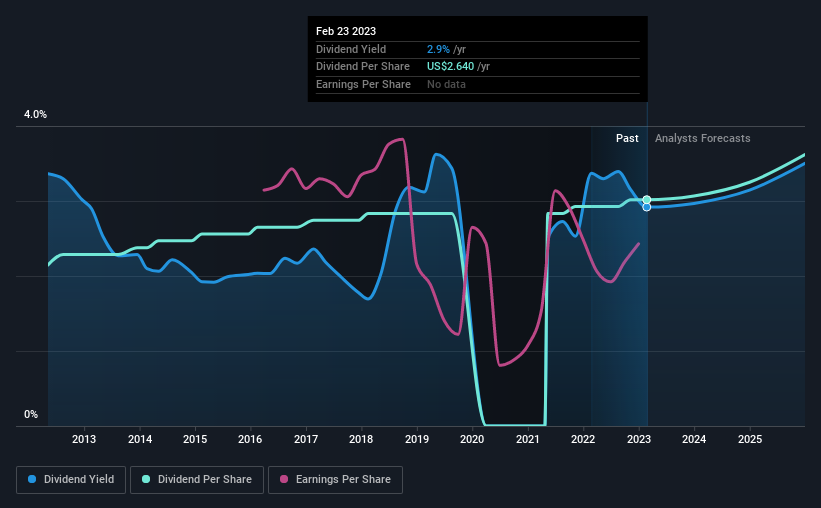

The board of Autoliv, Inc. (NYSE:ALV) has announced that it will be paying its dividend of $0.66 on the 23rd of March, an increased payment from last year's comparable dividend. This takes the dividend yield to 2.9%, which shareholders will be pleased with.

See our latest analysis for Autoliv

Autoliv's Payment Has Solid Earnings Coverage

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Prior to this announcement, Autoliv's dividend was only 53% of earnings, however it was paying out 178% of free cash flows. While the company may be more focused on returning cash to shareholders than growing the business at this time, we think that a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

The next year is set to see EPS grow by 121.3%. If the dividend continues along recent trends, we estimate the payout ratio will be 23%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2013, the annual payment back then was $1.88, compared to the most recent full-year payment of $2.64. This implies that the company grew its distributions at a yearly rate of about 3.5% over that duration. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

Dividend Growth Is Doubtful

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Autoliv has seen earnings per share falling at 6.0% per year over the last five years. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. Earnings are forecast to grow over the next 12 months and if that happens we could still be a little bit cautious until it becomes a pattern.

Autoliv's Dividend Doesn't Look Sustainable

In summary, while it's always good to see the dividend being raised, we don't think Autoliv's payments are rock solid. While Autoliv is earning enough to cover the payments, the cash flows are lacking. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 2 warning signs for Autoliv that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ALV

Autoliv

Through its subsidiaries, develops, manufactures, and supplies passive safety systems to the automotive industry in Europe, the Americas, China, Japan, and rest of Asia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion