- United States

- /

- Auto Components

- /

- NYSE:APTV

Aptiv and Robust.AI Team Up on Warehouse Robotics Might Change The Case For Investing In Aptiv (APTV)

Reviewed by Sasha Jovanovic

- On November 10, 2025, Aptiv PLC and Robust.AI announced a collaboration to co-develop AI-powered collaborative robots for warehouse and industrial automation, combining Aptiv’s perception and machine learning technologies with Robust.AI’s robotics expertise and human-centered design.

- This partnership positions Aptiv to extend its advanced automotive sensor and software platforms into non-automotive markets, offering flexibility and efficiency through scalable, AI-enabled automation solutions.

- We'll explore how leveraging Aptiv’s machine learning and sensor capabilities in industrial automation could influence the company’s evolving investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Aptiv Investment Narrative Recap

To be a shareholder in Aptiv, you need to believe in its ability to translate core automotive sensor and software strengths into new growth markets, such as industrial automation, while navigating ongoing margin and demand pressures. The new collaboration with Robust.AI enhances Aptiv’s long-term diversification story but is unlikely to affect near-term demand volatility or address the largest current risk, the persistence of unfavorable customer mix shifts and sudden OEM schedule changes, particularly in China.

The recent launch of Aptiv's Gen 8 radar technology for ADAS stands out as especially relevant, as it demonstrates continued progress in developing advanced perception capabilities, core technologies now being adapted beyond automotive via the Robust.AI partnership. Both announcements reflect a catalyst for expanding addressable markets and revenue streams, although each faces unique adoption barriers and risk profiles.

However, investors should also consider that while product innovation continues, ongoing challenges with local customer volumes in China remain a risk to...

Read the full narrative on Aptiv (it's free!)

Aptiv's narrative projects $23.3 billion revenue and $1.9 billion earnings by 2028. This requires 5.5% yearly revenue growth and an increase of $0.9 billion in earnings from $1.0 billion today.

Uncover how Aptiv's forecasts yield a $97.53 fair value, a 20% upside to its current price.

Exploring Other Perspectives

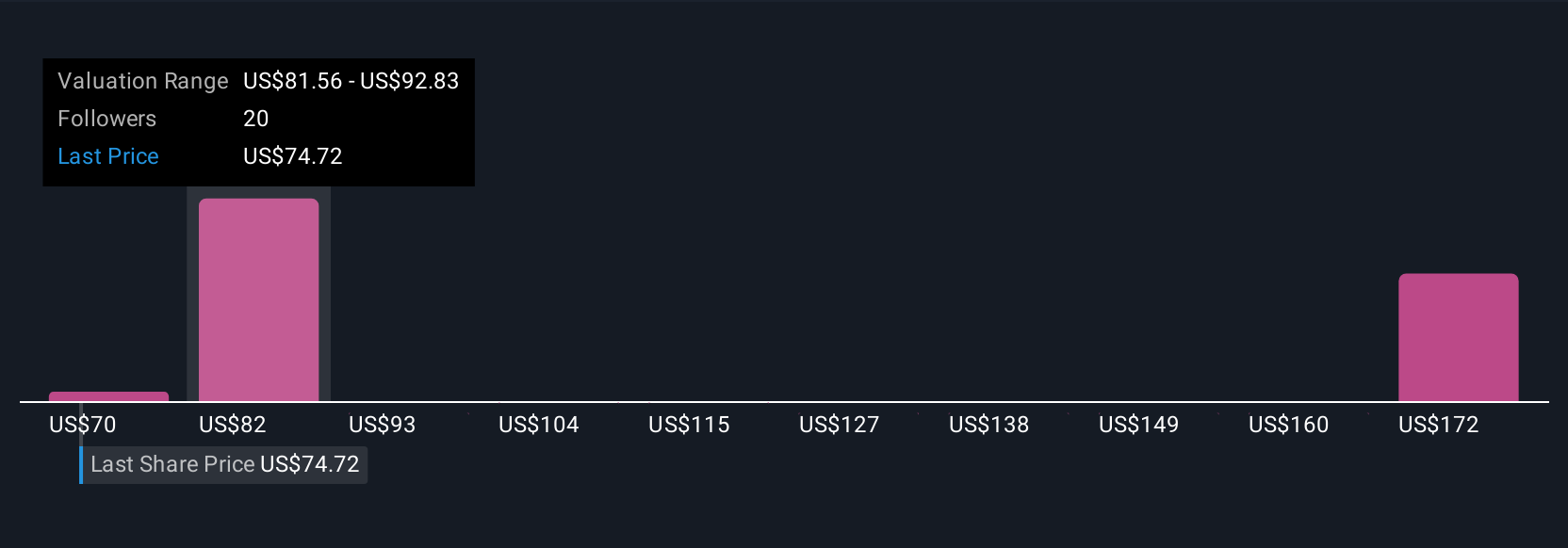

Six Simply Wall St Community members set fair values from US$70.29 to US$160.73 per share, showing wide divergence in outlooks. In contrast, recurring challenges in the Chinese auto market may weigh on near-term performance, make sure to weigh different approaches to fair value when making decisions.

Explore 6 other fair value estimates on Aptiv - why the stock might be worth 13% less than the current price!

Build Your Own Aptiv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aptiv research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Aptiv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aptiv's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APTV

Aptiv

Engages in design, manufacture, and sale of vehicle components for the automotive and commercial vehicle markets in North America, Europe, the Middle East, Africa, the Asia Pacific, South America, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives