- United States

- /

- Auto Components

- /

- NYSE:ADNT

Is Adient’s (ADNT) Share Buyback a Vote of Confidence Amid Net Loss?

Reviewed by Sasha Jovanovic

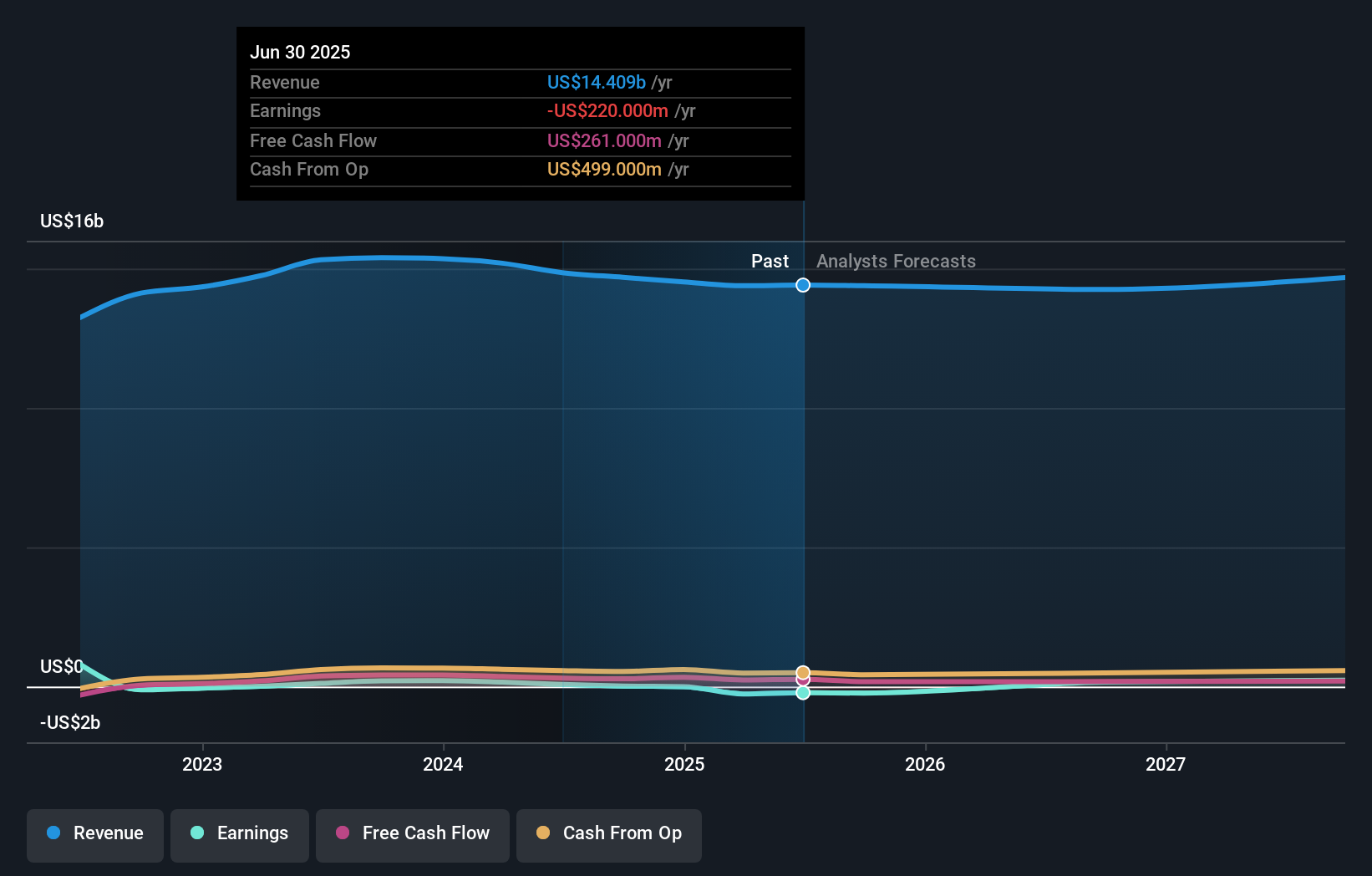

- Adient plc recently reported financial results for the year ended September 30, 2025, showing sales of US$14.54 billion, a decline from the previous year, alongside a net loss of US$281 million compared to a net income of US$18 million last year.

- During the same period, the company also completed a major share repurchase initiative, buying back over 18.40 million shares under its multi-year program announced in November 2022.

- We’ll explore how Adient’s swing to a net loss impacts its long-term investment thesis and future shareholder returns.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Adient Investment Narrative Recap

To invest in Adient, you need to believe in the company's ability to leverage vehicle electrification trends, capitalize on next-generation seating wins with EV manufacturers, and steadily improve margins in Europe. The recent annual swing to a net loss does not materially shift the most important short-term catalyst, new program launches in key markets, though it does reinforce the prominent risk tied to ongoing volume and margin headwinds, particularly in EMEA and China, where a sustained turnaround remains uncertain.

One relevant recent announcement is Adient's completion of a major share buyback program, retiring over 18.4 million shares since late 2022. While this move reduces share count and may enhance future earnings per share in a recovery, it does not immediately address the core challenge of improving operating margins in low-performing regions, which remains essential for long-term value creation.

Yet despite recent buybacks, investors should be aware that mounting volume and mix headwinds, especially across Europe and China, could ...

Read the full narrative on Adient (it's free!)

Adient's outlook anticipates $15.1 billion in revenue and $330.3 million in earnings by 2028. This scenario assumes 1.6% annual revenue growth and a $550.3 million improvement in earnings from the current level of -$220.0 million.

Uncover how Adient's forecasts yield a $29.04 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair values for Adient between US$29.04 and US$68.25, signaling considerable disagreement out of two detailed viewpoints. While some see clear upside, persistent challenges with EMEA and China recovery may weigh on long-term performance and invite close attention to contrasting opinions on potential upside and downside.

Explore 2 other fair value estimates on Adient - why the stock might be worth just $29.04!

Build Your Own Adient Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adient research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Adient research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adient's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADNT

Adient

Engages in the design, development, manufacture, and market of seating systems and components for passenger cars, commercial vehicles, and light trucks.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives