- United States

- /

- Auto Components

- /

- NasdaqGS:THRM

Gentherm (THRM): Exploring Valuation as Institutional Investors and Analysts Signal Renewed Confidence

Reviewed by Simply Wall St

Gentherm (THRM) has recently seen a wave of activity from major institutional investors, with firms like Boston Partners sharply increasing their holdings. In addition, steady analyst optimism and strong fundamentals are drawing fresh attention to the stock.

See our latest analysis for Gentherm.

This renewed confidence comes as Gentherm’s share price has struggled to gain traction, closing recently at $36.17. While the 1-day and weekly share price returns are modestly positive, longer-term momentum remains weak, with a 1-year total shareholder return of -15.25% and a three-year figure of -50.61%. Despite active institutional buying and ongoing upgrades, the stock’s lengthy performance slump suggests sentiment is only starting to shift, as investors weigh Gentherm’s solid fundamentals against its uneven market track record.

If Gentherm’s recent turnaround efforts have your attention, this could be the perfect moment to broaden your search for opportunity and discover See the full list for free.

With recent analyst upgrades and institutional investors boosting their stakes, is Gentherm trading at a discount that presents a compelling entry point, or is the market already reflecting expectations for a turnaround?

Most Popular Narrative: 20.7% Undervalued

Gentherm’s most widely followed narrative puts fair value at $45.60, a premium to the recent close of $36.17. This valuation is based not only on near-term expectations but also on strong forecasts for earnings and margin expansion over several years.

Operational efficiency initiatives and global footprint realignment, including automation and standardized business processes, are driving ongoing improvements in gross margins and operating margin. Anticipated margin expansion is particularly visible in the fourth quarter and beyond.

Want to see what’s fueling this double-digit upside? The analysts’ roadmap features major leaps in profitability and revenue. The future depends on significant margin gains and ambitious profit targets, but only a deep dive reveals how these assumptions stack up. Find out what drives this high-conviction price target.

Result: Fair Value of $45.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Gentherm's growth outlook could be challenged by weak Asian market performance and ongoing margin pressures if cost controls and market share gains falter.

Find out about the key risks to this Gentherm narrative.

Another View: Is Gentherm Overvalued on Earnings?

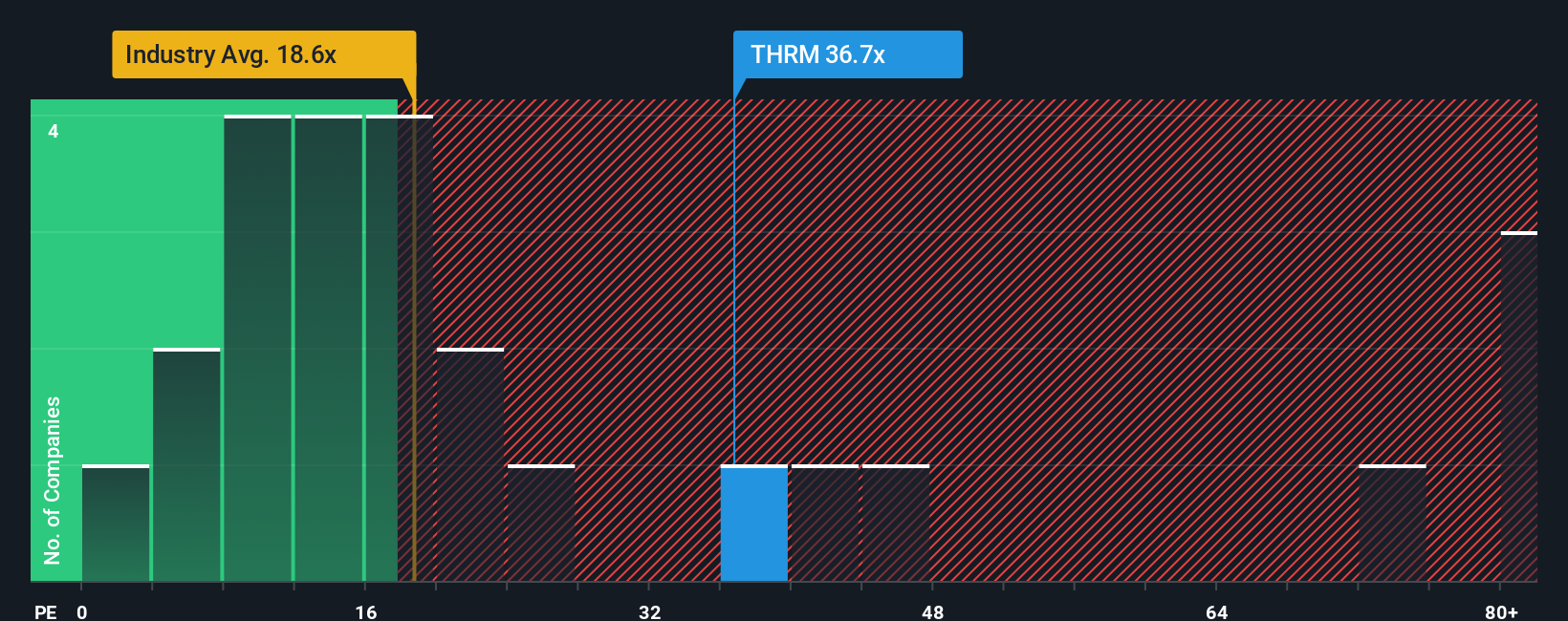

While some see Gentherm as undervalued, a closer look at its earnings-based valuation tells a different story. The company trades at 36.1 times earnings, which is much higher than the peer average of 18.9 times and the fair ratio of 22.6 times. This suggests investors may be paying a premium that is well above typical levels and may increase risk if expectations falter. Is the market pricing in too much optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gentherm Narrative

If these narratives don’t quite reflect your perspective or you want to come to your own conclusions, you can analyze the numbers and develop your own story in just a few minutes. Do it your way.

A great starting point for your Gentherm research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your portfolio’s potential with unique stock selections you might have missed. Get ahead by using these powerful tools to hunt for your next market win:

- Capture steady income and add long-term strength by reviewing these 14 dividend stocks with yields > 3% featuring high-yield opportunities across diverse sectors.

- Supercharge your returns when you check out these 923 undervalued stocks based on cash flows to uncover companies trading below their cash flow potential.

- Ride the future of medicine with these 30 healthcare AI stocks bringing you innovative names leading advances in healthcare technology and artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:THRM

Gentherm

Designs, develops, manufactures, and sells thermal management and pneumatic comfort technologies in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026