- United States

- /

- Auto Components

- /

- NasdaqGS:SLDP

Solid Power (SLDP): Five-Year Net Losses Compound at 50.3% as Revenue Forecasts Accelerate

Reviewed by Simply Wall St

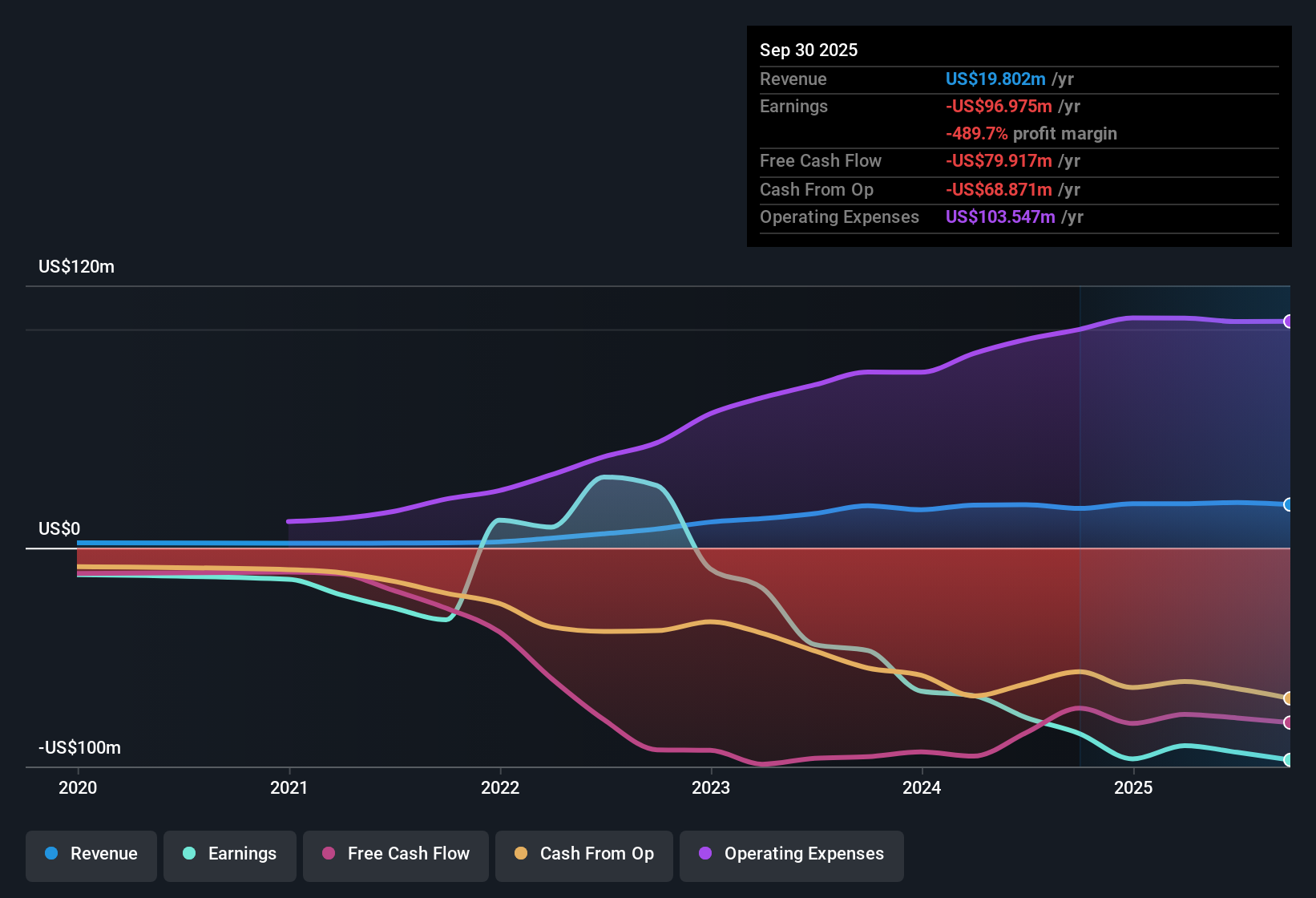

Solid Power (SLDP) continues to operate at a loss, with net losses deepening at a 50.3% annual rate over the last five years. Despite persistent negative profit margins, analysts forecast revenue growth of 40.5% per year, far outpacing the US market’s 10.5% average and SLDP’s peer group. This high growth outlook is very much in focus as investors weigh it against ongoing losses and a valuation that already sits far above sector averages.

See our full analysis for Solid Power.Next, we’ll see how these numbers fit with the broader narratives shaping Solid Power’s market story, and where expectations might run into reality.

See what the community is saying about Solid Power

Losses Deepen Despite Fast Revenue Outlook

- Net losses widened at a steep 50.3% compound annual rate over the last five years. This underscores that, despite the attention on future revenue growth, the business has not been able to shrink its losses or improve profit margins during that period.

- According to the analysts' consensus view, ongoing heavy operating losses and large capital requirements mean that profitability is not expected in the next three years. This is projected even as revenue is predicted to grow much faster than the industry average.

- Analysts see a sharp disconnect: robust projected sales growth of 40.5% per year is not yet translating into any clear improvement in net profit margins or positive earnings milestones.

- Those same forecasts suggest Solid Power would only reach earnings of $1.6 million by 2028. At current price levels, this would still require a future PE ratio of 362.6x to justify even the most optimistic price targets, far above the peer group's 17.3x.

- To see how these challenges and hopes play into the bigger investment narrative, check whether analysts agree on Solid Power's market story before making your next move. 📊 Read the full Solid Power Consensus Narrative.

Industry-Leading Valuation Risks

- Solid Power’s current Price-To-Book Ratio is 4.4x. This stands at nearly three times the US Auto Components industry average of 1.6x and over four times the peer group average of 1x, even though the company is still unprofitable and fair value estimates remain out of reach.

- Analysts' consensus view flags how an elevated valuation, driven by ambitious growth forecasts, hinges on SLDP dramatically improving profit margins, while its track record shows no such positive momentum so far.

- If the company only manages to close the margin gap to peers by 2028, it would have to justify a price/earnings ratio more than 20 times higher than the industry’s current average.

- The tension between structurally high market pricing and a prolonged absence of profits makes Solid Power’s shares especially sensitive to any misses in revenue or cost control against forecasts.

Partnership Dependence Raises Concentration Risk

- Solid Power's business growth and future earnings rely heavily on strategic partnerships, most notably with BMW and SK On. This increases the risk that any delay or change in commitment from these OEMs could curb revenue and reduce the upside anticipated by current valuations.

- Analysts' consensus view highlights how this concentration exposes investors to unexpected commercial adoption risks. It also compounds concerns about slow licensing traction and future gross margin volatility.

- Catalysts like new electrolyte sampling and pilot manufacturing lines are promising, but most new revenue growth will hinge on maintaining or expanding these few key relationships.

- Sustained product validation demands and supply chain hurdles mean further commercialization delays are still a live risk, affecting both revenue growth consistency and margin improvement.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Solid Power on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Share your insights and shape your version of Solid Power’s story in just a few minutes. Do it your way

A great starting point for your Solid Power research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Solid Power’s persistent losses, an uncertain path to profitability, and a valuation far exceeding industry averages present significant risk for investors seeking stable growth.

If you’re frustrated by lofty valuations and profit instability, discover potential bargains with stronger fundamentals by starting your search with these 840 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLDP

Solid Power

Develops solid-state battery technologies for the electric vehicles (EV) and other markets in the United States.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion