- United States

- /

- Auto Components

- /

- NasdaqGS:HSAI

What You Can Learn From Hesai Group's (NASDAQ:HSAI) P/S After Its 29% Share Price Crash

Hesai Group (NASDAQ:HSAI) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The good news is that in the last year, the stock has shone bright like a diamond, gaining 261%.

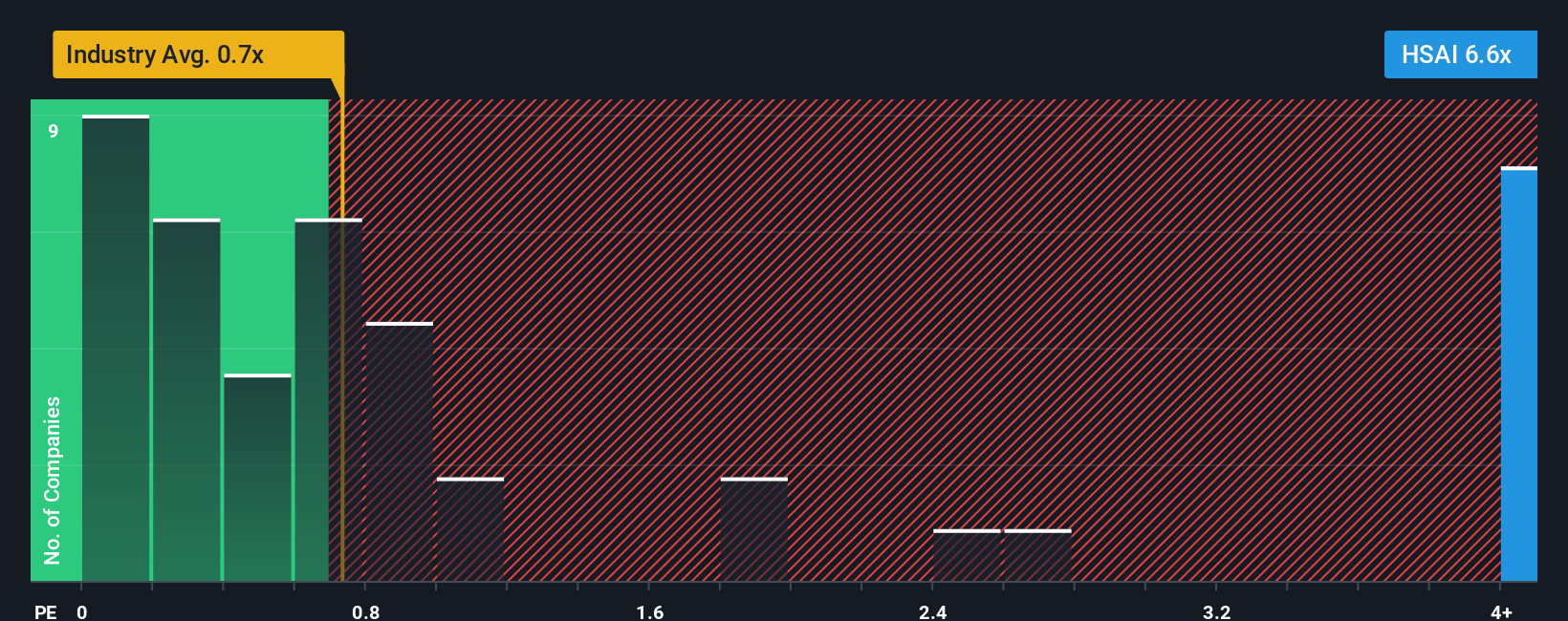

In spite of the heavy fall in price, when almost half of the companies in the United States' Auto Components industry have price-to-sales ratios (or "P/S") below 0.7x, you may still consider Hesai Group as a stock not worth researching with its 6.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Hesai Group

How Hesai Group Has Been Performing

Recent times have been advantageous for Hesai Group as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Hesai Group will help you uncover what's on the horizon.How Is Hesai Group's Revenue Growth Trending?

Hesai Group's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 43%. The latest three year period has also seen an excellent 160% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 39% per year over the next three years. That's shaping up to be materially higher than the 23% per year growth forecast for the broader industry.

In light of this, it's understandable that Hesai Group's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Even after such a strong price drop, Hesai Group's P/S still exceeds the industry median significantly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Hesai Group's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Hesai Group you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hesai Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HSAI

Hesai Group

Through with its subsidiaries, engages in the development, manufacture, and sale of three-dimensional light detection and ranging solutions (LiDAR) in Mainland China, Europe, North America, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives