- United States

- /

- Auto Components

- /

- NYSE:APTV

How Investors May Respond To Aptiv (APTV) Launching Gen 8 Radar and PULSE Sensor for Broad ADAS Expansion

Reviewed by Sasha Jovanovic

- On October 21, 2025, Aptiv PLC introduced its most advanced Gen 8 radar technology and the Aptiv PULSE Sensor, designed to enhance next-generation advanced driver-assistance systems (ADAS) with improved detection, expanded field of view, and cost-efficient solutions for automotive and broader industrial applications.

- This launch not only advances hands-free driving capabilities in complex settings but may also open revenue opportunities beyond the automotive sector by targeting drones and industrial robotics.

- We'll examine how Aptiv's leap in radar and sensing innovation could influence expectations for future software-driven growth and diversification.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Aptiv Investment Narrative Recap

For investors to remain confident in Aptiv, it's important to believe in the global expansion and accelerating adoption of advanced driver-assistance systems (ADAS), which fuel demand for next-generation automotive technologies. The launch of Aptiv’s Gen 8 radar and PULSE sensor could reinforce optimism about software and ADAS-driven revenue growth, but ongoing macroeconomic uncertainty and the pace of advanced vehicle adoption remain the most important catalysts and risks to monitor. At present, this news strengthens Aptiv’s positioning but does not fundamentally shift the near-term risk profile.

Among recent developments, Aptiv’s plans to spin off its Electrical Distribution Systems (EDS) business stand out, as this move could help streamline operations and give greater focus to high-growth areas like ADAS, including the innovations just announced. Progress on the EDS sale is closely watched by shareholders seeking improved margins and capital allocation, both of which support Aptiv’s growth ambitions as spotlighted by the Gen 8 radar launch.

By contrast, investors should also be aware of China market risks, especially as local OEM production shifts could…

Read the full narrative on Aptiv (it's free!)

Aptiv's outlook anticipates $23.3 billion in revenue and $1.9 billion in earnings by 2028. This scenario relies on 5.5% annual revenue growth and a $0.9 billion increase in earnings from the current $1.0 billion.

Uncover how Aptiv's forecasts yield a $95.53 fair value, a 11% upside to its current price.

Exploring Other Perspectives

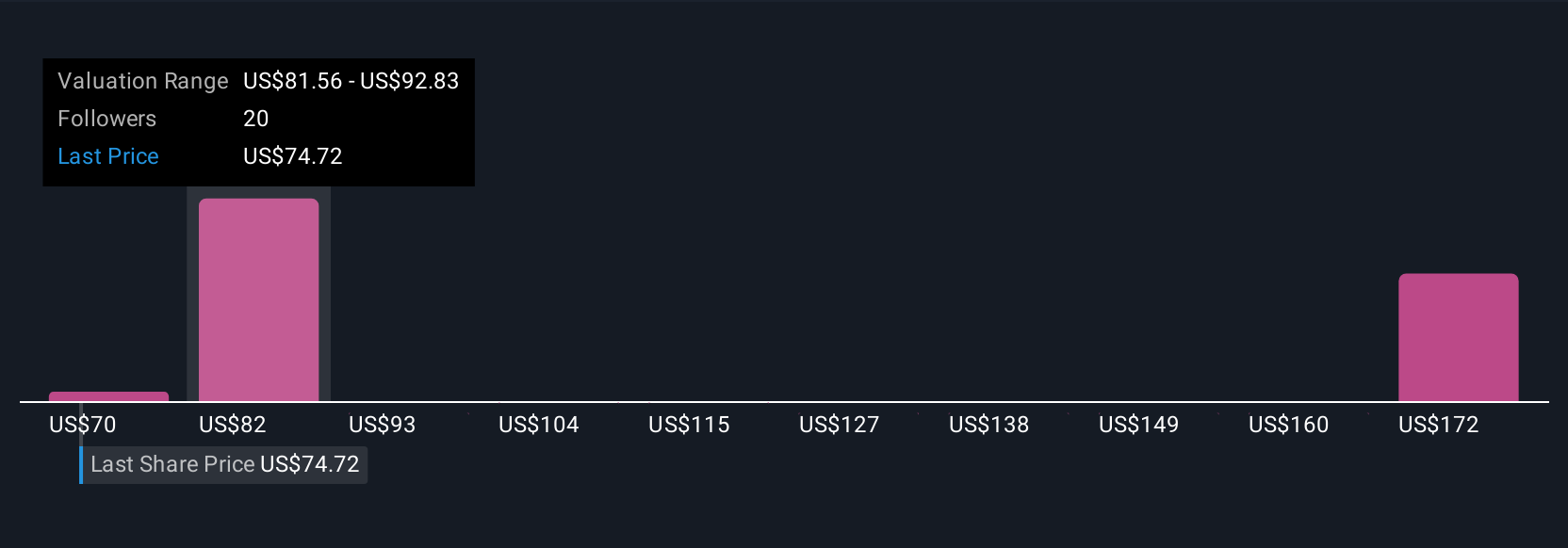

Five fair value estimates from the Simply Wall St Community range from US$70.29 to US$198.10, reflecting wide differences in expectations. With adoption of advanced driver-assistance systems as a key growth engine, investor opinions may shift as Aptiv pursues new business opportunities, take a closer look at several viewpoints.

Explore 5 other fair value estimates on Aptiv - why the stock might be worth over 2x more than the current price!

Build Your Own Aptiv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aptiv research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Aptiv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aptiv's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APTV

Aptiv

Engages in design, manufacture, and sale of vehicle components for the automotive and commercial vehicle markets in North America, Europe, the Middle East, Africa, the Asia Pacific, South America, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives