- United States

- /

- Auto Components

- /

- NasdaqCM:XPEL

Why Is XPEL (XPEL) Doubling Down on Manufacturing After Record Revenue and a New Product Launch?

Reviewed by Sasha Jovanovic

- XPEL, Inc. recently reported its third-quarter 2025 results, delivering record revenue of US$125.42 million, up from US$112.85 million a year earlier, while unveiling sizable investments of US$75 million to US$150 million over the next two years to enhance its manufacturing and supply chain.

- The company also debuted its new XPEL COLOR Paint Protection Film at the SEMA Show, highlighting ongoing product innovation to diversify revenue streams and increase market interest in vehicle personalization.

- Let's explore how XPEL's margin improvement targets and new colored paint protection product may influence its long-term investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

XPEL Investment Narrative Recap

To own XPEL, an investor typically needs to believe in the company's ability to capitalize on international expansion and continued innovation in vehicle protection films, while navigating margin pressures and evolving industry threats. The latest quarterly update, record revenue but a dip in net income, confirms topline momentum but also highlights rising costs, with margin improvement efforts now a crucial short-term catalyst. However, near-term profitability could be impacted by cost inflation and competition; the recent news does little to materially alter these fundamental dynamics.

Among the recent announcements, XPEL's commitment to invest between US$75 million and US$150 million in manufacturing and supply chain upgrades over the next two years stands out. This plan is directly tied to its ambition to lift gross margins to 52%-54% and operating margins into the mid to high 20% range by 2028, making operational efficiency upgrades highly relevant to margin recovery and earnings resilience.

On the flip side, investors should be prepared for the risk that comes from intensifying competition overseas, which...

Read the full narrative on XPEL (it's free!)

XPEL's outlook anticipates $644.9 million in revenue and $100.3 million in earnings by 2028. This scenario implies a 12.8% annual revenue growth rate and a $51.6 million increase in earnings from the current $48.7 million.

Uncover how XPEL's forecasts yield a $47.67 fair value, a 26% upside to its current price.

Exploring Other Perspectives

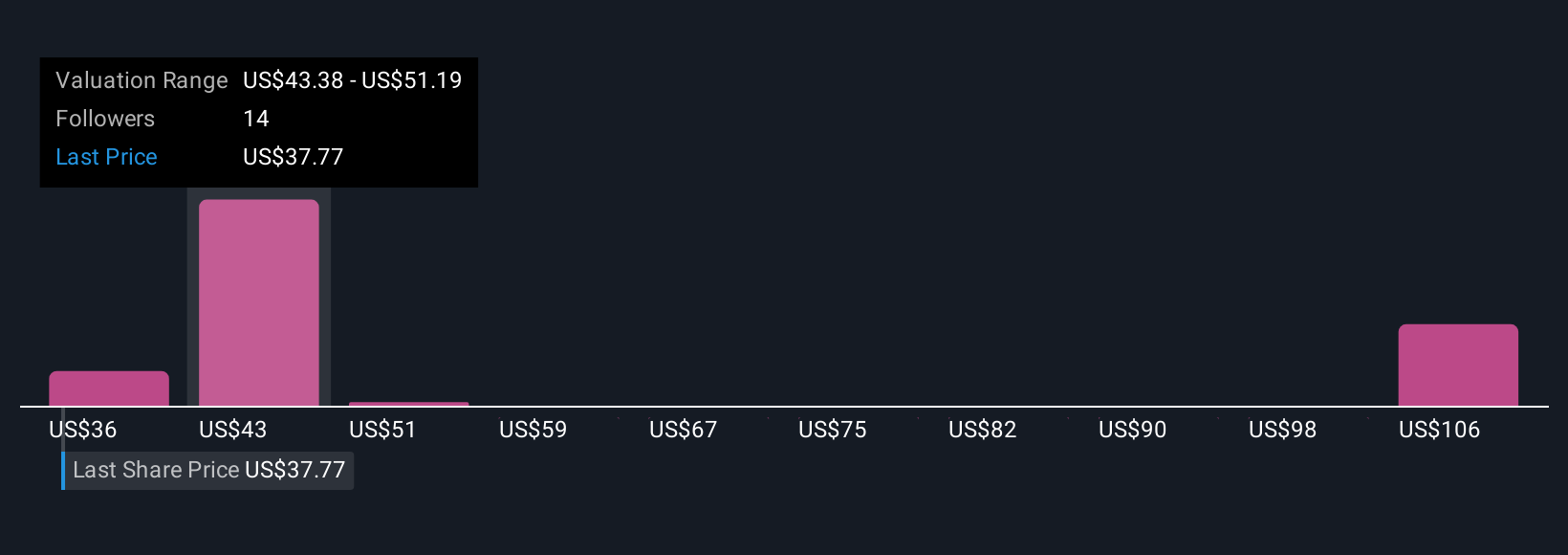

Six members of the Simply Wall St Community estimate XPEL’s fair value from US$35.58 to US$55 per share. While many expect earnings growth and margin expansion, differences in outlook show that market participants see several possible futures for XPEL.

Explore 6 other fair value estimates on XPEL - why the stock might be worth 6% less than the current price!

Build Your Own XPEL Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPEL research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free XPEL research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XPEL's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:XPEL

XPEL

Manufactures, installs, sells, and distributes protective films, coatings and related services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives