- United States

- /

- Auto Components

- /

- NYSE:APTV

How Aptiv’s (APTV) Share Buybacks and Lower Net Income Could Reshape Its Investment Outlook

Reviewed by Simply Wall St

- Aptiv PLC announced its second quarter 2025 financial results, updated earnings guidance for the third quarter and full year 2025, and provided an update on its ongoing share repurchase program.

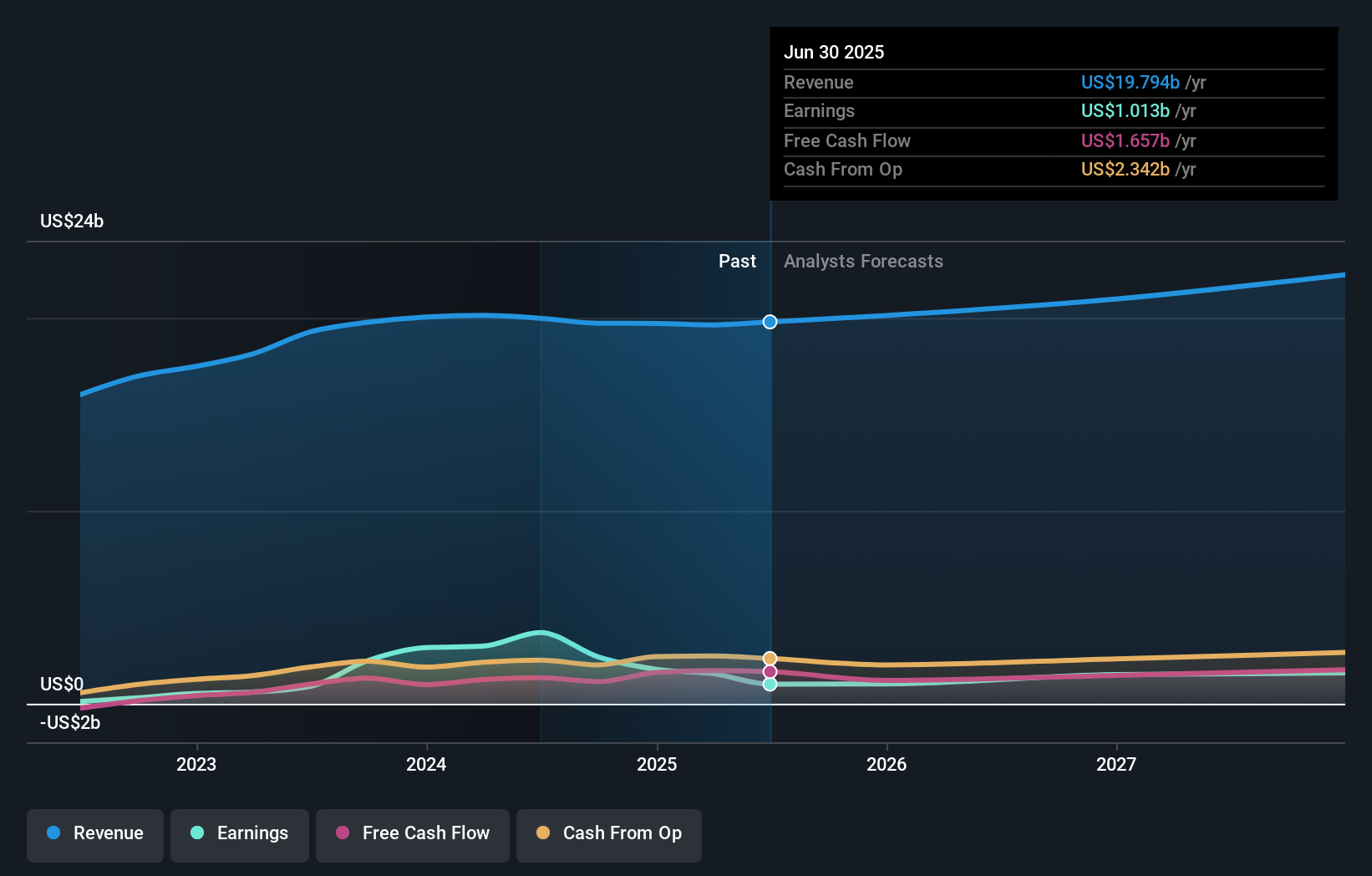

- While sales increased year-over-year in the second quarter, net income fell materially and the company continued significant share buybacks, retiring 2.73% of outstanding shares in the past quarter.

- With Aptiv confirming a sizable share buyback and lowering net income, we'll examine how these updates may shift its investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Aptiv Investment Narrative Recap

To be an Aptiv shareholder today, one must believe in the continued expansion of advanced vehicle electrical systems and growing adoption of electrification and ADAS platforms, despite short-term earnings volatility. The latest results saw better year-on-year sales but a sharp drop in net income, while ongoing share buybacks continued at scale; these updates have not materially changed the most important catalyst, content growth per vehicle linked to global EV and automation trends, or the key risk of macroeconomic uncertainty impacting vehicle production and demand.

Among recent announcements, Aptiv's corporate guidance update stands out as most relevant: the company now projects 2025 full-year net income of US$975 million to US$1,045 million, noticeably reduced from earlier guidance. This reset, in the context of robust automotive technology trends, puts even greater focus on how Aptiv can sustain margin improvement as volumes recover and new program launches ramp up.

Yet for all the optimism, investors should also be aware that persistent margin headwinds from volatile costs and foreign exchange could still...

Read the full narrative on Aptiv (it's free!)

Aptiv's narrative projects $23.3 billion in revenue and $1.9 billion in earnings by 2028. This requires 5.5% yearly revenue growth and an $0.9 billion increase in earnings from the current $1.0 billion.

Uncover how Aptiv's forecasts yield a $82.94 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Six Simply Wall St Community members estimate Aptiv's fair value between US$70.29 and US$180.06 per share. Against this diversity of opinion, margin challenges and ongoing macro uncertainty remain front of mind for many exploring future upside or downside.

Explore 6 other fair value estimates on Aptiv - why the stock might be worth over 2x more than the current price!

Build Your Own Aptiv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aptiv research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Aptiv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aptiv's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APTV

Aptiv

Engages in design, manufacture, and sale of vehicle components for the automotive and commercial vehicle markets in North America, Europe, the Middle East, Africa, the Asia Pacific, South America, and internationally.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives