- United States

- /

- Insurance

- /

- NasdaqGS:AIFU

1stdibs.Com And Two Other US Penny Stocks To Consider

Reviewed by Simply Wall St

As the U.S. stock market continues its post-election rally, reaching new record highs, investors are increasingly looking for opportunities in various corners of the market. Penny stocks, while often seen as a relic from past eras, remain relevant due to their potential for growth and affordability. These stocks typically involve smaller or newer companies that can offer unique value propositions when backed by strong financials. In this article, we will explore three such penny stocks that stand out for their financial strength and growth potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8479 | $5.86M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.91 | $590.24M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.65 | $2.03B | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $161.01M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2723 | $9.41M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $2.10 | $4.09M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.63 | $53.46M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.10 | $97.13M | ★★★★★☆ |

| PHX Minerals (NYSE:PHX) | $3.50 | $131.24M | ★★★★★☆ |

Click here to see the full list of 748 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

1stdibs.Com (NasdaqGM:DIBS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 1stdibs.Com, Inc. operates a global online marketplace specializing in luxury design products and has a market cap of $171.87 million.

Operations: The company generates revenue of $85.88 million from its online retail operations.

Market Cap: $171.87M

1stdibs.Com, Inc. operates with a market cap of US$171.87 million and generates revenue of US$85.88 million from its online marketplace, yet remains unprofitable with a net loss for the recent quarter at US$5.68 million, an increase from the previous year's loss. Despite this, it maintains no debt and has sufficient cash runway for over three years if cash flow reductions continue at historical rates. The company recently announced a share repurchase program up to US$10 million but has seen shareholder dilution over the past year and forecasts declining earnings by 17.5% annually over the next three years.

- Click here to discover the nuances of 1stdibs.Com with our detailed analytical financial health report.

- Explore 1stdibs.Com's analyst forecasts in our growth report.

AIX (NasdaqGS:AIFU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AIX Inc., along with its subsidiary, distributes insurance products in China and has a market cap of $70.31 million.

Operations: The company generates revenue from two primary segments: Agency, contributing CN¥1.91 billion, and Claims Adjusting, accounting for CN¥452.42 million.

Market Cap: $70.31M

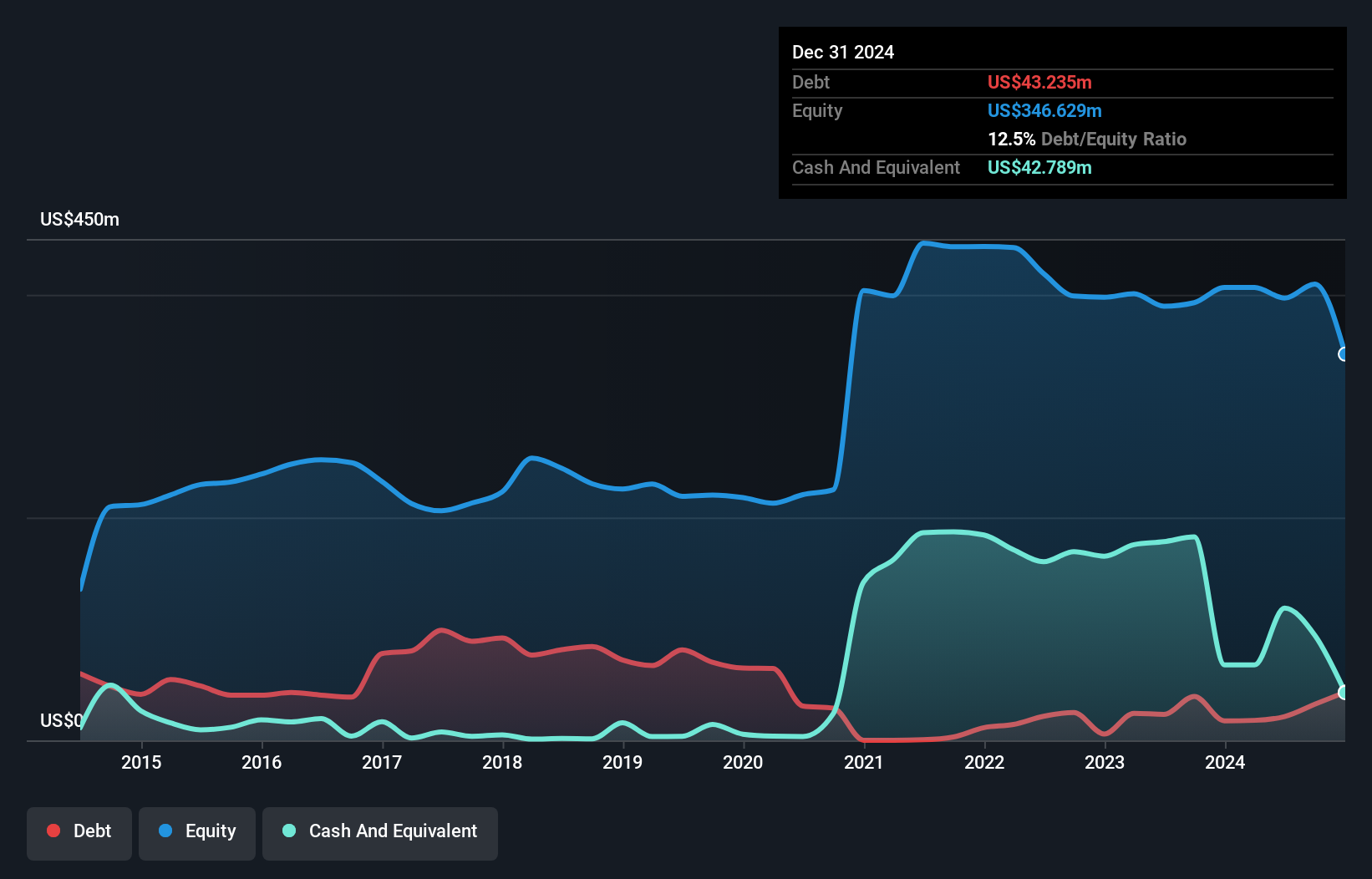

AIX Inc., with a market cap of $70.31 million, operates in the insurance sector and has reported CN¥1.91 billion from its Agency segment and CN¥452.42 million from Claims Adjusting. Despite this revenue, AIX faces challenges such as declining earnings growth over the past year and reduced profit margins compared to last year. The company's debt is well-covered by operating cash flow, indicating sound financial management, although its share price remains highly volatile recently. Recent board changes include appointing Ms. Hang Suong Nguyen as Chairperson, potentially bringing strategic shifts given her investment management background.

- Take a closer look at AIX's potential here in our financial health report.

- Gain insights into AIX's future direction by reviewing our growth report.

Kandi Technologies Group (NasdaqGS:KNDI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kandi Technologies Group, Inc. designs, develops, manufactures, and commercializes electric vehicle products and parts in China and the United States with a market cap of $112.69 million.

Operations: The company generates revenue from its Auto Manufacturers segment, amounting to $124.61 million.

Market Cap: $112.69M

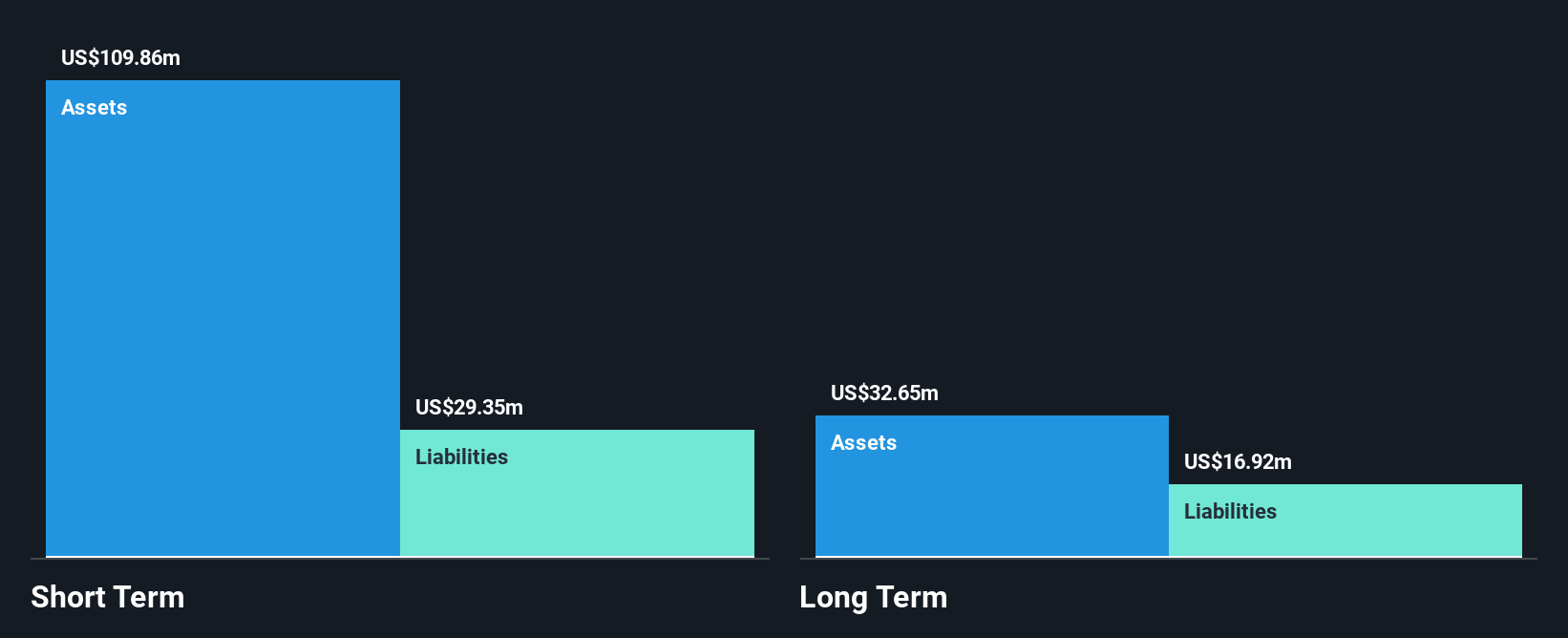

Kandi Technologies Group, with a market cap of US$112.69 million, has faced volatility but shows signs of financial stability. Despite being unprofitable, the company has reduced losses by 8.9% annually over five years and maintains a strong balance sheet with short-term assets exceeding liabilities and more cash than debt. Recent strategic moves include plans to invest US$100 million in a U.S.-based lithium battery facility and US$30 million for an all-terrain vehicle production line, aiming to expand its North American market presence. Additionally, new leadership under CEO Feng Chen may drive innovation in electric vehicle solutions.

- Click to explore a detailed breakdown of our findings in Kandi Technologies Group's financial health report.

- Review our historical performance report to gain insights into Kandi Technologies Group's track record.

Taking Advantage

- Embark on your investment journey to our 748 US Penny Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AIFU

AIX

Together with its subsidiary, distributes insurance products in China.

Excellent balance sheet and good value.