- United States

- /

- Auto Components

- /

- NasdaqGS:VC

Shareholders May Not Be So Generous With Visteon Corporation's (NASDAQ:VC) CEO Compensation And Here's Why

Key Insights

- Visteon will host its Annual General Meeting on 6th of June

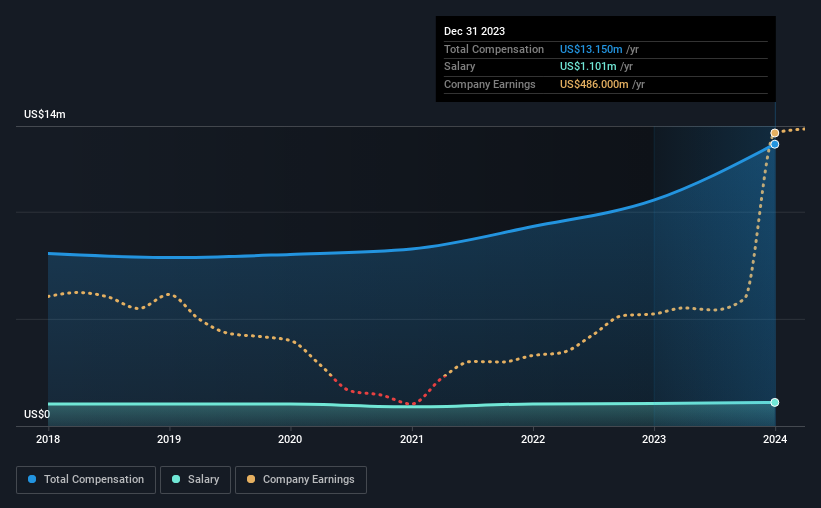

- CEO Sachin Lawande's total compensation includes salary of US$1.10m

- The total compensation is 95% higher than the average for the industry

- Visteon's three-year loss to shareholders was 16% while its EPS grew by 96% over the past three years

Shareholders of Visteon Corporation (NASDAQ:VC) will have been dismayed by the negative share price return over the last three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 6th of June. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for Visteon

Comparing Visteon Corporation's CEO Compensation With The Industry

At the time of writing, our data shows that Visteon Corporation has a market capitalization of US$3.0b, and reported total annual CEO compensation of US$13m for the year to December 2023. We note that's an increase of 25% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.1m.

For comparison, other companies in the American Auto Components industry with market capitalizations ranging between US$2.0b and US$6.4b had a median total CEO compensation of US$6.7m. Accordingly, our analysis reveals that Visteon Corporation pays Sachin Lawande north of the industry median. What's more, Sachin Lawande holds US$30m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$1.1m | US$1.1m | 8% |

| Other | US$12m | US$9.5m | 92% |

| Total Compensation | US$13m | US$11m | 100% |

On an industry level, around 13% of total compensation represents salary and 87% is other remuneration. Visteon sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Visteon Corporation's Growth Numbers

Visteon Corporation has seen its earnings per share (EPS) increase by 96% a year over the past three years. The trailing twelve months of revenue was pretty much the same as the prior period.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Visteon Corporation Been A Good Investment?

Given the total shareholder loss of 16% over three years, many shareholders in Visteon Corporation are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 2 warning signs for Visteon that investors should be aware of in a dynamic business environment.

Important note: Visteon is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VC

Visteon

An automotive technology company, designs, manufactures, and sells automotive electronics and connected car solutions for vehicle manufacturers.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion