- United States

- /

- Auto Components

- /

- NasdaqCM:CAAS

This Is Why China Automotive Systems, Inc.'s (NASDAQ:CAAS) CEO Can Expect A Bump Up In Their Pay Packet

Shareholders will be pleased by the robust performance of China Automotive Systems, Inc. (NASDAQ:CAAS) recently and this will be kept in mind in the upcoming AGM on 28 July 2021. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. In our analysis below, we discuss why we think the CEO compensation looks acceptable and the case for a raise.

View our latest analysis for China Automotive Systems

Comparing China Automotive Systems, Inc.'s CEO Compensation With the industry

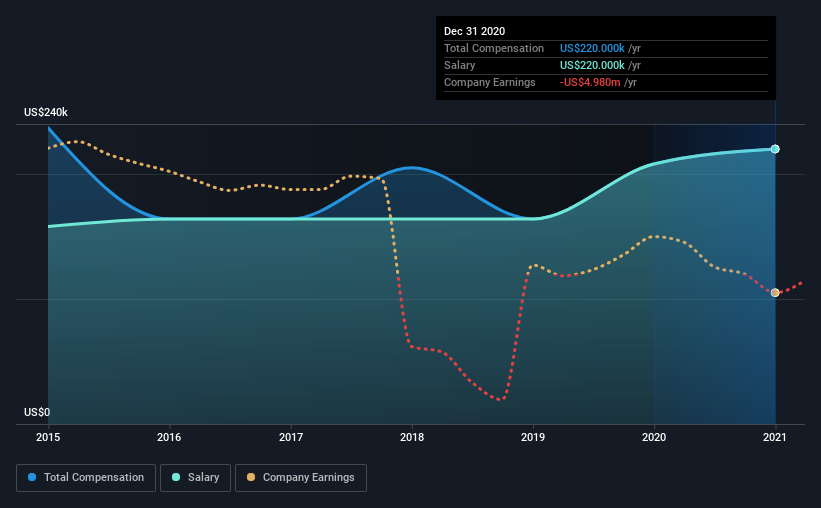

Our data indicates that China Automotive Systems, Inc. has a market capitalization of US$133m, and total annual CEO compensation was reported as US$220k for the year to December 2020. That's a modest increase of 5.8% on the prior year. Notably, the salary of US$220k is the entirety of the CEO compensation.

For comparison, other companies in the industry with market capitalizations below US$200m, reported a median total CEO compensation of US$327k. This suggests that Qizhou Wu is paid below the industry median. Furthermore, Qizhou Wu directly owns US$5.7m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$220k | US$208k | 100% |

| Other | - | - | - |

| Total Compensation | US$220k | US$208k | 100% |

Talking in terms of the industry, salary represented approximately 21% of total compensation out of all the companies we analyzed, while other remuneration made up 79% of the pie. At the company level, China Automotive Systems pays Qizhou Wu solely through a salary, preferring to go down a conventional route. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

China Automotive Systems, Inc.'s Growth

China Automotive Systems, Inc. has seen its earnings per share (EPS) increase by 94% a year over the past three years. In the last year, its revenue is up 20%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has China Automotive Systems, Inc. Been A Good Investment?

With a total shareholder return of 6.6% over three years, China Automotive Systems, Inc. has done okay by shareholders, but there's always room for improvement. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

In Summary...

China Automotive Systems rewards its CEO solely through a salary, ignoring non-salary benefits completely. The company's overall performance, while not bad, could be better. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

So you may want to check if insiders are buying China Automotive Systems shares with their own money (free access).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading China Automotive Systems or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:CAAS

China Automotive Systems

Through its subsidiaries, manufactures and sells automotive systems and components in the People’s Republic of China, the United States, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives