- United States

- /

- Auto Components

- /

- NYSE:LEA

Lear Corporation's (NYSE:LEA) Shares Not Telling The Full Story

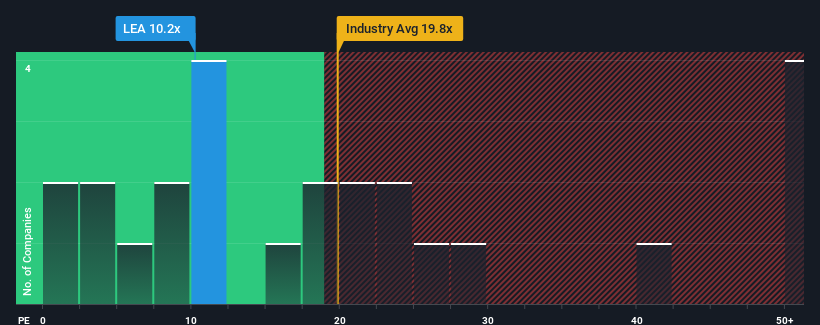

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 20x, you may consider Lear Corporation (NYSE:LEA) as an attractive investment with its 10.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

There hasn't been much to differentiate Lear's and the market's earnings growth lately. It might be that many expect the mediocre earnings performance to degrade, which has repressed the P/E. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for Lear

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Lear's is when the company's growth is on track to lag the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Regardless, EPS has managed to lift by a handy 9.1% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 22% per year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 11% per annum growth forecast for the broader market.

In light of this, it's peculiar that Lear's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Lear's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Lear's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Lear that you need to be mindful of.

You might be able to find a better investment than Lear. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LEA

Lear

Designs, develops, engineers, manufactures, assembles, and supplies automotive seating, and electrical distribution systems and related components for automotive original equipment manufacturers in North America, Europe, Africa, Asia, and South America.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives