- United States

- /

- Auto

- /

- NasdaqGM:PSNY

Does Polestar (PSNY)'s Nasdaq Bid Price Challenge Reflect Deeper Strategic Risks or Short-Term Volatility?

Reviewed by Sasha Jovanovic

- Polestar Automotive Holding UK PLC recently received a notice from Nasdaq indicating non-compliance with the minimum US$1.00 bid price requirement, giving the company until April 29, 2026, to regain compliance or potentially face delisting action.

- This development puts a spotlight on Polestar’s ability to meet exchange listing standards while balancing operational and financial challenges intrinsic to the competitive electric vehicle sector.

- We'll examine how the Nasdaq non-compliance notice increases attention on listing risk and influences Polestar's investment outlook going forward.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Polestar Automotive Holding UK Investment Narrative Recap

Owning Polestar shares today hinges on confidence in the company’s ability to scale electric vehicle sales while addressing mounting financial losses and compliance hurdles. The recent Nasdaq non-compliance notice, while serious, does not materially change the most pressing risk, Polestar’s negative cash position and ongoing losses outweigh short-term listing threats. The principal catalyst remains continued sales growth and cost reductions, though operational execution is now under sharper scrutiny following this development.

Among recent announcements, Polestar’s US$200 million private placement in June stands out. This capital injection, made at US$1.05 per share, is particularly relevant as it demonstrates ongoing investor support slightly above the current bid price, potentially supporting short-term listing compliance and providing runway for operational initiatives and future product launches. However, compared to these fundraising moves, attention to cash burn remains crucial if the company is to reach profitability and sustain listing status.

By contrast, while the Nasdaq notice does not trigger immediate delisting, investors should be aware of the heightened risk if cash reserves and compliance...

Read the full narrative on Polestar Automotive Holding UK (it's free!)

Polestar Automotive Holding UK's outlook anticipates $11.0 billion in revenue and $559.6 million in earnings by 2028. This implies a 63.1% annual revenue growth and a $3.26 billion earnings increase from current earnings of -$2.7 billion.

Uncover how Polestar Automotive Holding UK's forecasts yield a $1.00 fair value, a 31% upside to its current price.

Exploring Other Perspectives

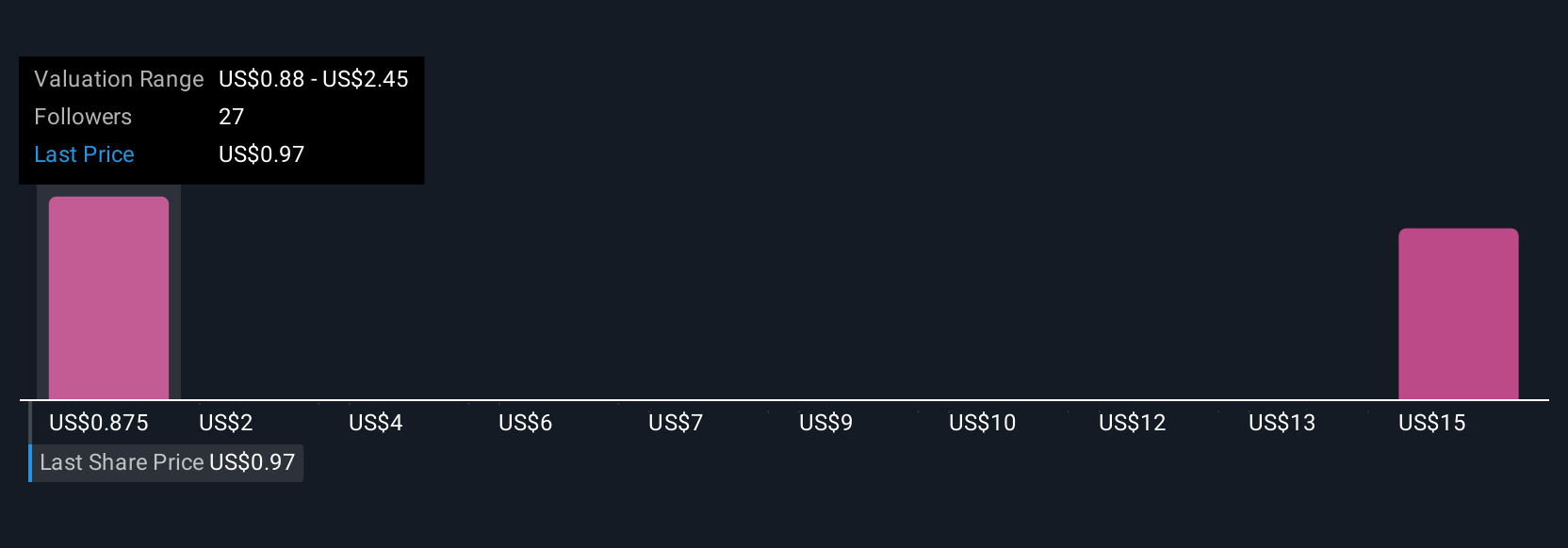

Nine members of the Simply Wall St Community estimate Polestar’s fair value from US$1 up to US$7, with most between US$1 and US$1.60 per share. Against this backdrop, persistent net losses raise fundamental questions for those weighing the long-term potential of Polestar’s business model.

Explore 9 other fair value estimates on Polestar Automotive Holding UK - why the stock might be worth just $1.00!

Build Your Own Polestar Automotive Holding UK Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Polestar Automotive Holding UK research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Polestar Automotive Holding UK research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Polestar Automotive Holding UK's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PSNY

Polestar Automotive Holding UK

Engages in the research and development, marketing, commercialization, and sale of battery electric vehicles and related technology solutions.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives