- United States

- /

- Auto Components

- /

- NasdaqGS:VC

Visteon (VC): Evaluating the Latest Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

Visteon (VC) stock has seen some movement recently, with shares down about 1% over the past week and slipping 9% during the past month. This has some investors taking a closer look at recent trends around the auto technology supplier.

See our latest analysis for Visteon.

While Visteon's recent 1-week and 1-month share price returns show some cooling momentum, the stock has still managed a solid 21% share price gain year-to-date, with a 1-year total shareholder return of nearly 15%, suggesting longer-term investors are still sitting on respectable gains even as short-term volatility picks up.

If shifts in auto tech stocks have your attention, broaden your perspective and discover new opportunities through our auto manufacturers screener, See the full list for free.

With Visteon trading nearly 28% below both its analyst price target and estimated intrinsic value, the question is clear for investors: is this a market mispricing worth acting on, or is future growth already built in?

Most Popular Narrative: 21% Undervalued

With Visteon trading at $105.12 and the most widely followed narrative setting fair value at $133.77, expectations are clearly set above the current market consensus. This sharp gap is driven by forward-looking assessments of the company’s technology leadership and strategic market expansion, setting the stage for the narrative excerpt below.

Visteon's advancements in automotive display technologies and cockpit AI solutions are likely to drive future revenue growth as they position the company as a top supplier for large displays and digital cockpit innovations. The recent new business wins, totaling $1.9 billion, especially with key OEMs like Toyota and the expansion plans with fast-growing domestic OEMs in China, are expected to bolster future earnings and revenue streams.

Want to see what’s fueling this lofty price target? The fair value estimate is built on bold growth moves and a handful of aggressive expectations. Discover the specific financial milestones and projections that could make this valuation a reality. Find out what the narrative reveals and why analysts think the payoff might be worth the wait.

Result: Fair Value of $133.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tariff-related headwinds or a drop in production volumes for global automakers could still significantly disrupt Visteon's optimistic outlook.

Find out about the key risks to this Visteon narrative.

Another View: What Do the Ratios Say?

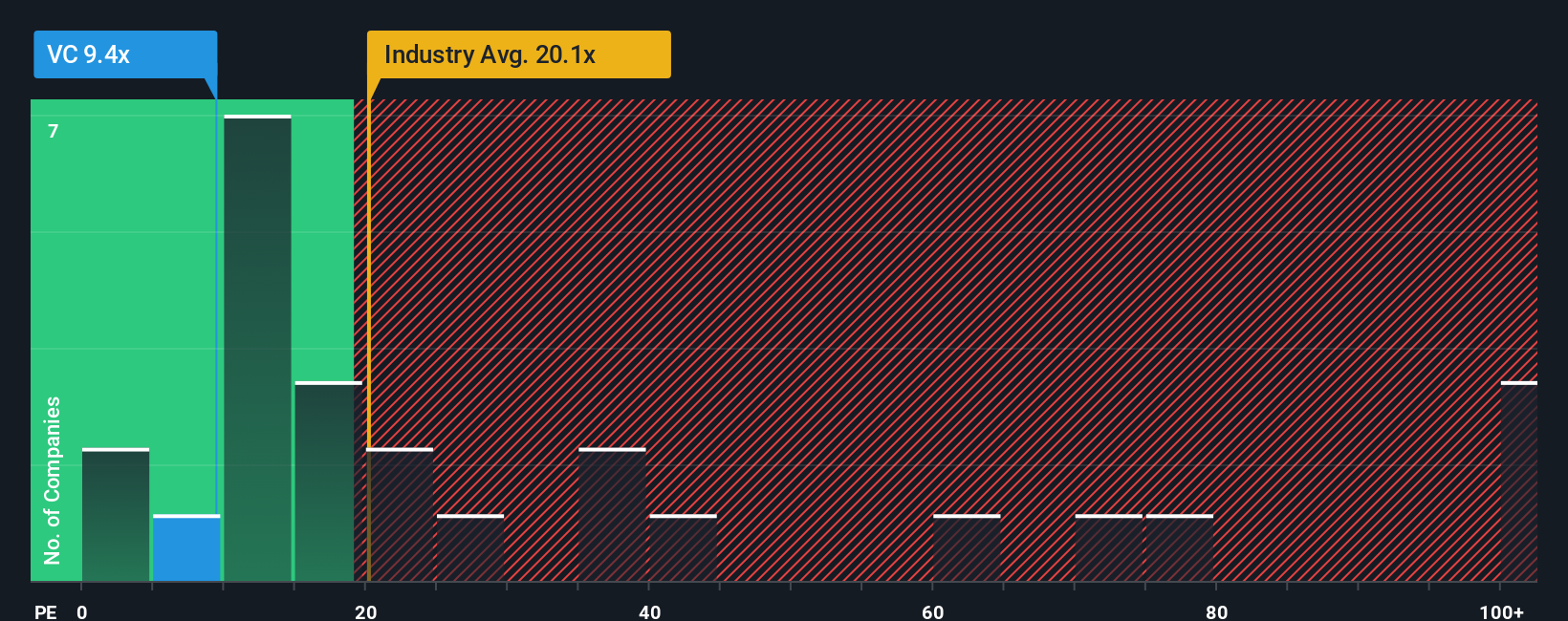

While the fair value estimate paints Visteon as significantly undervalued, looking at its price-to-earnings ratio raises a few eyebrows. Visteon trades at 9.3x earnings, which is lower than the US Auto Components industry average of 23.4x and below peers at 21.3x, but slightly above its own fair ratio of 8.9x. This suggests there is room for adjustment, and investors should consider if the current low valuation adequately compensates for growth risks or if the market might move closer to the fair ratio over time. How much margin of safety can you really count on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Visteon Narrative

If you have a different take or want to dive into the numbers yourself, crafting your own perspective on Visteon is quick and straightforward. It often takes just a few minutes. Do it your way

A great starting point for your Visteon research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Skip the guesswork and take charge of your financial future with fresh stock ideas powered by Simply Wall Street's powerful screeners. Opportunities like these don’t wait, so don’t risk missing out.

- Amplify your portfolio with high-yield potential by checking out these 16 dividend stocks with yields > 3%, which offers strong returns and attractive payouts above 3%.

- Capture the transformative potential of next-generation medical innovation when you start your search with these 31 healthcare AI stocks. This highlights companies blending healthcare expertise with artificial intelligence.

- Seize undervalued opportunities in the market by using these 879 undervalued stocks based on cash flows to spot stocks trading below their fair value based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VC

Visteon

An automotive technology company, designs, manufactures, and sells automotive electronics and connected car solutions for vehicle manufacturers.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives