- United States

- /

- Auto Components

- /

- NYSE:APTV

Aptiv (APTV) Margin Drop Reinforces Concerns Despite Strong Three-Year Earnings Growth Outlook

Reviewed by Simply Wall St

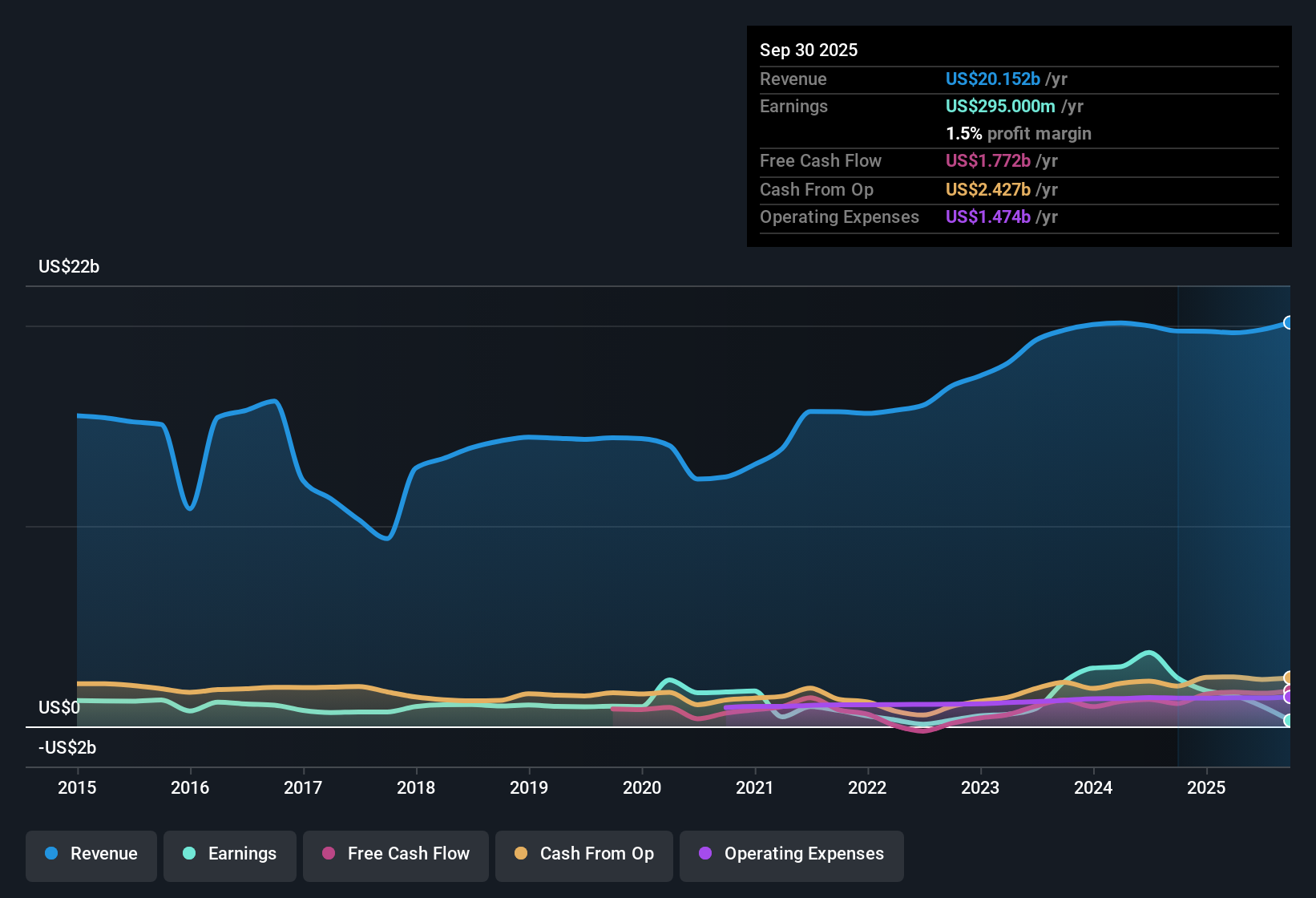

Aptiv (APTV) reported a robust outlook as earnings are forecast to grow 36.8% per year over the next three years, well outpacing the US market’s estimated 15.7% rate. While net profit margin has fallen to 5.1% from last year’s 18.5%, the company has achieved a significant 23% annual earnings growth over the past five years. Revenue growth is expected to be more modest at 5.2% per year compared to the broader US market at 10.3%. The stock currently trades at a price-to-earnings ratio of 17.7x, below both industry peers and sector averages, with shares changing hands below an indicated fair value estimate. These results leave investors weighing the company’s stronger projected profit growth and appealing valuation against weaker current margins and a less robust financial position.

See our full analysis for Aptiv.Next, we will see how these results measure up against the leading market narratives and community insights for Aptiv. Some expectations could be confirmed, while others might get a reality check.

See what the community is saying about Aptiv

Profit Margins Poised for a Comeback

- Analysts anticipate Aptiv’s profit margins will rise from today’s 5.1% to 8.2% within three years, countering the recent dip and setting the stage for potentially stronger earnings leverage if revenue volumes hit their marks.

- According to the analysts' consensus view,

- The margin expansion thesis is heavily supported by Aptiv’s push into high-margin software and advanced driver-assistance systems, which are delivering recurring revenue streams on top of traditional components.

- However, consensus also warns that ongoing supply chain disruptions and volatile commodity prices, especially copper, could limit the magnitude or pace of margin recovery.

- Curious if analysts are still siding with margin optimism? Compare the full range of bull and bear arguments in the consensus narrative before making your move. 📊 Read the full Aptiv Consensus Narrative.

Share Count Shrinking Accelerates Per-Share Growth

- Analysts expect the number of shares outstanding to decline 7.0% annually over the next three years, magnifying potential earnings per share even if absolute profits rise more moderately.

- The consensus narrative notes that

- This ongoing buyback activity gives Aptiv more flexibility to offset volatility in bottom-line growth, especially if macro or operational headwinds put pressure on revenues.

- On the flip side, if free cash flow falls short or balance sheet flexibility erodes, Aptiv may need to moderate these returns, which could dampen the per-share growth outlook.

Valuation Discount Hinges on Future Delivery

- Aptiv’s price-to-earnings ratio of 17.7x remains below both its industry peer group and the broader US auto components sector, and the current $82.12 share price still sits at a discount to the consensus analyst target of $96.65.

- In the consensus narrative,

- Analysts see Aptiv’s below-sector valuation as justified only if margin and earnings growth targets are met, since even a moderate miss could keep the stock range-bound near its current price.

- With a DCF fair value of $194.17, the magnitude of this gap creates a notable tension in market expectations and underlines how much future delivery matters for upside.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Aptiv on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique angle on the story? Share your own take in just a few minutes and make your perspective count with Do it your way.

A great starting point for your Aptiv research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Aptiv’s long-term earnings outlook is strong, its narrow margins and less robust financial footing mean future growth could be vulnerable to setbacks.

If you’re looking for businesses with greater financial resilience, check out solid balance sheet and fundamentals stocks screener (1986 results) to discover companies focused on stronger balance sheets and dependable fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APTV

Aptiv

Engages in design, manufacture, and sale of vehicle components for the automotive and commercial vehicle markets in North America, Europe, the Middle East, Africa, the Asia Pacific, South America, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives