David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Harley-Davidson, Inc. (NYSE:HOG) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Harley-Davidson

What Is Harley-Davidson's Net Debt?

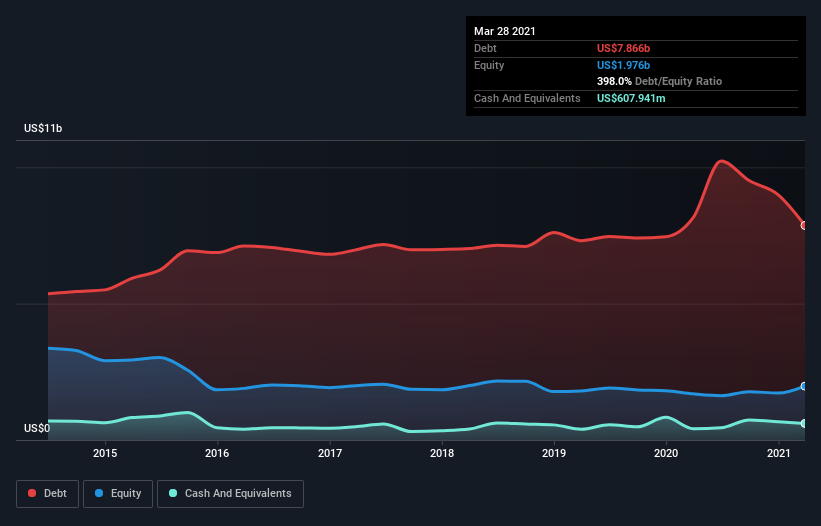

As you can see below, Harley-Davidson had US$7.87b of debt, at March 2021, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has US$607.9m in cash leading to net debt of about US$7.26b.

How Strong Is Harley-Davidson's Balance Sheet?

We can see from the most recent balance sheet that Harley-Davidson had liabilities of US$3.45b falling due within a year, and liabilities of US$5.91b due beyond that. On the other hand, it had cash of US$607.9m and US$216.6m worth of receivables due within a year. So its liabilities total US$8.54b more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of US$7.16b, we think shareholders really should watch Harley-Davidson's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

As it happens Harley-Davidson has a fairly concerning net debt to EBITDA ratio of 13.1 but very strong interest coverage of 17.0. This means that unless the company has access to very cheap debt, that interest expense will likely grow in the future. Shareholders should be aware that Harley-Davidson's EBIT was down 30% last year. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Harley-Davidson's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Harley-Davidson actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

On the face of it, Harley-Davidson's net debt to EBITDA left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its interest cover is a good sign, and makes us more optimistic. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Harley-Davidson stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 4 warning signs with Harley-Davidson (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Harley-Davidson, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Harley-Davidson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:HOG

Harley-Davidson

Manufactures and sells motorcycles in the United States and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives