- United States

- /

- Auto Components

- /

- NYSE:CPS

Even With A 33% Surge, Cautious Investors Are Not Rewarding Cooper-Standard Holdings Inc.'s (NYSE:CPS) Performance Completely

Cooper-Standard Holdings Inc. (NYSE:CPS) shares have had a really impressive month, gaining 33% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 44% in the last year.

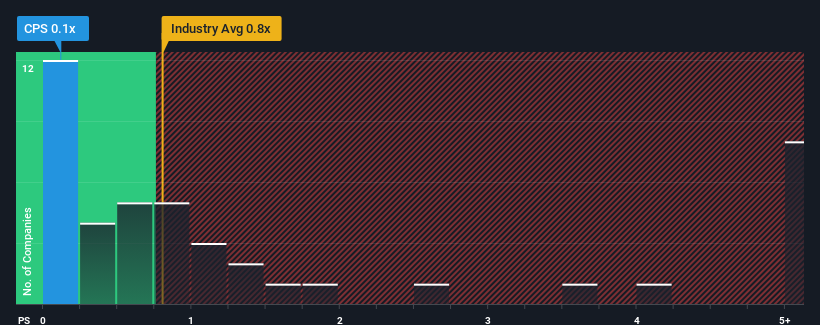

Even after such a large jump in price, given about half the companies operating in the United States' Auto Components industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider Cooper-Standard Holdings as an attractive investment with its 0.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Cooper-Standard Holdings

What Does Cooper-Standard Holdings' Recent Performance Look Like?

Recent revenue growth for Cooper-Standard Holdings has been in line with the industry. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Cooper-Standard Holdings will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Cooper-Standard Holdings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. The solid recent performance means it was also able to grow revenue by 19% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 4.8% over the next year. Meanwhile, the rest of the industry is forecast to expand by 3.3%, which is not materially different.

With this information, we find it odd that Cooper-Standard Holdings is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Cooper-Standard Holdings' P/S?

Cooper-Standard Holdings' stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It looks to us like the P/S figures for Cooper-Standard Holdings remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Cooper-Standard Holdings you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CPS

Cooper-Standard Holdings

Through its subsidiary, manufactures and sells sealing, fuel and brake delivery, and fluid transfer systems in the North America, Europe, the Asia Pacific, and the South America.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives