- United States

- /

- Auto Components

- /

- NasdaqGM:WRD

Will WeRide (WRD)’s New UAE Robotaxi Launch Shape Its Long-Term Global Ambitions?

Reviewed by Sasha Jovanovic

- WeRide announced the launch of its Robotaxi GXR and Robobus pilot operations in partnership with the Ras Al Khaimah Transport Authority (RAKTA), marking its first deployment in Ras Al Khaimah and expansion into a third emirate in the UAE.

- This initiative integrates WeRide’s autonomous vehicles into the emirate’s public transport network and highlights growing collaboration between Chinese technology and the UAE’s smart mobility ambitions.

- We'll explore how WeRide's exclusive role in shaping Ras Al Khaimah's autonomous mobility framework may influence its investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is WeRide's Investment Narrative?

To be a shareholder in WeRide, you need to believe in the company’s ability to convert its rapid international expansion, most recently with the high-profile launch in Ras Al Khaimah, into future commercial traction, despite recurring losses and a market that remains skeptical about near-term profitability. The latest UAE pilot is material, as it places WeRide in a prime position to influence regulatory frameworks and secure a long-term operating foothold in a region actively pursuing smart mobility. This potentially reshapes short-term catalysts, as public sector endorsements and visible deployments could help address lingering doubts about regulatory and operational hurdles. However, it doesn’t eliminate the most pressing risks: high cash burn, continued losses, expensive valuation on revenue and book ratios, and fairly new board leadership. Investors should watch for any revenue impact and changes in local partnerships emerging from this initiative.

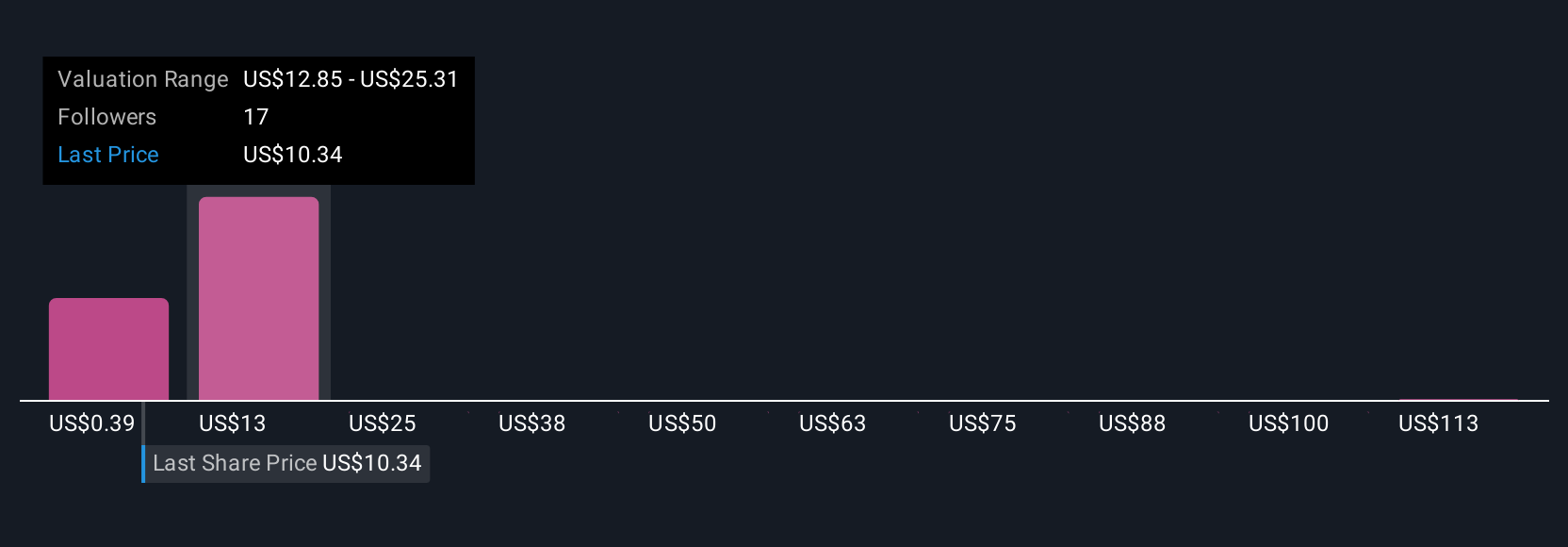

But as government partnerships expand, cost control and profitability remain critical risks investors need to watch. Our expertly prepared valuation report on WeRide implies its share price may be too high.Exploring Other Perspectives

Explore 15 other fair value estimates on WeRide - why the stock might be worth less than half the current price!

Build Your Own WeRide Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WeRide research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free WeRide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WeRide's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WeRide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WRD

WeRide

Operates as a mover in the autonomous driving industry and a robotaxi company.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives