- United States

- /

- Auto Components

- /

- NYSE:CPS

Sentiment Still Eluding Cooper-Standard Holdings Inc. (NYSE:CPS)

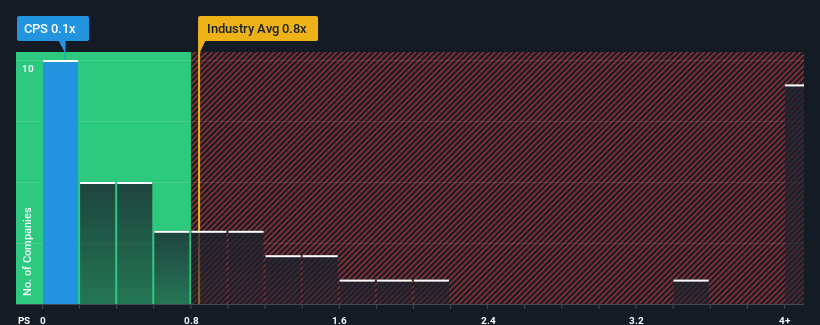

When close to half the companies operating in the Auto Components industry in the United States have price-to-sales ratios (or "P/S") above 0.8x, you may consider Cooper-Standard Holdings Inc. (NYSE:CPS) as an attractive investment with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Cooper-Standard Holdings

How Cooper-Standard Holdings Has Been Performing

Cooper-Standard Holdings has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on Cooper-Standard Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Cooper-Standard Holdings will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Cooper-Standard Holdings?

In order to justify its P/S ratio, Cooper-Standard Holdings would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. The solid recent performance means it was also able to grow revenue by 16% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 4.9% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Cooper-Standard Holdings' P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On Cooper-Standard Holdings' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Cooper-Standard Holdings revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. While recent

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Cooper-Standard Holdings, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Cooper-Standard Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CPS

Cooper-Standard Holdings

Through its subsidiary, manufactures and sells sealing, fuel and brake delivery, and fluid transfer systems in the North America, Europe, the Asia Pacific, and the South America.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives