- United States

- /

- Auto Components

- /

- NYSE:CPS

Cooper Standard (CPS): First Profit in Years Reinforces Bulls, But One-Off Loss Clouds Narrative

Reviewed by Simply Wall St

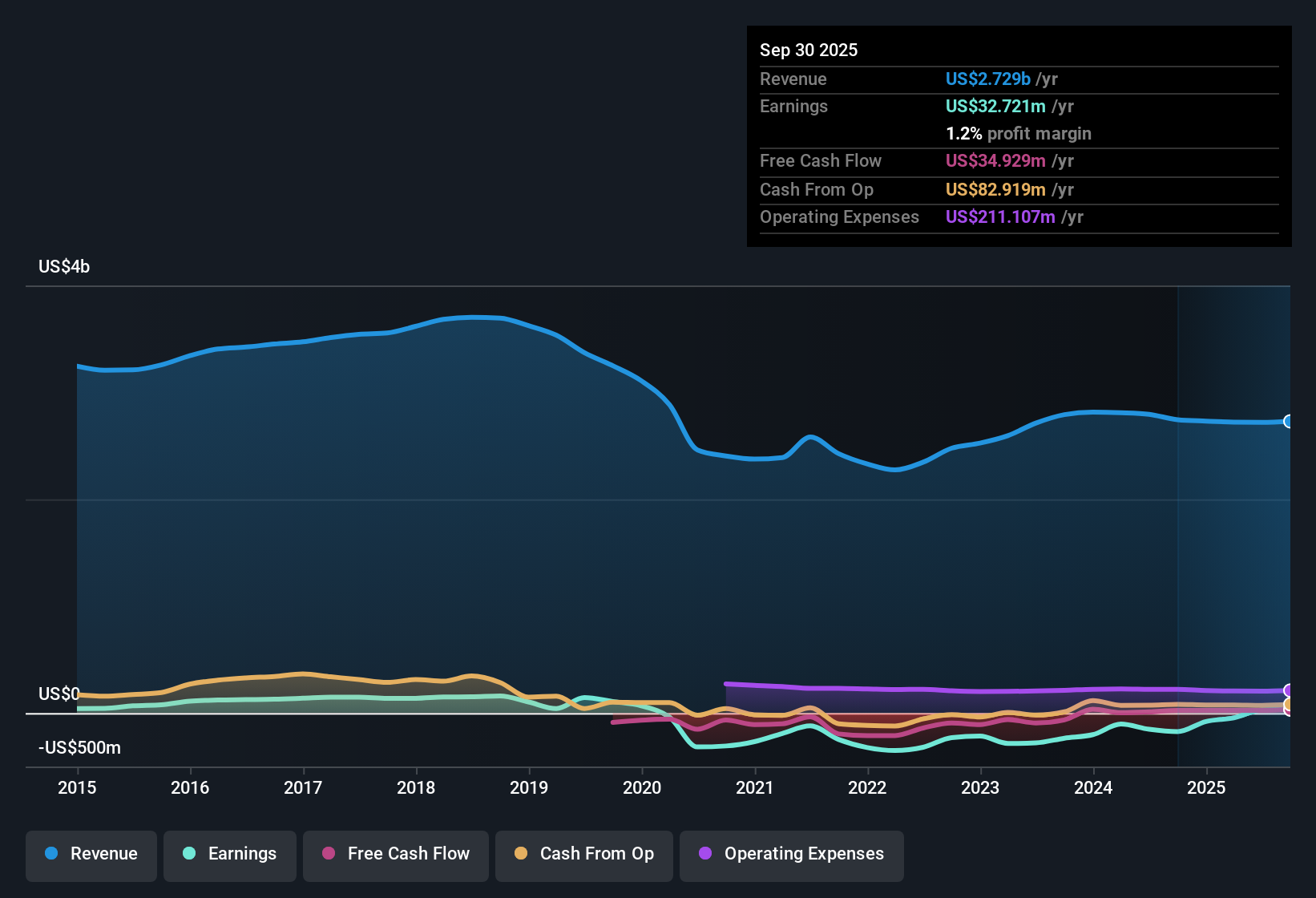

Cooper-Standard Holdings (CPS) has turned profitable for the first time in years, with earnings growing at an average annual rate of 22.4% over the last five years. Looking ahead, the company’s earnings are forecast to surge at an impressive 109.6% annually, well above the US market's expected 15.9% growth rate. Revenue is projected to grow 5.7% per year compared to the broader market's 10.3%. The positive net profit margin reflects an improving profitability trend, though a one-off $2.8 million loss in the last period has influenced recent results.

See our full analysis for Cooper-Standard Holdings.Next, we’ll see how these headline numbers compare to the most-followed narratives about CPS, which expectations they support, and where they might raise new questions.

See what the community is saying about Cooper-Standard Holdings

Margins Tracking Toward 6.1% Target By 2026

- Analysts project profit margins will increase from today’s 1.1% to 6.1% over the next three years, outpacing the company’s recent historic trends and providing an incremental boost to expected net income.

- Analysts’ consensus view sees this margin expansion as anchored by Cooper-Standard’s strong $800 million net new business pipeline for sealing and fluid systems, much of which comes from premium contracts linked to electric and hybrid vehicles.

- With cost-saving programs such as digital manufacturing and AI-powered process improvements already delivering $29 million in Q2 savings, consensus believes more global rollouts will lift margins even further as industry sustainability trends push automakers toward higher-value solutions.

- However, a recent one-off $2.8 million loss highlights operational risks. The consensus expects ongoing margin improvement but acknowledges that volatility may remain given exposure to inflation and volume swings.

- See how analysts justify their optimism in the full Consensus Narrative. 📊 Read the full Cooper-Standard Holdings Consensus Narrative.

P/E Signals Mixed Value Versus Peers and Industry

- At a Price-to-Earnings (P/E) ratio of 18.2x, Cooper-Standard sits just above the industry average (18.1x) but trades well below the peer group average (21.6x), leaving investors debating whether market pricing accurately reflects the company’s potential for rapid earnings growth.

- Analysts’ consensus view is that this middling P/E reflects a split market: some believe near-term profit acceleration is worth betting on, while others hesitate due to the company’s ongoing quality-of-earnings concerns and not-yet-robust financial position.

- Even with a positive trend in net profit margin and strong business pipeline, the flat P/E relative to industry suggests the market remains skeptical about the sustainability of near-term results.

- Meanwhile, a lower P/E than peers signals there could be upside if margin and earnings projections are met or topped.

Stock Trades At 71% Discount To DCF Fair Value

- Cooper-Standard’s share price of $30.22 is far below its DCF fair value estimate of $104.62, spotlighting a major disconnect between market sentiment and analysts’ model-driven valuation.

- Analysts’ consensus narrative posits that this gulf largely comes down to uncertainty about earnings durability and company leverage; bulls cite upside potential if earnings targets are hit while more cautious investors see justified risk discount.

- The analyst consensus price target of $34.33 implies the market sees the shares as fairly priced near-term, with upside contingent on sustained margin gains and deleveraging.

- With sector revenue projected to rise 10.3% annually, Cooper-Standard’s slower 5.7% growth weighs on confidence, but successful execution could see the stock re-rate closer to its model value.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cooper-Standard Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a fresh take on these results? Share your view with the community and put your own narrative together in just a few minutes. Do it your way

A great starting point for your Cooper-Standard Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite the company’s margin recovery and growth projections, investor skepticism lingers because of ongoing quality-of-earnings concerns and a less robust financial position.

If a shakier financial foundation gives you pause, use our solid balance sheet and fundamentals stocks screener (1983 results) to uncover companies boasting stronger balance sheets and greater resilience for the long term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPS

Cooper-Standard Holdings

Through its subsidiary, manufactures and sells sealing, fuel and brake delivery, and fluid transfer systems in the North America, Europe, the Asia Pacific, and the South America.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives