- United States

- /

- Auto

- /

- NYSE:LVWR

Does LiveWire Group’s (LVWR) Expanded EICMA Lineup Reveal a New Edge in Global Competition?

Reviewed by Sasha Jovanovic

- LiveWire Group, Inc. revealed its most comprehensive product lineup to date at the EICMA International Motorshow in Milan, including the European debut of the S4 Honcho Trail and Street models, updates on its maxi-scooter project with KYMCO, new electric motorcycle concepts, and law enforcement offerings.

- This event highlighted LiveWire’s expanded push into new categories and regions, signaling a multi-pronged strategy to broaden its reach in the global electric mobility market.

- We’ll look at how LiveWire’s introduction of the S4 Honcho models in Europe shapes the company’s investment narrative moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is LiveWire Group's Investment Narrative?

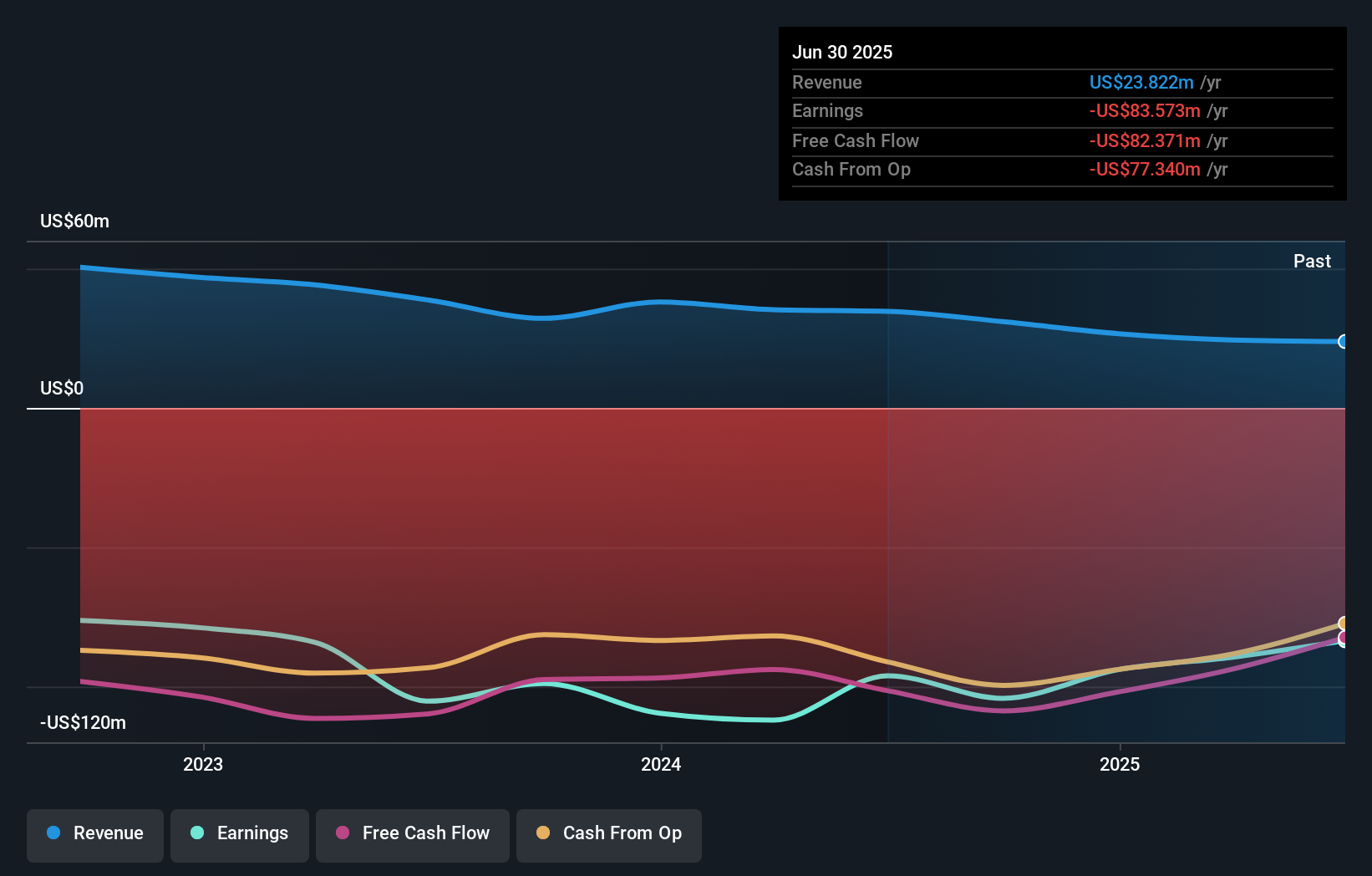

If you’re considering LiveWire Group, the real question is whether its ambitions in electric motorcycles and mobility can overcome persistent losses and hefty valuations. The European debut of the S4 Honcho lineup at EICMA is a clear attempt to spark near-term excitement, generate broader demand, and activate a multi-pronged growth story beyond North America. While this could create positive momentum around catalysts like a new product cycle, broader distribution, and additional partnerships, especially in underpenetrated markets, the risk profile does not fundamentally change overnight. Revenue remains weak and the company is still posting significant losses, which, combined with a high price-to-sales ratio and volatile shares, continue to weigh heavily on sentiment. The impact from these product announcements may boost awareness but is unlikely to be a material catalyst until LiveWire shows progress on sales and profitability targets.

However, new product lines won’t necessarily resolve concerns about low board independence and management inexperience. Upon reviewing our latest valuation report, LiveWire Group's share price might be too optimistic.Exploring Other Perspectives

Explore 2 other fair value estimates on LiveWire Group - why the stock might be worth less than half the current price!

Build Your Own LiveWire Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LiveWire Group research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free LiveWire Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LiveWire Group's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LVWR

LiveWire Group

Manufactures and sells electric motorcycles in the United States, Austria, and internationally.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives