- United States

- /

- Auto Components

- /

- NasdaqGS:KNDI

How Many Kandi Technologies Group, Inc. (NASDAQ:KNDI) Shares Have Insiders Sold, In The Last Year?

We often see insiders buying up shares in companies that perform well over the long term. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So shareholders might well want to know whether insiders have been buying or selling shares in Kandi Technologies Group, Inc. (NASDAQ:KNDI).

What Is Insider Buying?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, rules govern insider transactions, and certain disclosures are required.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But equally, we would consider it foolish to ignore insider transactions altogether. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise'.

See our latest analysis for Kandi Technologies Group

The Last 12 Months Of Insider Transactions At Kandi Technologies Group

In the last twelve months, the biggest single sale by an insider was when the Director, Chenming Sun, sold US$143k worth of shares at a price of US$11.02 per share. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. The silver lining is that this sell-down took place above the latest price (US$8.55). So it may not shed much light on insider confidence at current levels.

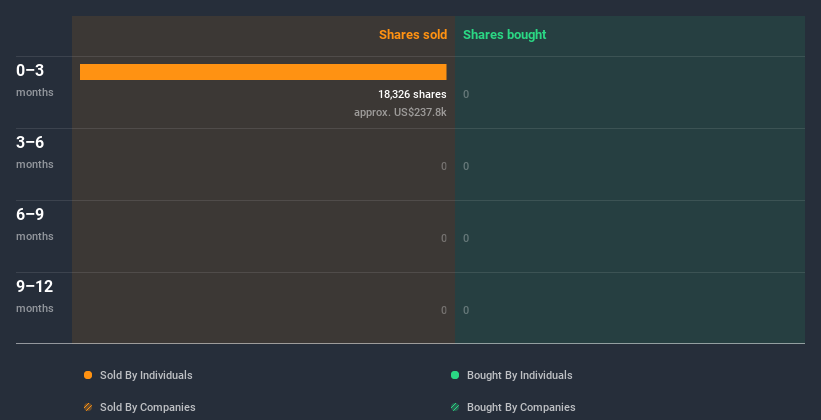

In the last year Kandi Technologies Group insiders didn't buy any company stock. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Insiders at Kandi Technologies Group Have Sold Stock Recently

The last three months saw significant insider selling at Kandi Technologies Group. In total, insiders dumped US$71k worth of shares in that time, and we didn't record any purchases whatsoever. In light of this it's hard to argue that all the insiders think that the shares are a bargain.

Insider Ownership of Kandi Technologies Group

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Kandi Technologies Group insiders own about US$124m worth of shares (which is 20% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Do The Kandi Technologies Group Insider Transactions Indicate?

Insiders haven't bought Kandi Technologies Group stock in the last three months, but there was some selling. And there weren't any purchases to give us comfort, over the last year. While insiders do own a lot of shares in the company (which is good), our analysis of their transactions doesn't make us feel confident about the company. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Our analysis shows 5 warning signs for Kandi Technologies Group (2 don't sit too well with us!) and we strongly recommend you look at them before investing.

But note: Kandi Technologies Group may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Kandi Technologies Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kandi Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:KNDI

Kandi Technologies Group

Produces and sells electric off-road vehicles and associated parts in the People’s Republic of China, the United States, and internationally.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives