- United States

- /

- Auto

- /

- NasdaqCM:CENN

Even With A 25% Surge, Cautious Investors Are Not Rewarding Cenntro Inc.'s (NASDAQ:CENN) Performance Completely

Those holding Cenntro Inc. (NASDAQ:CENN) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 71% share price decline over the last year.

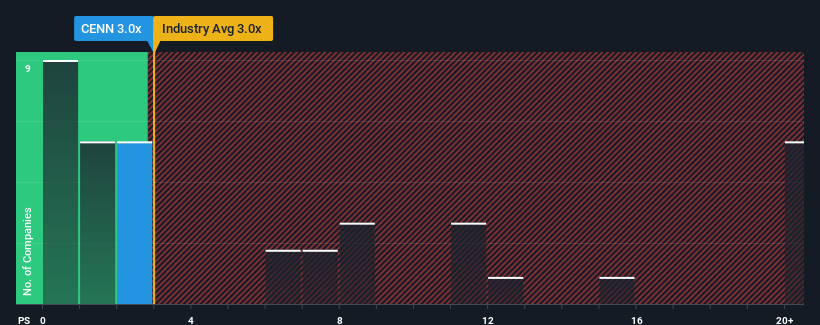

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Cenntro's P/S ratio of 3x, since the median price-to-sales (or "P/S") ratio for the Auto industry in the United States is about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Cenntro

How Has Cenntro Performed Recently?

With revenue growth that's exceedingly strong of late, Cenntro has been doing very well. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Cenntro, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Cenntro's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 50% gain to the company's top line. The latest three year period has also seen an excellent 180% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 20% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that Cenntro's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Cenntro's P/S?

Cenntro's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To our surprise, Cenntro revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Plus, you should also learn about these 5 warning signs we've spotted with Cenntro (including 2 which are a bit unpleasant).

If these risks are making you reconsider your opinion on Cenntro, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CENN

Cenntro

Engages in the design, development, and manufacture of electric light and medium-duty commercial vehicles in Europe, Asia, and the United States.

Moderate risk with mediocre balance sheet.

Market Insights

Community Narratives