- United States

- /

- Auto Components

- /

- NasdaqGM:SYPR

These 4 Measures Indicate That Sypris Solutions (NASDAQ:SYPR) Is Using Debt Extensively

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Sypris Solutions, Inc. (NASDAQ:SYPR) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Sypris Solutions

What Is Sypris Solutions's Debt?

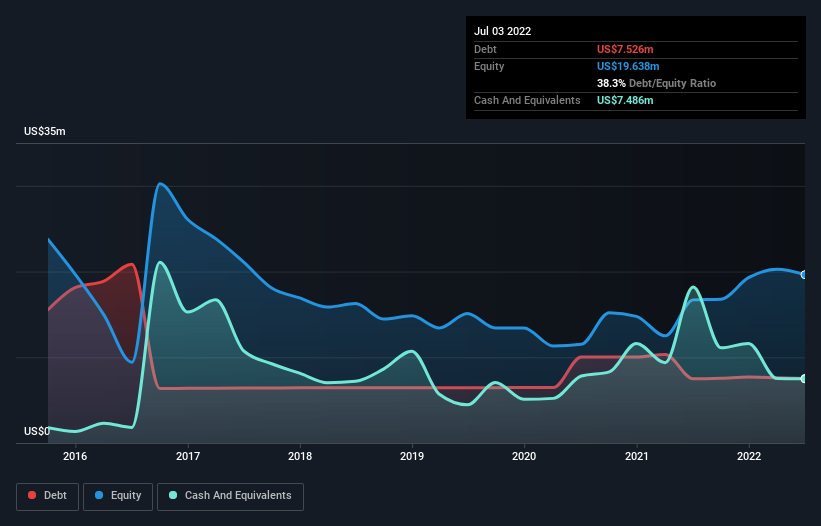

As you can see below, Sypris Solutions had US$7.53m of debt, at July 2022, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of US$7.49m, its net debt is less, at about US$40.0k.

How Healthy Is Sypris Solutions' Balance Sheet?

The latest balance sheet data shows that Sypris Solutions had liabilities of US$38.9m due within a year, and liabilities of US$17.8m falling due after that. On the other hand, it had cash of US$7.49m and US$11.8m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$37.4m.

This deficit is considerable relative to its market capitalization of US$43.8m, so it does suggest shareholders should keep an eye on Sypris Solutions' use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. But either way, Sypris Solutions has virtually no net debt, so it's fair to say it does not have a heavy debt load!

We also note that Sypris Solutions improved its EBIT from a last year's loss to a positive US$2.7m. When analysing debt levels, the balance sheet is the obvious place to start. But it is Sypris Solutions's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. During the last year, Sypris Solutions burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

We'd go so far as to say Sypris Solutions's conversion of EBIT to free cash flow was disappointing. But on the bright side, its net debt to EBITDA is a good sign, and makes us more optimistic. Overall, we think it's fair to say that Sypris Solutions has enough debt that there are some real risks around the balance sheet. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Sypris Solutions (1 shouldn't be ignored) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:SYPR

Sypris Solutions

Engages in the provision of truck components, oil and gas and water pipeline components, and aerospace and defense electronics primarily in North America and Mexico.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion