- United States

- /

- Auto Components

- /

- NasdaqGM:WRD

Uber’s Autonomous Robotaxi Launch in Saudi Arabia Could Be a Game Changer for WeRide (WRD)

Reviewed by Sasha Jovanovic

- Uber Technologies announced the launch of autonomous Robotaxi rides with WeRide in Riyadh, marking the first public deployment of autonomous vehicles on Uber’s platform in Saudi Arabia, in partnership with the Transport General Authority as part of the country’s Vision 2030 initiative.

- This development not only introduces passengers to driverless mobility in the Kingdom but also significantly advances WeRide’s expansion into key Middle Eastern markets following earlier entries in Abu Dhabi and Dubai.

- We’ll examine how access to Saudi Arabia’s new mobility market on Uber’s platform is shaping WeRide’s investment narrative.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is WeRide's Investment Narrative?

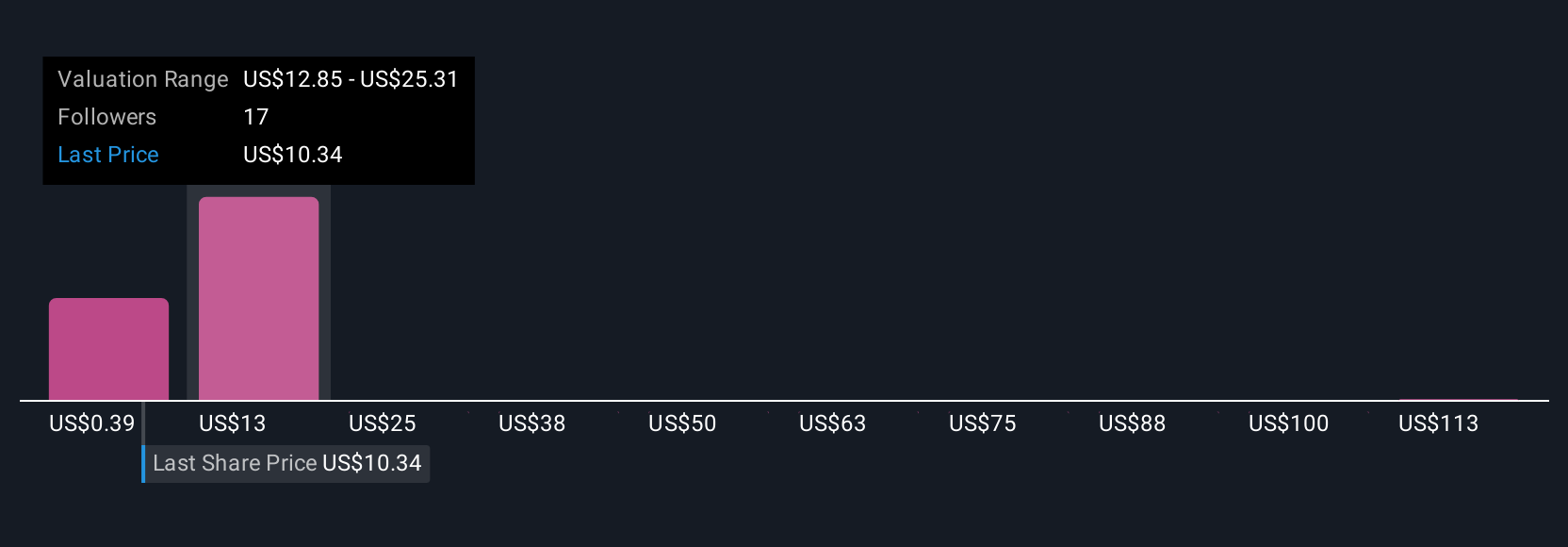

For anyone considering a stake in WeRide, the story has always been about believing in the long-term global adoption of autonomous vehicles, and the company’s ability to translate innovation and partnerships into a path toward profitability. The Uber partnership in Riyadh is a visible signal of WeRide’s ability to execute and scale internationally, offering a real proof point for its expansion ambitions. In the near term, this could ease concerns about commercial traction and help solidify WeRide’s position as a technology provider to major players. However, while the news is significant, it doesn't offset key risks. The company remains unprofitable, board tenure is low, and valuation remains steep relative to peers. The Riyadh launch may boost confidence in the business model, but the most immediate catalyst remains converting pilot projects and regulatory wins into sustained, profitable operations, a hurdle that still stands.

But, the path to profitability and board experience will be critical factors investors shouldn't overlook. The analysis detailed in our WeRide valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore 16 other fair value estimates on WeRide - why the stock might be worth less than half the current price!

Build Your Own WeRide Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WeRide research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free WeRide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WeRide's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WeRide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WRD

WeRide

An investment holding company, provides autonomous driving products and solutions for mobility, logistics, and sanitation industries in the People’s Republic of China.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion