinforced, while others could be up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Remain Deeply Negative

- LiveWire’s net profit margin has consistently stayed in negative territory without any signs of improvement. This aligns with management’s caution that profitability is not expected to accelerate soon.

- Bears argue that stubbornly negative margins demonstrate a lack of operational leverage. Recent trends provide little evidence of a turnaround on the horizon.

- Persistent annual losses growing at 5.1% per year highlight the scale of operational challenges facing the business.

- The absence of margin improvement supports bearish concerns that key risks remain unresolved and financial health is not improving.

Poor Share Price Stability and Growth Prospects

- The company’s share price failed to demonstrate any sustained strength over the past three months. This aligns with the risk summary's warning that revenue and earnings growth are not expected.

- It is notable that the stock’s lack of upward movement undermines any claims of positive momentum and reinforces the prevailing market view that LiveWire is not poised for near-term growth.

- With no material rewards identified and continued volatility, investors have scant indication of an inflection point approaching.

- The ongoing drag from unprofitable operations keeps the outlook cautious rather than constructive.

Valuation Stands in Stark Contrast to Industry Norms

- LiveWire trades at a Price-To-Sales Ratio of 38.9x, which is an extreme premium compared to the US auto industry average of 1.2x and the peer average of 0.7x. This makes its current $4.79 share price difficult to justify against sector benchmarks.

- While the prevailing market view notes that premium valuations can sometimes reflect growth potential, in LiveWire’s case the absence of profitability or near-term growth signals makes this multiple appear even steeper.

- Peer and industry comparisons highlight just how much more investors are paying per dollar of sales, with little evidence of durable competitive advantage.

- Market skepticism around valuation appears warranted as no material growth or operational rewards are expected to bridge this premium soon.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on LiveWire Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

LiveWire’s persistent losses, negative profit margins, and an extremely high valuation highlight ongoing operational struggles and a lack of financial stability compared to industry peers.

If you want exposure to companies with more reasonable prices and stronger fundamental value, check out these 844 undervalued stocks based on cash flows that match cash flow strength with compelling upside potential today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LVWR

LiveWire Group

Manufactures and sells electric motorcycles in the United States, Austria, and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives