- United States

- /

- Auto Components

- /

- NasdaqGM:WRD

WeRide (WRD) Is Up 7.1% After Launching Level 4 Robotaxi Platform and Singapore Approval Has The Bull Case Changed?

Reviewed by Simply Wall St

- WeRide recently launched the HPC 3.0 high-performance computing platform, co-developed with Lenovo and powered by NVIDIA DRIVE AGX Thor, making its debut in the world’s first mass-produced Level 4 autonomous Robotaxi and supporting fully driverless Robobus operations in Singapore after receiving regulatory approval.

- This marks a significant step forward in global autonomous vehicle commercialization, as WeRide’s latest technology reduces system costs and establishes operations in key international markets, including Southeast Asia.

- We’ll explore how WeRide’s debut of cost-reducing, globally scalable Level 4 Robotaxis could shape its investment narrative moving forward.

What Is WeRide's Investment Narrative?

For anyone considering WeRide as an investment, the big picture centers on the belief that rapid global deployment and cost reduction in Level 4 autonomous vehicles can drive long-term adoption and revenue growth, even while losses remain high in the near term. The unveiling of the HPC 3.0 platform, with its robust performance specs and significant cost savings, is a material event that strengthens the case for WeRide’s technology achieving commercial viability and scaling internationally. This, paired with operational milestones like the first fully driverless Robobus in Singapore, positions the company as a frontrunner in deploying driverless mobility at scale. However, these catalysts must be weighed against WeRide’s ongoing unprofitability, expensive share valuation, and an inexperienced board. The recent news slightly shifts near-term catalysts: successful rollouts and regulatory approvals become even more critical, and technological or operational missteps, especially in new markets, pose amplified risks for shareholders compared to earlier analyses.

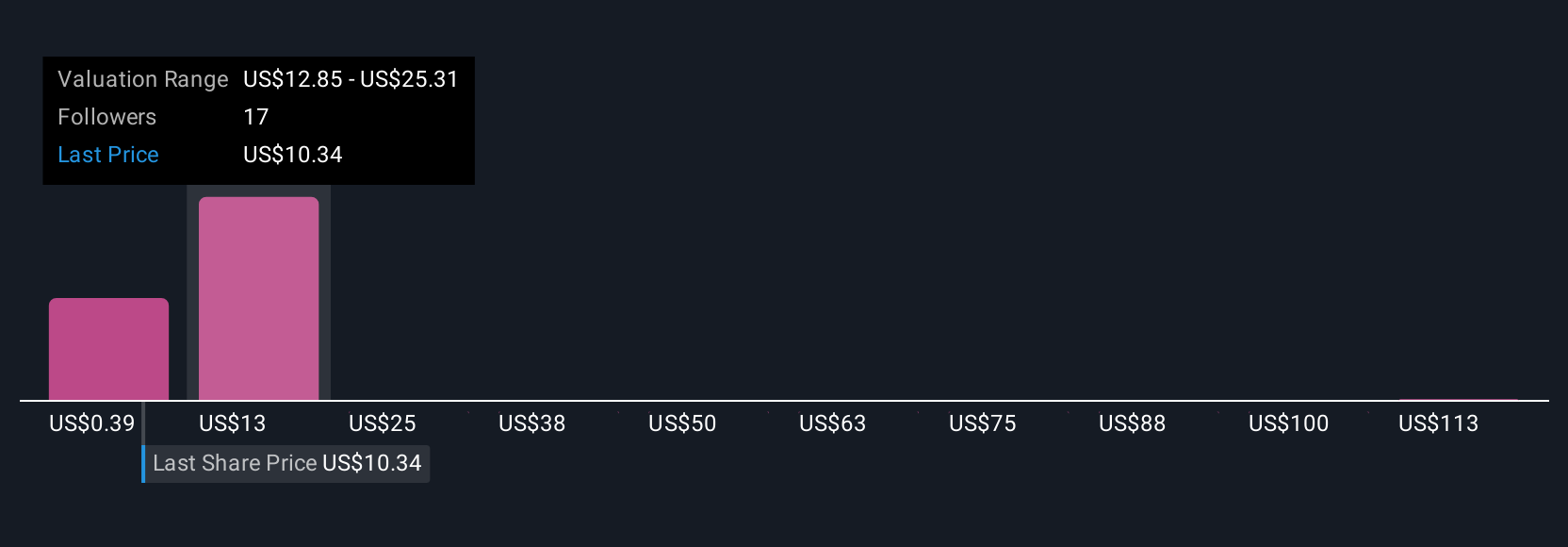

But regulatory and execution risks are higher now, so investors should be aware of those potential headwinds. In light of our recent valuation report, it seems possible that WeRide is trading beyond its estimated value.Exploring Other Perspectives

Explore 11 other fair value estimates on WeRide - why the stock might be a potential multi-bagger!

Build Your Own WeRide Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WeRide research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free WeRide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WeRide's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WeRide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WRD

WeRide

Operates as a mover in the autonomous driving industry and a robotaxi company.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives